Minutes August 14, 2012 Guild Office

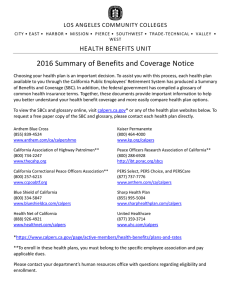

advertisement

Minutes August 14, 2012 Guild Office PARTICIPANTS: Susan Aminoff, AFT; Don Sparks, Faculty; Galen Bullock, Trade Tech SEIU 721; Barbara Harman, Retiree (Staff Guild); Velma Butler, AFT1521A; Armida Ornelas, Faculty Guild; Joanne Waddell, Faculty Guild; Leila Menzies, Business Services; Annie G. Reed, 911 Teamsters; Sue Carleo, President Valley College; James Bradley, Local 99; Manny Rangel, Local 99; Ken Takeda, West/MGT; Dorothy Bates, AFT1521A; Ethel McClatchey, President AFT1521; Nancy Carson, Teamsters Retiree; Gary Delaney, WFIS; Kristin Yokoyama, WFIS; Liliana Salazar, WFIS; Terri Mendez, WFIS I. Call to Order: 9:40 a.m. II. Approval of the 6/12/2012 Agenda: Approved III. Approval of the 6/12/2012 Minutes: No minutes due to retreat IV. Public Comments: WFIS introduction was requested. Brief introductions were made by each WFIS member. V. Health Benefit Unit Activities Discussion • Annual open Enrollment: 9/10 – 10/5 (CalPERS will handle all Enrollment). Fall 2012 Newsletter is in progress, and due to go out on 8/30. Newsletter should be reviewed by all. Deadline for comments is 8/20/2012 (send to Kristin and/or Armida.) Items discussed: • PROCESS for NEWSLETTER, • The timing - send out a shorter version in Spring or send out a quarterly email blast, • Committee wants to review NEWSLETTER in greater detail Need to create a Subcommittee for Communications along with an annual timeline. Volunteers are Armida, Leila, Ethel, Sue, Velma, Dorothy and James. Newsletter changes are due by 8/20. Change pictures in NEWSLETTER. Need employees’ pictures. Newsletter should be EE driven vs. Student driven. Refer to back page – Retirees should be listed as “Resources”. Please list Barbara, Ethel and Nancy as Retiree Resources. Annie’s name is not listed correctly on back. How should names be listed? Suggests names be listed in alpha order/last name. Ken s/b Management Rep Alternate. (Pg 5 – HRA box add: “and Early Retirees”. JoAnn mentioned TASK force for Budget Committee if PROP 30 fails. One item to be negotiated is HRAs. Employees should know this is changing. LABOR caucus will follow this meeting to discuss further. Best time will be before OE. Another possibility is that Comm. Committee can have something similar. Comment made that timing is problematic. Changes cannot be made after the closing date of OE. Decision needs to be made prior to OE. Andy Duran does advisories during the OE?? Comment made this would not be fair. Leila confirmed that CalPERS reps will come to all 3 Health Fairs. Regarding the Card Swipe Page for FSA – It must be validated to be sure it meets all the guidelines. What can be communicated? Drafts were provided to be reviewed/edited/discussed. Question came up regarding OE from home computer. (End of Calendar and end of FY). Group discussed how to access remotely: Internet vs. Intranet. Page 7 will need to be updated in brochure/Newsletter. Comment: need to designate a location like in the past. Armida asked about Health Fairs communications – how? Email blasts? Leila use to send out communications and explain it was “LIVE STREAMING” , then resent at a later date as an “ARCHIVE” message; need to reconstruct the message. Comment/Question: “What will the Health Fair consist of? “Vendors/One on One - with Laptops and video tape/give a 10-15 talk to audience. Give -aways? CalPERS (be clear to EEs) CalPERS calls it a “BENEFIT WORKSHOP”. Keep that name. Refer to section “Swiping Card” – have Communications Subcommittee help explain - refer to documents for review/edits/feedback. Newsletter will be mailed out to retirees and emailed to Actives and Early Retirees (before and during OE.) Comment: create special OE pieces for RETIREES only. CalPERS also sends out information. CURRENT FORMAT is not working: reading it is a problem. CalPERS sends out info for medical. LACCD should send out something on all other coverage’s. Need to include telephone numbers for Retirees alongside email address since all retirees don’t have computer access. Suggest doing a postcard, reminder, handout for Retirees. Refer to CSC for future discussion. Also use a bigger font size. Leila will follow up on warrants and check stubs. Put them on both. August 31 and Sept 15th, and 30th Contact information – add “LACCD” to all other vendors after (page 7) VI. Health Care Reform Update discussed by Liliana: Topic: Medicaid coverage/restrictions – U.S. Supreme Court deemed Medicaid penalty for states that opt-out to be unconstitutional, therefore the penalty was removed and now states can choose to opt-out or opt-in of Medicaid expansion. Discussed in detail: “Opt in or out”? CA will opt in. Individuals with household income at or below 138% of the FPL will be eligible for Medicaid at little or