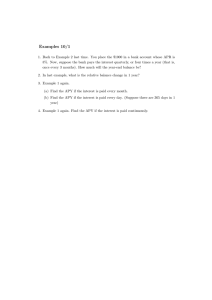

Examples 10/8

advertisement

Examples 10/8 0. Suppose you want to deposit $10,000 in a bank for 5 years. Wells Fargo offers you a saving account with an APR of 12.5% and compounding annually. Chase Bank offers you another saving account with an APR of 12% but compounding monthly. Now you have to make a choice between these two account. (a) Calculate the accumulated balance after 5 years for both account if you deposit your $10,000 into them. Which one will give you more interest? (b) Find the APY for both account. Notice that Wells Fargo’s account has a higher APR but a lower APY than Chase Bank. Can you draw a conclusion on the relation among APR, APY and the total interest paid? 1. Suppose you borrow $1,200 at an annual interest rate of APR = 12%, or 1% per month, and you will pay off the debt in 3 months. 2. Back to Example 1. How much should you pay every month in the loan is an installment one. 3. You need a $6,000 loan to buy a used car. Your bank offers a 3-year loan at 8% and a 5-year loan at 10%. Calculate your monthly payments and total interest over the loan term with each option.