At a Glance my money savvy investor

advertisement

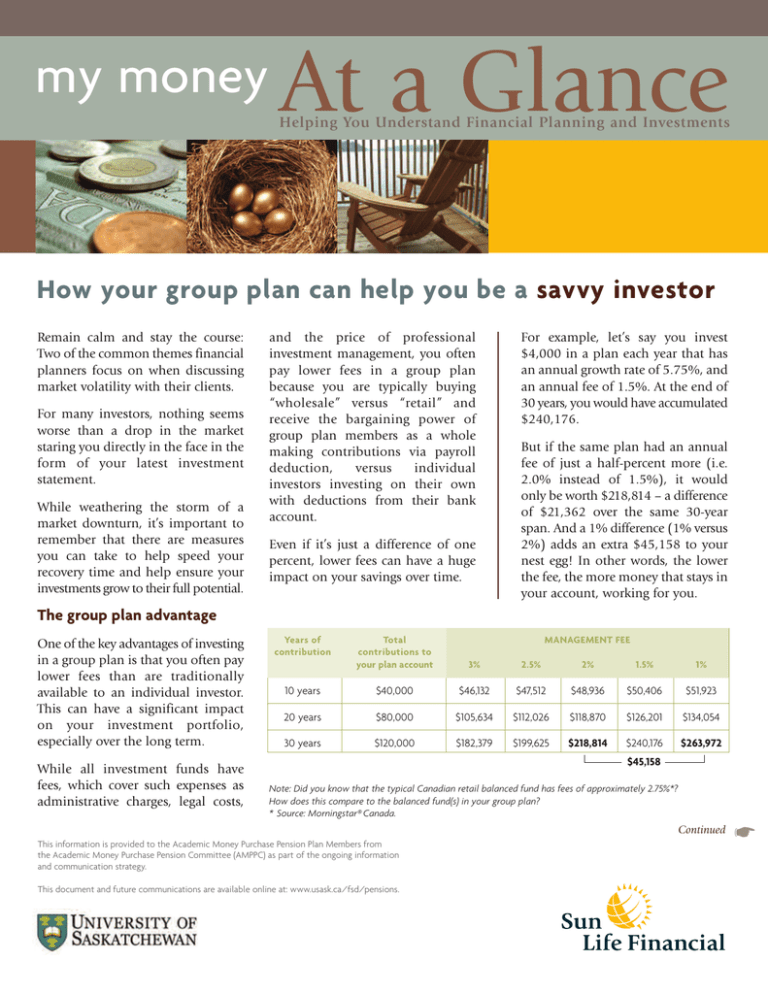

my money At a Glance Helping You Understand Financial Planning and Investments How your group plan can help you be a savvy investor Remain calm and stay the course: Two of the common themes financial planners focus on when discussing market volatility with their clients. For many investors, nothing seems worse than a drop in the market staring you directly in the face in the form of your latest investment statement. While weathering the storm of a market downturn, it’s important to remember that there are measures you can take to help speed your recovery time and help ensure your investments grow to their full potential. and the price of professional investment management, you often pay lower fees in a group plan because you are typically buying “wholesale” versus “retail” and receive the bargaining power of group plan members as a whole making contributions via payroll deduction, versus individual investors investing on their own with deductions from their bank account. Even if it’s just a difference of one percent, lower fees can have a huge impact on your savings over time. For example, let’s say you invest $4,000 in a plan each year that has an annual growth rate of 5.75%, and an annual fee of 1.5%. At the end of 30 years, you would have accumulated $240,176. But if the same plan had an annual fee of just a half-percent more (i.e. 2.0% instead of 1.5%), it would only be worth $218,814 – a difference of $21,362 over the same 30-year span. And a 1% difference (1% versus 2%) adds an extra $45,158 to your nest egg! In other words, the lower the fee, the more money that stays in your account, working for you. The group plan advantage One of the key advantages of investing in a group plan is that you often pay lower fees than are traditionally available to an individual investor. This can have a significant impact on your investment portfolio, especially over the long term. While all investment funds have fees, which cover such expenses as administrative charges, legal costs, Years of contribution Total contributions to your plan account 3% 2.5% 2% 1.5% 1% 10 years $40,000 $46,132 $47,512 $48,936 $50,406 $51,923 20 years $80,000 $105,634 $112,026 $118,870 $126,201 $134,054 30 years $120,000 $182,379 $199,625 $218,814 $240,176 $263,972 MANAGEMENT FEE $45,158 Note: Did you know that the typical Canadian retail balanced fund has fees of approximately 2.75%*? How does this compare to the balanced fund(s) in your group plan? * Source: Morningstar® Canada. Continued This information is provided to the Academic Money Purchase Pension Plan Members from the Academic Money Purchase Pension Committee (AMPPC) as part of the ongoing information and communication strategy. This document and future communications are available online at: www.usask.ca/fsd/pensions. (cont’d) Because you’re buying wholesale, group plans don’t charge front end or back end loads, which is why they’re a better bet if you’re looking to speed up your recovery from a bear market. Lower fees really do make a difference over time. For example, let’s say you had $1,000.00 invested in equities, which dropped to $750.00 due to market turbulence. It would take less time to recover the loss through your group plan, compared to a personal RRSP that you may have at a bank, where the fees for a typical balanced fund would be higher. This example is provided for general illustrative purposes only, assuming a 5.75% annualized rate of return. Fees in this example are 1.5% and 2.75% for group and individual balanced funds respectively, with no additional contributions made during the recovery period. And if the fees in your group plan are even lower, than the recovery would be that much faster! Disclosure is a good thing! Your group plan statement fully discloses the fees you’re paying within the plan. This helps you to be a more informed investor. And, since fees are always applicable when it comes to investing, you can use this information to ask your retail institution about all of the fees that may be reflected in your retail investments. If the fees are not disclosed on your retail statement, they would be reflected in the rate of return that may be applied to your investments i.e. higher fees translate into a lower rate of return. Asking questions will help you to decide if you should take full advantage of the lower fees in your group plan by consolidating your investments and maximizing your investment returns when the market rebounds. i If you have a general question or suggestion about this newsletter, please send an e-mail to can_pencontrol@sunlife.com or write to my money At a Glance Newsletter, Group Retirement Services Marketing, Sun Life Financial, 225 King Street West, Toronto, ON M5V 3C5. This bulletin has been created exclusively for you. It addresses issues to help you with your financial planning and investments, and cannot be reproduced in whole or in part without the express permission of Sun Life Financial. 11/08-st-eo