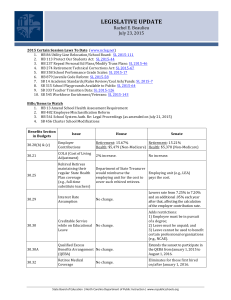

Retirement Handbook

advertisement