March Market Commentary

advertisement

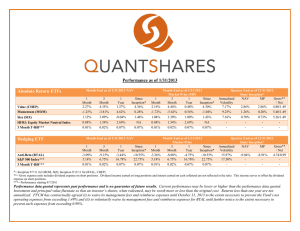

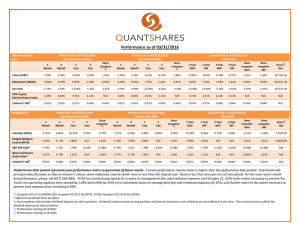

March Market Commentary March capped off the strongest start of the year since the first quarter of 1998 for both the Dow (8.14%) and S&P 500 (12.00%), respectively. In addition to the strides made in the equity markets, data from both the housing and labor markets has been encouraging. Although the general direction of the economy appears to be trending in the right direction, many obstacles remain in the way of a sustained recovery. Chairman Bernanke has been tepid in his response to the encouraging signs in the economy and notes that “accommodative monetary policy is still needed to spur jobs.” The University of Michigan survey measuring consumer sentiment reached its highest levels since February, 2011. However, questions do remain concerning the resiliency of the consumer. We have seen the price of oil continue to march higher and time will tell if pricing pressures at the pump will derail the steady gains observed in the broader economy since early October, 2011. Political pressures on both sides of the Atlantic are perpetuating. Europe looks to have addressed some of the liquidity issues, but a structural imbalance persists between the northern and southern economies. As attentions have shifted from Greece, Euro area finance ministers have begun to keep a close eye on both Spain and Italy. Closer to home, the picture from Washington is one of partisan politics in an election year. As election season moves closer however, a clearer picture should present itself in regards to the constitutionality of “Obamacare”, the expiring Bush tax cuts, deficit and debt ceiling discussions - which have all added to the markets “wall of worry.” The QuantShares line-up of Market Neutral ETFs is positioned to perform in any of the previous listed market environments, due to their uncorrelated return profile to the broader market and their ability to capture persistent market premiums with lower volatility. Q1 QuantShares Commentary Q1 of 2012 proved to be a very difficult environment for traditional quant based strategies. There was no clear cut market leader; we saw a substantial amount of volatility between strategies as they see-sawed for leadership throughout the quarter. Low quality and high beta names led in Q1, evidenced by the QuantShares High Beta Fund (BTAH) up 10.08% for the quarter. On the flipside the QuantShares Quality Fund (QLT) underperformed, down -1.36% in Q1, in one of the worst quarters on record for quality factors (QuantShares QLT fund is long high quality stocks and short low quality stocks, based on Return On Equity and debtto-equity ratios). Growth stocks outperformed Value stocks throughout the first quarter, with the QuantShares Value Fund (CHEP) down -1.18% in Q1, but longer term returns remained positive, up 2.39% since inception in early September. Value has trended downwards since peaking for the year in mid-January. Small caps slightly underperformed large caps in Q1 and this was true for the QuantShares Size Fund (SIZ) which posted -0.40% for the quarter, but remained positive since inception, up 1.05%. As mentioned earlier, high beta names fueled the first quarter, and to this trend, the QuantShares Anti-Beta Fund (BTAL) underperformed -9.75% in Q1, but posted solid results in March, up 1.43%, as market participants harvested some profits and cash redeployed to lower beta names as the markets fluctuated. Performance as of 03/31/2012 Strategic ETFs Month-End as of 03/31/2012 NAV 1-Mo 3-Mo Value (CHEP) Quality (QLT) -2.61% -0.21% Size (SIZ) HFRI EH: Equity Market Neutral Index Russell 1000 Index*** 3 Month T-Bill*** Tactical ETFs Month-End as of 03/31/2012 Market Price (MP) 1-Mo 3-Mo -1.18% -1.36% Since Inception* 2.39% -3.73% -4.04% -1.40% -1.76% -0.40% 1.05% 0.08% 3.13% 0.00% 1.86% 12.89% 0.00% NA 22.28% 0.00% -1.66% -1.32% Since Inception* 1.94% -3.69% Annualized Volatility 7.36% 6.34% 2.39% -3.73% 1.94% -3.69% 2.50/.99 2.50/.99 -1.72% 0.12% 1.13% 8.64% 1.05% 1.13% 2.97/.99 0.08% 3.13% 0.00% 1.86% 12.89% 0.00% NA 22.28% 0.00% 21.92% - - - - Month-End as of 03/31/2012 NAV 1-Mo 3-Mo High Beta (BTAH) Momentum (MOM) Anti-Beta (BTAL) Anti-Momentum (NOMO) -1.59% 1.42% 1.43% -1.66% HFRI EH: Equity Market Neutral Index Russell 1000 Index*** 3 Month T-Bill*** Quarter End as of 03/31/2012 Since Inception* NAV MP Month-End as of 03/31/2012 Market Price (MP) 1-Mo 3-Mo 10.08% -1.01% -9.75% -0.08% Since Inception* 9.63% -3.10% -13.35% -0.70% -1.21% 0.38% -0.56% -1.58% 0.08% 3.13% 1.86% 12.89% NA 22.28% 0.00% 0.00% 0.00% Quarter End