Quantifying the Benefits of Trunk Highway and Local Road Investments

advertisement

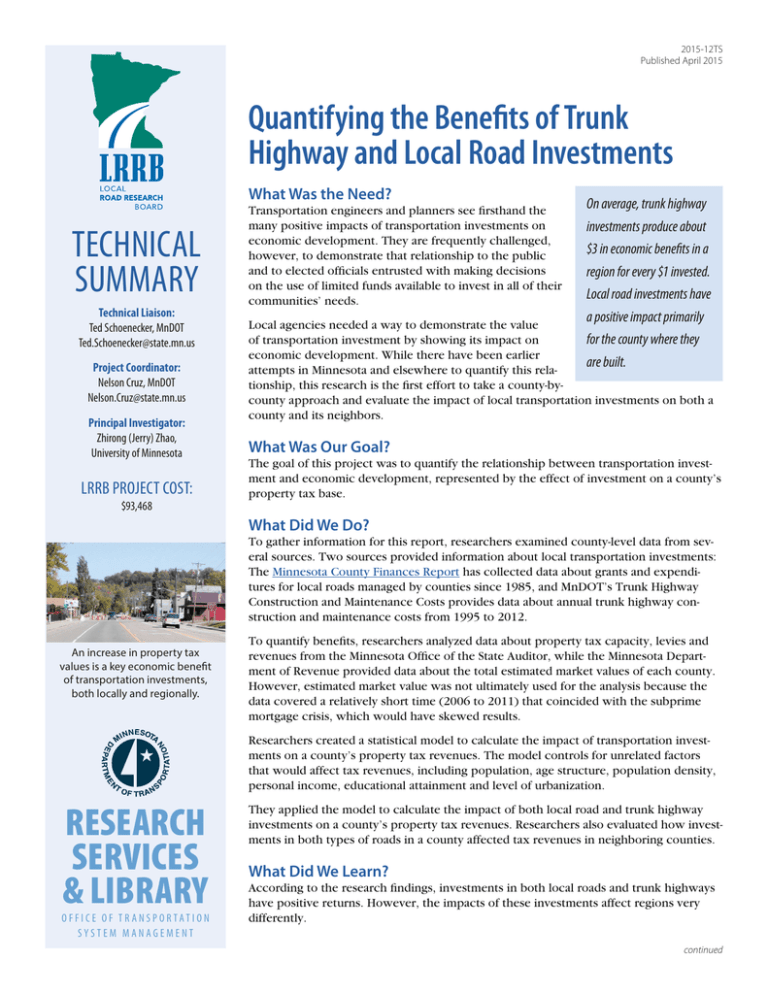

2015-12TS Published April 2015 Quantifying the Benefits of Trunk Highway and Local Road Investments What Was the Need? TECHNICAL SUMMARY Technical Liaison: Ted Schoenecker, MnDOT Ted.Schoenecker@state.mn.us Project Coordinator: Nelson Cruz, MnDOT Nelson.Cruz@state.mn.us Principal Investigator: Zhirong (Jerry) Zhao, University of Minnesota LRRB PROJECT COST: $93,468 Transportation engineers and planners see firsthand the many positive impacts of transportation investments on economic development. They are frequently challenged, however, to demonstrate that relationship to the public and to elected officials entrusted with making decisions on the use of limited funds available to invest in all of their communities’ needs. On average, trunk highway investments produce about $3 in economic benefits in a region for every $1 invested. Local road investments have a positive impact primarily for the county where they are built. Local agencies needed a way to demonstrate the value of transportation investment by showing its impact on economic development. While there have been earlier attempts in Minnesota and elsewhere to quantify this relationship, this research is the first effort to take a county-bycounty approach and evaluate the impact of local transportation investments on both a county and its neighbors. What Was Our Goal? The goal of this project was to quantify the relationship between transportation investment and economic development, represented by the effect of investment on a county’s property tax base. What Did We Do? To gather information for this report, researchers examined county-level data from several sources. Two sources provided information about local transportation investments: The Minnesota County Finances Report has collected data about grants and expenditures for local roads managed by counties since 1985, and MnDOT’s Trunk Highway Construction and Maintenance Costs provides data about annual trunk highway construction and maintenance costs from 1995 to 2012. An increase in property tax values is a key economic benefit of transportation investments, both locally and regionally. To quantify benefits, researchers analyzed data about property tax capacity, levies and revenues from the Minnesota Office of the State Auditor, while the Minnesota Department of Revenue provided data about the total estimated market values of each county. However, estimated market value was not ultimately used for the analysis because the data covered a relatively short time (2006 to 2011) that coincided with the subprime mortgage crisis, which would have skewed results. Researchers created a statistical model to calculate the impact of transportation investments on a county’s property tax revenues. The model controls for unrelated factors that would affect tax revenues, including population, age structure, population density, personal income, educational attainment and level of urbanization. RESEARCH SERVICES & LIBRARY O FFICE O F TR ANSP O R TATI O N SYSTEM MANAGEMENT They applied the model to calculate the impact of both local road and trunk highway investments on a county’s property tax revenues. Researchers also evaluated how investments in both types of roads in a county affected tax revenues in neighboring counties. What Did We Learn? According to the research findings, investments in both local roads and trunk highways have