APR Homework

advertisement

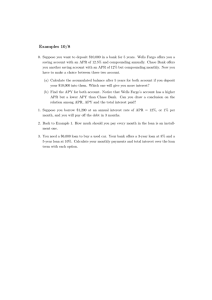

APR Homework 1) Calculate the APR of the following add-on loans assuming monthly payments (exactly like you did in Friday lab, so pull out your notes from Friday). Recall that for the arithmetic series (sum), S=1+2+3+ … +n, we n(n 1) showed on Friday that S . 2 a. Purchase a living room set for $3600 with a 7.5% add-on loan over a 3 year period. b. Purchase a stereo set for $2760 with a 7.5% add-on loan over a 3 year period. 2) Did the principal mater in the above calculation? Justify your answer by calculating the APR for a 7.5% 3 year add-on loan for $P. Hint: It may be easier to think of the principal in terms of the monthly payment, d; let P=36d where d represents the monthly payments towards the loan balance and then show that the value of d is irrelevant in the calculation of this APR. 3) Determine the general form of the APR of an add-on loan. In other words, what is the APR of an add-on loan for $P with N total payments made n times per year at a rate of r? I think it would be helpful to let P=Nd, as you 2rt did with #2. You should get a compound period rate of i , so N 1 2rt 2rnt 2rN 2rN APR ni n . Note that since APR , the N 1 N 1 N 1 N 1 only thing relevant when determining APR is the add-on rate and the totally number of payments (so the principal and the actual loan time are irrelevant). 4) A car dealer will sell you the $18,436 car of your dreams for $3,000 down and 60 easy monthly payments of $384. a. How much would you end up paying for the car? b. How much interest would you pay? c. Assuming this is an add-on loan, what is the add-on interest rate? d. Assuming this is an add-on loan, what is the APR? Note that you may 2rN use the formula derived in #3 to answer this: APR . N 1