ECONOMIC BULLETIN June 2015

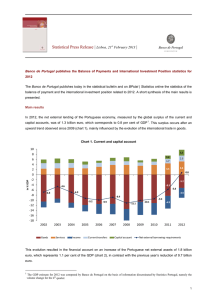

advertisement