positive returns. However, the impacts of these investments affect regions very differently. continued “We all know we don’t have enough funding for transportation, in part because we don’t have good evidence to show the benefits of transportation and give political leaders the incentive to invest.” —Jerry Zhao, Associate Professor, University of Minnesota Humphrey School of Public Affairs Trunk highway investments, such as Trunk Highway 61 in northeast Minnesota, produce significant economic benefits in the counties where they are built and in neighboring counties. “There’s been an understanding for years that investment in roads and bridges pays by facilitating economic development, serving citizens and promoting safety. This study provides objective data that shows that investment does in fact pay.” —Alan Forsberg, Blue Earth County Engineer On average, $1 of local road investment increases property value by $1.254 for the county. However, local road investments can have a negative impact on the property tax revenue in neighboring counties. The overall regional impact is still positive but reduced, likely because of inter-local competition: Local roads tend to support a community’s economic development at the expense of its neighbors. Trunk highway investments have a somewhat lower return on investment for the county where they are made. A $1 trunk highway investment increased a county’s property value by $0.871. However, investments produced significant benefits to neighboring counties as well, producing total benefits throughout the region of nearly four times that amount, likely because of the role that trunk highways play in connecting communities. These results are averages statewide, so the benefits of investment in an individual road may vary significantly. The average ROI of road investments in the Twin Cities tends to be lower than in rural areas, particularly in the western part of the state, simply because the urban area already has higher levels of roadway investment. What’s Next? This research should provide a valuable tool for local agencies and MnDOT to use in communicating the economic value of transportation investments and winning support for these investments from elected officials and the general public. While the research suggests that trunk highways generally have greater regional benefits than local roads, individual projects will still need to be assessed for their specific impacts. For example, some local roads function more like trunk highways in the way they connect communities. This research shows that roads with the greatest regional significance provide the greatest benefits. Produced by CTC & Associates for: Minnesota Department of Transportation Research Services & Library MS 330, First Floor 395 John Ireland Blvd. St. Paul, MN 55155-1899 651-366-3780 www.mndot.gov/research No follow-up research is currently planned, although it may be valuable to analyze the data at more detailed levels to understand subtleties such as the impact of geographic region, how ROI changes over time and the difference in economic effects of investment and maintenance spending. Future research may also evaluate the impact of transportation investment on other economic factors such as income tax or sales tax bases. This Technical Summary pertains to the LRRB-produced Report 2015-12, “Transportation Investment and Economic Development in Minnesota Counties,” published April 2015. The full report can be accessed at http://www.lrrb.org/PDF/201512.pdf.