Document 12074205

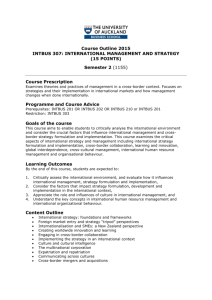

advertisement