CEBS Guidelines on Supervisory Disclosure - Revised

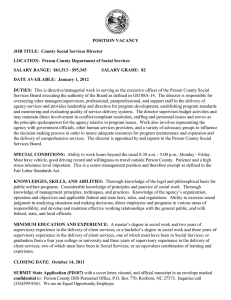

advertisement