September Market Commentary

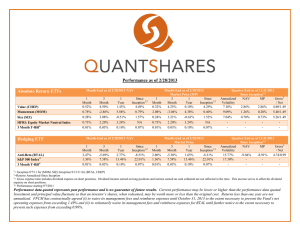

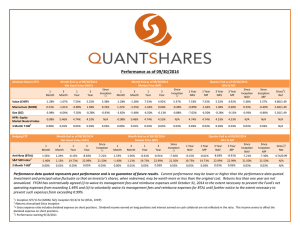

advertisement

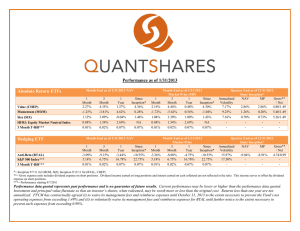

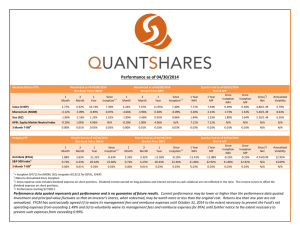

September Market Commentary September marked another strong month in the equity markets. Both the Dow Jones Industrial Average (DJIA) and the S&P 500 finished the month up, 2.75% and 2.58% respectively. The equity markets seemed to shrug off increasing uncertainty both home and abroad, and marched to higher finish for the third quarter. The Commerce Department’s final read on US Gross Domestic Product (GDP) noted slower growth in the second quarter, 1.3% annual rate vs. a 1.7% estimate, which is the lowest since the third quarter of 2011. Consumer and business spending have begun to slow; drought conditions have pushed agricultural commodity prices higher, and increases in fuel costs have proved taxing on the consumer’s wallet. The Commerce Department reported a drop of 13.2% for durable goods for August, the largest drop since January of 2009. The Institute for Supply Management (ISM) Business Survey registered 49.7 for September, an unexpected contraction for the first time in three years, down from 53 in August. A reading of 50 is the dividing line between contraction and expansion. We continue to face elevated joblessness, with unemployment exceeding 8% for the 43rd consecutive month. The Federal Reserve announced in early September further accommodation with open-ended purchases of $40 billion in mortgage debt a month in an effort to reduce unemployment and boost economic growth. Lingering concerns surround the outcome of the presidential election and the “fiscal cliff”, more than $600 billion in automatic tax increases and spending cuts if Congress doesn’t act. Headwinds continue to persist outside the US, and these problems have global economic ramifications. Tensions in the Middle East have flared; fighting in Syria and escalating rhetoric from Israel and Iran threaten neighbor states which provide almost a third of the world’s oil. Europe continues to experience fits and starts, but seems committed to working towards a solution for the broad issues that face the region. September QuantShares Commentary Value strategies, after spending much of 2012 out of favor, have been able to string together a couple of months of positive performance. Valuation has begun to matter again, as evidenced by the QuantShares Market Neutral Value Fund (CHEP) finishing September up 0.22%, after a solid August return of 1.01%. Small Cap strategies continue to try to find footing in 2012, spending most of the year out of favor, September was no different as the QuantShares Market Neutral Size Fund (SIZ) closed down -0.81%. Momentum strategies continued to sell off in September, as QuantShares Market Neutral Momentum Fund (MOM) was down -1.44%% for the month. The QuantShares Market Neutral Anti-Momentum Fund (NOMO) has been able to capitalize on the August/September sell-off in momentum strategies finishing September up 0.68%, after a solid 1.64% August. High beta and Low beta names continue to jockey for market leadership as the year moves forward. For September both the QuantShares Market Neutral High-Beta Fund (BTAH) and the QuantShares Market Neutral Anti-Beta Fund (BTAL) finished down -0.08% and -0.43% respectively. Increasing uncertainty surrounding both a presidential election and the “fiscal cliff” may provide a backdrop for increased volatility as we move into Q4. QuantShares has a couple of strategies to take advantage of the heightened market uncertainty. Both the QuantShares Market Neutral Anti-Beta Fund (BTAL) and the QuantShares Market Neutral Quality Fund (QLT) have negative correlations to the S&P 500. QuantShares BTAL has provided a nice hedge for equity exposure with a negative correlation (0.85) to the S&P 500, since inception (9/13/2011). In addition, Quality strategies tend to outperform in uncertain markets as there is reach for stability; QuantShares QLT has a negative correlation of (0.45) to the S&P 500, since inception (9/7/2011) and has helped smooth out some of the volatility associated with increased market uncertainty. Performance as of 09/30/2012 Strategic ETFs Month-End as of 09/30/2012 NAV Month-End as of 09/30/2012 Market Price (MP) 1 3 1 Since Month Month Year Inception* 0.01% -0.43% -2.80% -1.28% -2.39% -3.14% -10.90% -8.58% Quarter End as of 09/30/2012 Since Inception* Annualized NAV MP Gross** Volatility / Net 7.40% -1.16% -1.28% 2.50/.99 5.68% -8.46% -8.58% 2.50/.99 Value (CHEP) Quality (QLT) 1 Month 0.22% -2.35% 3 Month 0.56% -3.01% 1 Year -1.59% -9.76% Since Inception* -1.16% -8.46% Size (SIZ) -0.81% -1.49% 0.81% -1.21% -0.89% -1.61% 0.97% -1.33% 7.72% -1.21% -1.33% 2.97/.99 HFRI: Fund Weighted Composite Index Russell 1000 Index*** 3 Month T-Bill*** 0.76% 2.57% 0.01% 2.01% 6.31% 0.02% 5.55% 30.05% 0.04% NA 25.98% 0.04% 0.76% 2.57% 0.01% 2.01% 6.31% 0.02% 5.55% 30.05% 0.04% NA 25.98% 0.04% 18.42% - - - - Tactical ETFs Month-End as of 09/30/2012 NAV Month-End as of 09/30/2012 Market Price 3 1 Since Month Year