BY ORDER OF THE AIR FORCE INSTRUCTION 32-1061 23 FEBRUARY 2011

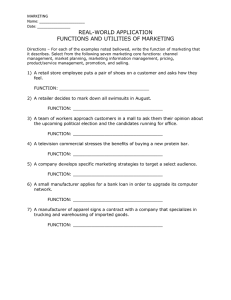

advertisement