Document 12069666

advertisement

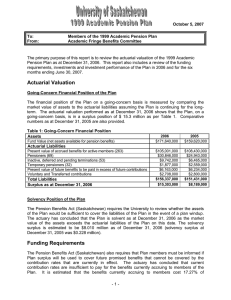

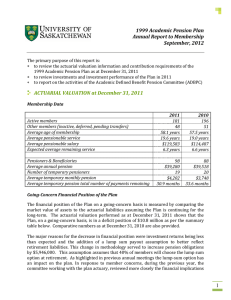

June, 2009 To: Members of the 1999 Academic Pension Plan From: Fringe Benefits Committee The primary purpose of this report is to review the interim actuarial valuation of the 1999 Academic Pension Plan as at December 31, 2008. This report also includes a review of the funding requirements, investments and investment performance of the Plan in 2008. Interim Actuarial Valuation Going-Concern Financial Position of the Plan The financial position of the Plan on a going-concern basis is measured by comparing the market value of assets to the actuarial liabilities assuming the Plan is continuing for the longterm. The actuarial valuation performed as at December 31, 2008 shows that the Plan, on a going-concern basis, is in a deficit position of $(6.1) million as per Table 1. Comparative numbers as at December 31, 2007 are also provided. Table 1: Going-Concern Financial Position Assets Fund Value (net assets available for pension benefits) 2008 $135,472,000 2007 $156,402,000 $90,691,000 33,862,000 7,229,000 1,583,000 5,768,000 2,264,000 204,000 $141,601,000 $ (6,129,000) $96,522,000 33,517,000 6,230,000 2,076,000 5,884,000 2,467,000 88,000 $146,784,000 $9,618,000 Actuarial Liabilities Present value of accrued benefits for active members (228) Pensioners (78) Inactive, deferred and pending terminations (51) Temporary pensioners (24) Present value of future benefits to be paid in excess of future contributions Voluntary and Transferred contributions Defined contribution account balances Total Liabilities (Unfunded Liability)/Surplus as at December 31, 2008 The major reason for the decrease in surplus was the investment returns during 2008 (-9.7%) being less than expected 6.25%. Hypothetical Wind-Up Position of the Plan The Pension Benefits Act (Saskatchewan) requires the University to review whether the assets of the Plan would be sufficient to cover the liabilities of the Plan in the event of a plan windup. The actuary has concluded that the Plan had a hypothetical wind-up deficit as at December 31, 2008 as the actuarial liabilities of the Plan exceed the market value of the assets on that date. The hypothetical wind-up deficit is estimated to be $25.182 million as of December 31, 2008 (solvency deficit at December 31, 2007 was $3.856 million). Again, the major reason for the increase in the solvency deficit was investment returns being less than expected. -1- Funding Requirements The actuary has also concluded that current contribution rates are insufficient to pay for the benefits currently accruing to members of the Plan. It is estimated that the benefits currently accruing to members cost 17.68% of pensionable earnings, whereas the current contribution rates amount to 13.64% of pensionable earnings. The contribution shortfall, 4.04% of pensionable earnings, amounts to $5,768,000 (see Table 1 “Present value of future benefits to be paid in excess of future contributions”). This has been deducted in calculating the Plan’s unfunded liability on a going-concern basis. The University filed a valuation with regulatory authorities as at December 31, 2006. The valuation at December 31, 2008 is an interim valuation and is not required to be filed. The next required valuation must be filed not later than December 31, 2009. Temporary Solvency Deficiency Payment Relief In response to the unprecedented decline in the capital markets in 2008, The Pension Benefits Regulations, 1993 has been amended to provide temporary relief from solvency deficiency funding for sponsors of defined benefit plans. The plan administrator may file an election for a three year moratorium from funding a solvency deficiency established in a valuation between December 31, 2008 and January 1, 2011. Investments of the Pension Plan Investments The long-term investment goal of the Plan is to achieve a minimum annualized rate of return of 3.25% in excess of the Canadian Consumer Price Index. To achieve this goal, the Plan has adopted an asset mix that has a bias in favour of equity investments. Over the last ten years the annualized rate of return for the Plan has been 4.2% compared to an annualized increase in the Consumer Price Index of 2.2%. Investment Performance For 2008 -9.7% -15.2% Plan Return (gross) Plan Return Benchmark (gross) Last 4 years 2.7% 1.4% The Plan’s Return Benchmark is a performance standard developed by the Investment Consultants, Hewitt Associates. The Fringe Benefits Committee and the Board of Governors have approved the benchmark. The investment fund managers of the Plan are expected to meet or surpass the benchmark. Investment Fund Managers of the Plan The responsibility for investing the assets of the Plan has been delegated to three professional investment fund managers with different mandates to ensure adequate investment diversification. The managers and the market value of assets controlled by each at December 31, 2008 are shown below. -2- Barclay’s Global Investors Jarislowsky Fraser Limited Tweedy, Browne Company LLC $68.8 Million $53.4 Million $13.0 Million The Value of the Pension Plan as at December 31, 2008 Table 2 shows the value of the Pension Plan as at December 31, 2008 by major asset classes. TABLE 2: Market Value of Pension Plan Assets Asset Class Canadian Equities Non-Canadian Equities Total Equities Dec 31, 2008 ($000) $ 26,778 50,333 77,111 Per Cent of Market Value 19.8% 37.3% 57.1% Bonds Short-Term Investments Total Fixed Income $ 54,860 3,180 58,040 40.6% 2.3% 42.9% Market Value of Investments $ 135,151 100.0% Accrued Investment Earnings Total Market Value of the Fund 144 $ 135,295 Note to Table 2: The market value of the total fund ($135,295,000) reported by the investment fund managers differs from the fund value ($135,472,000) reported by the actuary. The investment fund managers report on investment funds only; whereas the actuary includes accounts payable and contributions receivable within its fund value. Plan Documents The FBC met 10 times during 2008. Copies of the agenda, minutes, auditor’s report, financial reports and all actuarial reports are on file in the Faculty Association office and the office of the Director of Pensions. They are available for inspection by any member of the Plan during regular working hours by prior arrangement. Please contact the Pensions Office at 966-6633 or any member of the Fringe Benefits Committee if you have any questions about the items covered. -3- Academic Pension Plan Information Fringe Benefits Committee Members Faculty Association Appointees: Pat Krone Ron Cuming Anatomy & Cell Biology Law Board of Governors Appointees: Laura Kennedy Bob Elliott Matt Webster Financial Services Financial Services Financial Services Observer (ASPA) Al Rung Veterinary Medicine Actuary AON Consulting Investment Consultants Hewitt Associates Investment Custodian CIBC Mellon Global Securities -4-