no cost, regardless of age. What changes should the district consider due to the Supreme Court upholding the ACA? (1) Eliminate dollar limits (maximum); (2) The HRA for Actives and early retirees is subject to the elimination of restrictive annual dollar limits on essential health benefits. Law states an employer cannot impose an annual dollar limit if employer offers a standalone HRA to EEs but the ACA restrictions on annual limits do not apply to RETIREE only plans. ACTIVES are exempt until end of 2013 when the global waiver granted by HHS expires. Exception to elimination of restrictive annual dollar limits as it pertains to the HRA. ER can offer a FSA-like plans if the max. contribution is $500 or less. At the end of 12/31/13, and assuming no new guidance is issued eliminating the applicability of the restrictive annual dollar limits to stand alone HRAs, the HRA for active employees will have to terminate and all HRA balances would be forfeited. The balance in the HRA would be FORFEITED and revert to plan sponsor. Additional guidance on the treatment of HRAs is awaited from HHS. Ideas for consideration – convert the ACTIVE balance into a RETIREE HRA account but member cannot access funds until retirement: “A converted plan”. Another option would be for the Plan Sponsor to pay out the amounts to employee and early retirees with account balances once the funds revert back to the District in the form of cash. Earned Benefit = TAXABLE disbursement. May use for deferral or by choice. Like FSA “Lose it or Use it”. Last deposit is 2014. TB Negotiated. Other features – FSA capped at $2500 if renewing 1/1/2013; currently it is capped at $5000. Do a special outreach to those in this scenario. No aggregate based on spouse. Dependent Care is NOT impacted. Other item to note: Current HRA EEs, need to send out ‘Notice of “Exemption” for HRAs. Other provisions are included in the Legislative Updates. CalPERS should be already sending info. New vehicle of annual value of coverage paid by both EE and ER; include in W-2 form in box 12 DD, W-2 to be issued on January 2013. Just information, new reporting section. Future taxation will exist. A 40% excise tax will apply if annual cost of ER coverage medical/FSA contribution (EE only) exceeds $10,200. (Excludes separate dental and vision plan.) Tax applies to costs of total premiums. The totals are “indexed”. Carrier will be paying the tax; the ER pays for tax on Self-Funded plans. (Self -funded plans like PERS Choice, PERS Select). Info is for “informational use only” until 2018. Preventive Care for WOMEN – contraceptive care = no copay, pregnancy, etc. HMO’s 2011 no referral, pediatrician, preventive care is now 100%. PPOs through 2014. Requested FACT Sheet on HRA by CSC VII. CalPERS Update • Medical Rates 2013 – refer to handout CalPERS 2013 annual cost. Reviewed MACS sheet. Explained the Actives and ER of 4287. $2,923,459 increase or 4.7%. Comment made that in 2009 and 2010 totals were more in the 70 range. Medical only. Is listed. Still need the vision and dental. Prepping for the board. Additional data will include all Medical, Dental, and Vision Enrollment. Are Adjuncts included in counts? 350 adjuncts pay half the premium. Comment made to show more details. They want to view the actual number. Need to include 349 Early Retirees. Velma made that comment. • Amnesty for Dependent Care Update. Ethel made a comment in reference to clean up ineligible dependents. Amnesty will be after June. Let members know that if you have ineligible dependents, such as a divorced dependent, they are not allowed to keep ex spouse on plan. Notify members of the Federal Law, within 60 days of qualified event. If the employee retains the former spouse on the plan, then claims paid will be reverted. EE is responsible to report change. Once ER is notified, then ER can notify CalPERS on behalf of the employee but should be notifying CalPERS direct. Legally separated – is a qualifying event. Refer back to CalPERS sheet: 2691 in that number, CalPERS will charge A&B if members are not recording the proper membership. ER = must have A&B, CalPERS doesn’t. Must be in AB, tax should be paid. Need to clarify the number of those who are not following the directions. (sub list of about a dozen received a letter to ….pay) Grandfathered ….. VIII. Paying Cost for Medicare Ineligibles – see notes above. Need to identify those members. Need to be consistent with CP rules. Recover the costs from members. IX. JLMBC Meeting Schedule: August 2012 through June 2013 - APPROVED! WFIS WILL SEND OUT A REMINDER the Friday before. Newsletter, Benefits Workshop should be Tuesday 9/11, not Thursday X. Board Meeting – September 12, 2013, 3:00PM XI. Adjourn XII. Labor Caucus 11:50 AM - at the DISTRICT OFFICE The next JLMBC meeting will be held September 11, 2012 at the Guild Office