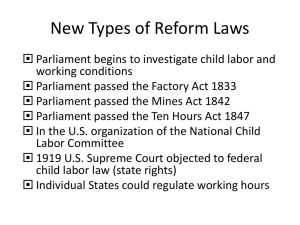

ZEF Bonn Institutional Reform of Economic Legislation in

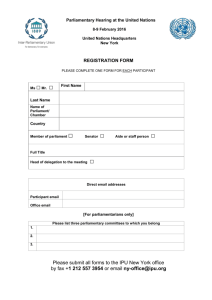

advertisement