Document 12069669

advertisement

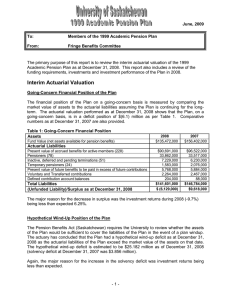

October 5, 2007 To: From: Members of the 1999 Academic Pension Plan Academic Fringe Benefits Committee The primary purpose of this report is to review the actuarial valuation of the 1999 Academic Pension Plan as at December 31, 2006. This report also includes a review of the funding requirements, investments and investment performance of the Plan in 2006 and for the six months ending June 30, 2007. Actuarial Valuation Going-Concern Financial Position of the Plan The financial position of the Plan on a going-concern basis is measured by comparing the market value of assets to the actuarial liabilities assuming the Plan is continuing for the longterm. The actuarial valuation performed as at December 31, 2006 shows that the Plan, on a going-concern basis, is in a surplus position of $ 15.3 million as per Table 1. Comparative numbers as at December 31, 2005 are also provided. Table 1: Going-Concern Financial Position Assets Fund Value (net assets available for pension benefits) 2006 $171,640,000 2005 $159,620,000 $105,001,000 $30,846,000 $9,742,000 $1,877,000 $6,163,000 $2,708,000 $156,337,000 $15,303,000 $108,430,000 $24,943,000 $6,465,000 $2,559,000 $6,234,000 $2,800,000 $151,431,000 $8,189,000 Actuarial Liabilities Present value of accrued benefits for active members (263) Pensioners (69) Inactive, deferred and pending terminations (53) Temporary pensioners (32) Present value of future benefits to be paid in excess of future contributions Voluntary and Transferred contributions Total Liabilities Surplus as at December 31, 2006 Solvency Position of the Plan The Pension Benefits Act (Saskatchewan) requires the University to review whether the assets of the Plan would be sufficient to cover the liabilities of the Plan in the event of a plan windup. The actuary has concluded that the Plan is solvent as at December 31, 2006 as the market value of the assets exceeds the actuarial liabilities of the Plan on this date. The solvency surplus is estimated to be $8.010 million as of December 31, 2006 (solvency surplus at December 31, 2005 was $0.228 million). Funding Requirements The Pension Benefits Act (Saskatchewan) also requires that Plan members must be informed if Plan surplus will be used to cover future promised benefits that cannot be covered by the contribution rates that are currently in effect. The actuary has concluded that current contribution rates are insufficient to pay for the benefits currently accruing to members of the Plan. It is estimated that the benefits currently accruing to members cost 17.27% of -1- pensionable earnings, whereas the current contribution rates amount to 13.64% of pensionable earnings. The contribution shortfall, 3.63% of pensionable earnings, amounts to $6,163,000 (see Table 1 “Present value of future benefits to be paid in excess of future contributions”) and has been deducted in calculating the Plan surplus on a going-concern basis. Since the Plan does not have a solvency deficiency as at December 31, 2006, no additional employer contributions other than those outlined above are required. Investments of the Pension Plan Investments The long-term investment goal of the Plan is to achieve a minimum annualized rate of return of 3.25% in excess of the Canadian Consumer Price Index. To achieve this goal, the Plan has adopted an asset mix that has a bias in favour of equity investments. Over the last ten years the annualized rate of return for the Plan has been 8.1% compared to an annualized increase in the Consumer Price Index of 2.0%. The responsibility for investing the assets of the Plan has been delegated to three professional investment fund managers with different mandates to ensure adequate investment diversification. Investment Performance For 2006 13.4% 13.2% Plan Return (gross) Plan Return Benchmark (gross) Last 4 years 10.3% 10.9% The Plan’s Return Benchmark is a performance standard developed by the Investment Consultants, Hewitt Associates. The Fringe Benefits Committee and the Board of Governors have approved the benchmark. The investment fund managers of the Plan are expected to meet or surpass the benchmark. To the end of June, 2007 equity markets were strong, particularly in those areas where oil stocks comprise a major part of the index. The Canadian stock market was one of the best performers in the world, and the broader U.S. market was not far behind. The 8.4% gain of the Canadian dollar during the second quarter caused the U.S. returns to be a negative number when expressed in Canadian dollars. Global growth continues to be fuelled by the less developed economies; in particular, China. It was a dismal quarter for the bond market as rising inflation and unexpectedly strong economic growth moved yields upward across the maturity spectrum. Inflation is rising and thus the Bank of Canada raised rates 0.25% in July. The consequence of the Bank of Canada’s action has been an unprecedented rapid rise in the Canadian dollar compared to the U.S. dollar. The Canadian dollar continues to track the price of oil as high oil prices result in significant inflows into Canada. It is also boosted by the sizable takeovers of Canadian companies by foreign investors who must purchase Canadian dollars to complete their transactions (report by Jarislowsky Fraser Limited – July, 2007). The six month rate of return earned by the Plan was 0.7% before expenses. During the same period, the S&P/TSX index returned 9.1%, the S&P 500 (U.S. equities) returned -2.2% and the Europe, Australia and Far East (EAFE) index, which measures non-North American equities, increased by 1.2%. The Scotia Bond Universe posted a -0.8% return. -2- Investment Fund Managers of the Plan The managers and the market value of assets controlled by each at December 31, 2006 are shown below. Barclay’s Global Investors Jarislowsky Fraser Limited Tweedy, Browne Company LLC $55.4 Million $91.5 Million $24.3 Million The Value of the Pension Plan as at December 31, 2006 Table 2 shows the value of the Pension Plan as at December 31, 2006 by major asset classes. TABLE 2: Market Value of Pension Plan Assets Asset Class Canadian Equities Non-Canadian Equities Total Equities Dec 31, 2006 ($000) $ 34,109 72,988 107,097 Per Cent of Market Value 19.9% 42.7% 62.6% Bonds Short-Term Investments Total Fixed Income $ 58,139 5,926 64,065 34.0% 3.5% 37.4% Market Value of Investments $ 171,162 100.0% Accrued Investment Earnings Total Market Value of the Fund 406 $ 171,568 Note to Table 2: The market value of the total fund ($171,568,000) reported by the investment fund managers differs from the fund value ($171,640,000) reported by the actuary. The investment fund managers report on investment funds only; whereas the actuary includes accounts payable and contributions receivable with its fund value. Plan Documents The AFBC met 14 times during 2006. Copies of the agenda, minutes, auditor’s report, financial reports and all actuarial reports are on file in the Faculty Association office and the office of the Director of Benefits. They are available for inspection by any member of the Plan during regular working hours by prior arrangement. Please contact the Benefits Office at 966-6633 or any member of the Academic Fringe Benefits Committee if you have any questions about the items covered. -3- Academic Pension Plan Information Academic Fringe Benefits Committee Members Faculty Association Appointees: Pat Krone Ron Cuming Anatomy & Cell Biology Law Faculty Association Participant Daryl Lindsay Commerce Board of Governors Appointees: Laura Kennedy Bob Elliott Matt Webster Financial Services Financial Services Financial Services Observer (ASPA) Al Rung Veterinary Medicine Actuary AON Consulting Investment Consultants Hewitt Associates Investment Custodian CIBC Mellon Global Securities -4-