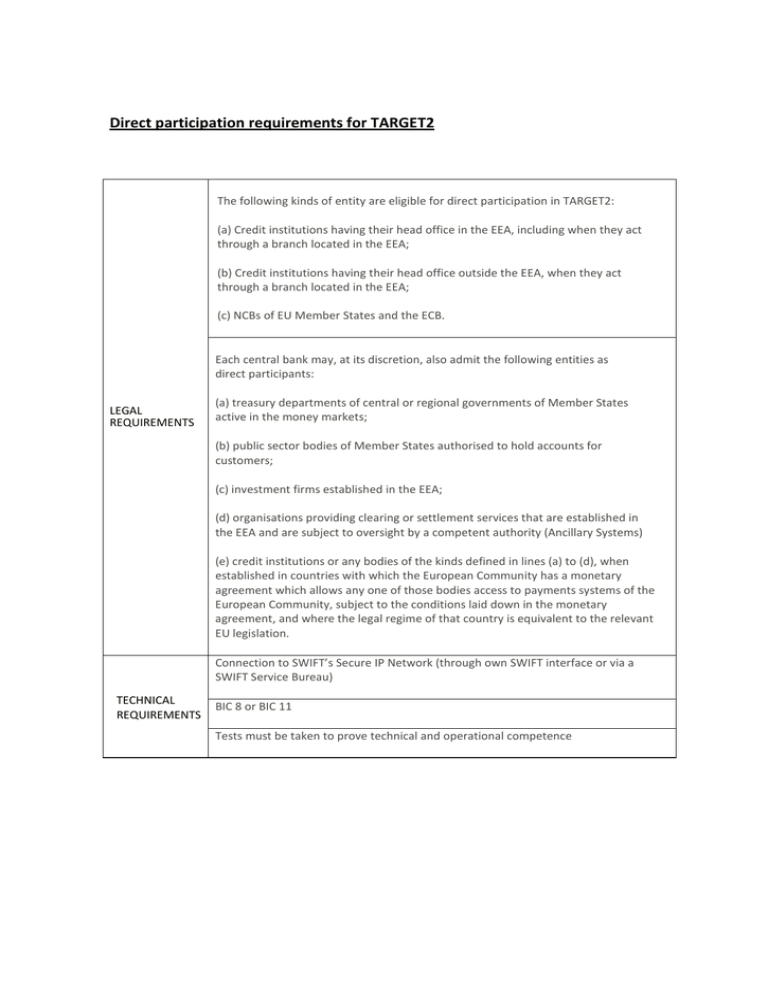

Direct participation requirements for TARGET2

advertisement

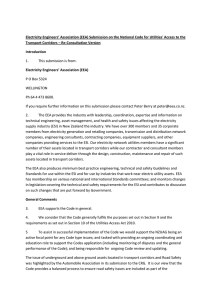

Direct participation requirements for TARGET2 The following kinds of entity are eligible for direct participation in TARGET2: (a) Credit institutions having their head office in the EEA, including when they act through a branch located in the EEA; (b) Credit institutions having their head office outside the EEA, when they act through a branch located in the EEA; (c) NCBs of EU Member States and the ECB. Each central bank may, at its discretion, also admit the following entities as direct participants: LEGAL REQUIREMENTS (a) treasury departments of central or regional governments of Member States active in the money markets; (b) public sector bodies of Member States authorised to hold accounts for customers; (c) investment firms established in the EEA; (d) organisations providing clearing or settlement services that are established in the EEA and are subject to oversight by a competent authority (Ancillary Systems) (e) credit institutions or any bodies of the kinds defined in lines (a) to (d), when established in countries with which the European Community has a monetary agreement which allows any one of those bodies access to payments systems of the European Community, subject to the conditions laid down in the monetary agreement, and where the legal regime of that country is equivalent to the relevant EU legislation. Connection to SWIFT’s Secure IP Network (through own SWIFT interface or via a SWIFT Service Bureau) TECHNICAL REQUIREMENTS BIC 8 or BIC 11 Tests must be taken to prove technical and operational competence