Financial Action Task Force Groupe d'action financière P

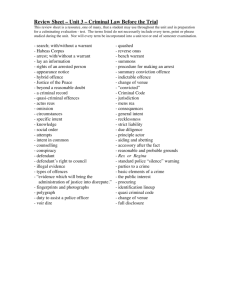

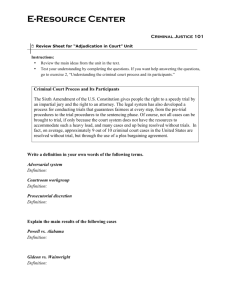

advertisement