Inception* -2.98% -10.69% -6.22% -0.39% 7.04% 3.87% 1.65% 3.71% -3.30% -2.02% -12.94% -10.36% Quarter End as of 09/30/2012 Since Inception* Annualized NAV MP Gross** Volatility / Net 17.67% -6.10% -6.22% 1.92/.99 9.90% 4.00% 3.87% 2.79/.99 17.36% -3.34% -3.30% 3.27/.99 10.28% -10.41% -10.36% 2.07/.99 Anti-Beta (BTAL) Momentum (MOM) High Beta (BTAH) Anti-Momentum (NOMO) 1 Month -0.43% -1.44% -0.08% 0.68% 3 Month -2.98% -0.04% 1.86% -2.11% 1 Year -10.60% 7.30% 2.61% -12.81% Since Inception* -6.10% 4.00% -3.34% -10.41% 1 Month -0.43% -1.21% 0.17% 0.87% HFRI: Fund Weighted Composite Index Russell 1000 Index*** 0.76% 2.57% 2.01% 6.31% 5.55% 30.05% NA 25.98% 0.76% 2.57% 2.01% 6.31% 5.55% 30.05% NA 25.98% 18.42% - - - 3 Month T-Bill*** 0.01% 0.02% 0.04% 0.04% 0.01% 0.02% 0.04% 0.04% - - - - *= Inception 9/7/11 for (MOM, NOMO, QLT, SIZ); Inception 9/13/11 for (BTAH, BTAL, CHEP) **= Gross expense ratio includes dividend expense on short positions. Dividend income earned on long positions and interest earned on cash collateral are not reflected in the ratio. This income serves to offset the dividend expense on short positions. ***= Performance starting 9/7/2011 Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment and principal value fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Returns less than one year are not annualized. Since the Funds are new, the Operating expenses are based on first year anticipated Assets Under Management growth. FFCM has contractually agreed (i) to waive its management fees and reimburse expenses until October 31, 2013 to the extent necessary to prevent the Fund’s net operating expenses from exceeding 1.49% and (ii) voluntarily to waive its management fees and reimburse expenses until further notice to the extent necessary to prevent such expenses from exceeding 0.99%. Company Overview: QuantShares designs and manages Market Neutral ETFs to provide exposure to well-known equity factors such as Momentum, Value, Quality, Beta and Size. QuantShares Market Neutral ETFs are the first ETFs that have the capability to short physical stocks (as opposed to derivatives) that passively track indexes. Our ETFs offer investors a diversifying asset that is both highly liquid and fully transparent. The ETFs are designed to generate spread returns, diversify risk and reduce volatility. Value, Size and Quality tend to be more strategic in nature and provide strong risk-adjusted returns; Beta and Momentum are more tactical and allows investors to hedge or express short term investment convictions. QuantShares Market Neutral ETFs provide a liquid alternative to help dampen volatility and enhance the risk return profile of an investment portfolio. Disclosures: Before investing you should carefully consider the Fund’s investment objectives, risks, charges, and expenses. This and other information is in the prospectus, a copy of which can be obtained by visiting the Fund’s website at www.quant-shares.com. Please read the prospectus carefully before you invest. Foreside Fund Service, LLC, Distributor. Shares are not individually redeemable and can be redeemed only in Creation Units. The market price of shares can be at, below or above the NAV. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00PM Eastern time (when NAV is normally determined), and do not represent the returns you would receive if you traded shares at other times. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense subsidies and waivers in effect during certain periods. Absent these waivers, results would have been less favorable. Risks: There is no guarantee that the funds will reach their objective. An investment in the Funds is subject to risk including the possible loss of principal amount invested. See prospectus for specific risks regarding each Fund. There is a risk that during a “bull” market, when most equity securities and long only ETFs are increasing in value, the Funds’ short positions will likely cause the Fund to underperform the overall U.S. equity market and such ETFs. The Funds may not be suitable for all investors. Short selling could cause unlimited losses, derivatives could result in losses beyond the amount invested, and the value of an investment in the Fund may fall sharply. Beta is a measure of an asset’s sensitivity to an underlying index. Long is purchasing a stock with the expectation that it is going to rise in value. Short is selling stock with the expectation of profiting by buying it back later at a lower price. HFRI Fund Weighted Composite Index is a global, equal-weighted index of over 2,000 single-manager funds that report to Hedge Fund Research Database. Negative correlation is a relationship between two variables in which one variable increases as the other decreases. Russell 1000 Index measures the performance of approximately 1000 of the largest companies in the U.S. equity market. DJIA – Dow Jones Industrial Average is a price weighted average of 30 significant stocks traded on the NYSE and NASDAQ. S&P 500 is an index of 500 large cap common stocks actively traded on the NYSE and NASDAQ. One cannot invest directly in an index.