AMENDMENT NO. 2 Employer/Applicant:

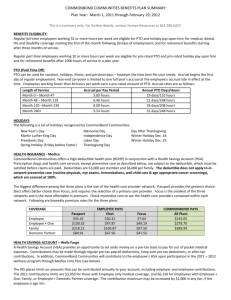

advertisement