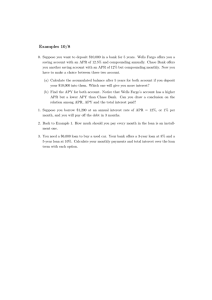

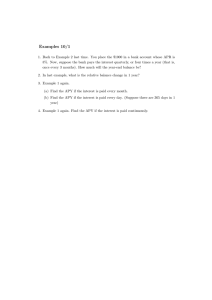

Solution to Example 0 on 10/8

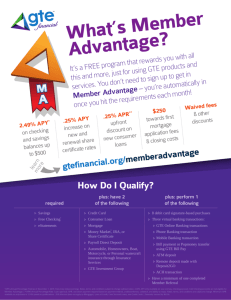

advertisement

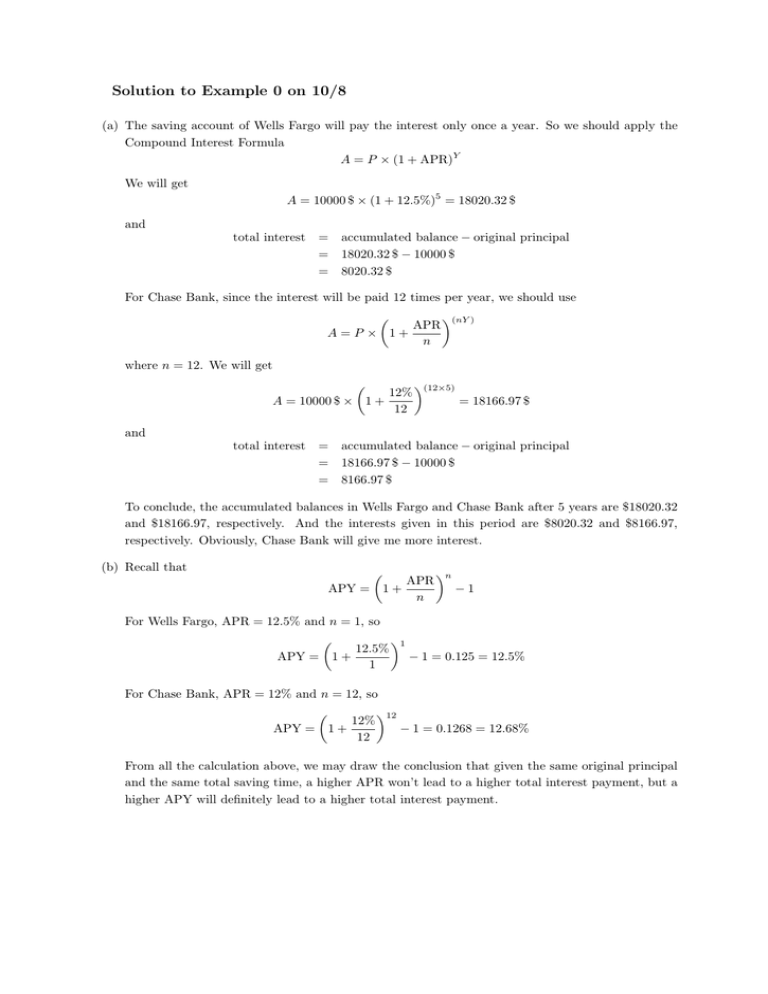

Solution to Example 0 on 10/8 (a) The saving account of Wells Fargo will pay the interest only once a year. So we should apply the Compound Interest Formula A = P × (1 + APR)Y We will get A = 10000 $ × (1 + 12.5%)5 = 18020.32 $ and total interest = accumulated balance − original principal = 18020.32 $ − 10000 $ = 8020.32 $ For Chase Bank, since the interest will be paid 12 times per year, we should use µ APR A=P × 1+ n ¶(nY ) where n = 12. We will get µ ¶(12×5) 12% A = 10000 $ × 1 + = 18166.97 $ 12 and total interest = accumulated balance − original principal = 18166.97 $ − 10000 $ = 8166.97 $ To conclude, the accumulated balances in Wells Fargo and Chase Bank after 5 years are $18020.32 and $18166.97, respectively. And the interests given in this period are $8020.32 and $8166.97, respectively. Obviously, Chase Bank will give me more interest. (b) Recall that µ APY = APR 1+ n ¶n −1 For Wells Fargo, APR = 12.5% and n = 1, so µ APY = 1+ 12.5% 1 ¶1 − 1 = 0.125 = 12.5% For Chase Bank, APR = 12% and n = 12, so µ APY = 12% 1+ 12 ¶12 − 1 = 0.1268 = 12.68% From all the calculation above, we may draw the conclusion that given the same original principal and the same total saving time, a higher APR won’t lead to a higher total interest payment, but a higher APY will definitely lead to a higher total interest payment.