as of 03/31/2012 Since Inception* NAV MP Gross**/Net 9.48% -1.38% -10.03% 0.21% Since Inception* 8.59% -3.26% -13.84% -0.66% Annualized Volatility 18.99% 8.46% 20.14% 9.08% Gross**/Net 9.63% -3.10% -13.35% -0.70% 8.59% -3.26% -13.84% -0.66% 3.27/.99 2.79/.99 1.92/.99 2.07/.99 0.08% 3.13% 1.86% 12.89% NA 22.28% 21.92% - - - 0.00% 0.00% 0.00% - - - - *= Inception 9/7/11 for (MOM, NOMO, QLT, SIZ); Inception 9/13/11 for (BTAH, BTAL, CHEP) **= Gross expense ratio includes dividend expense on short positions. Dividend income earned on long positions and interest earned on cash collateral are not reflected in the ratio. This income serves to offset the dividend expense on short positions. ***= Performance starting 9/7/2011 Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment and principal value fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Returns less than one year are not annualized. Since the Funds are new, the Operating expenses are based on first year anticipated Assets Under Management growth. FFCM has contractually agreed to waive fees and expenses to limit net expenses from exceeding 0.99% until August 31, 2012. Company Overview: QuantShares designs and manages Market Neutral ETFs to provide exposure to well-known equity factors such as Momentum, Value, Quality, Beta and Size. QuantShares Market Neutral ETFs are the first ETFs that have the capability to short physical stocks (as opposed to derivatives) that passively track indexes. Our ETFs offer investors a diversifying asset that is both highly liquid and fully transparent. The ETFs are designed to generate spread returns, diversify risk and reduce volatility. Value, Size and Quality tend to be more strategic in nature and provide strong risk-adjusted returns; Beta and Momentum are more tactical and allows investors to hedge or express short term investment convictions. QuantShares Market Neutral ETFs provide a liquid alternative to help dampen volatility and enhance the risk return profile of an investment portfolio. Disclosures: Before investing you should carefully consider the Fund’s investment objectives, risks, charges, and expenses. This and other information is in the prospectus, a copy of which can be obtained by visiting the Fund’s website at www.quant-shares.com. Please read the prospectus carefully before you invest. Foreside Fund Service, LLC, Distributor. Shares are not individually redeemable and can be redeemed only in Creation Units. The market price of shares can be at, below or above the NAV. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00PM Eastern time (when NAV is normally determined), and do not represent the returns you would receive if you traded shares at other times. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense subsidies and waivers in effect during certain periods. Absent these waivers, results would have been less favorable. Risks: There is no guarantee that the funds will reach their objective. An investment in the Funds is subject to risk including the possible loss of principal amount invested. See prospectus for specific risks regarding each Fund. There is a risk that during a “bull” market, when most equity securities and long only ETFs are increasing in value, the Funds’ short positions will likely cause the Fund to underperform the overall U.S. equity market and such ETFs. The Funds may not be suitable for all investors. Short selling could cause unlimited losses, derivatives could result in losses beyond the amount invested, and the value of an investment in the Fund may fall sharply. Beta is a measure of an asset’s sensitivity to an underlying index. Long is purchasing a stock with the expectation that it is going to rise in value. Short is selling stock with the expectation of profiting by buying it back later at a lower price. HFRI EH: Equity Market Neutral Index incorporates equity market neutral strategies including both Factor-based and Statistical Arbitrage/Trading Strategies. Factor-based investment strategies include strategies in which the investment thesis is predicated on the systematic analysis of common relationships between securities. Statistical Arbitrage/Trading consist of strategies in which the investment thesis is predicated on exploiting pricing anomalies which may occur as a function of expected mean reversion inherent in security prices. Equity Market Neutral Strategies typically maintain characteristic net equity market exposure no greater than 10% long or short. Russell 1000 Index measures the performance of approximately 1000 of the largest companies in the U.S. equity market. One cannot invest directly in an index.