ZEF Bonn Towards Enhancing the Role of Microfinance for

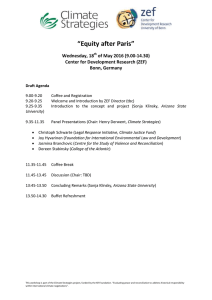

advertisement