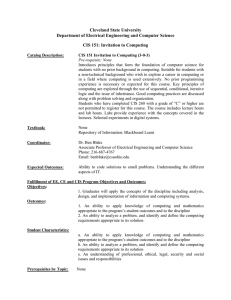

Brazil Credit Information System 1 The use of microdata in credit statistics

advertisement

Brazil Credit Information System The use of microdata in credit statistics Porto, June 20-21, 2013 Credit Information System (CIS) 1. Overview 2. Banking supervision 3. Credit bureau 4. Credit statistics 2 1 Financial Inclusion Increased access to financial services 82% of municipalities had less than 5 points per 10,000 adults in 2000. In 2010, 94% were above this level. 2000 # of points per 10,000 adults (% of municipalities) 0 (20%) 2010 # of points per 10,000 adults (% of municipalities) 0 (0%) >0 to 2 (22%) >0 to 2 (0%) >2 to 5 (40%) >2 to 5 (6%) >5 to 10 (16%) >5 to 10 (29%) >10 (2%) >10 (65%) Bank branches, bank advanced outposts (PAA), credit cooperatives (headquarters and outposts) and correspondents Sources: BCB / IBGE 3 Credit Information System (CIS) Overview CIS is a credit register which gathers information from all credit operations granted by the financial system. Implemented in 1997. CIS Phase 2 implemented in 2012. Managed by the central bank with information provided by financial institutions; Includes aggregated data covering 100% of the financial system’s credit operations, plus individualized data from each single operation of borrowers with total exposure against the financial system over R$ 1,000 (c. USD 500); Main purpose is to provide the central bank’s supervision with a wide range of information about credit operations, allowing for detailed assessment of the soundness conditions of all financial institutions thus contributing to the protection of deposit holders and the stability of the financial system. 4 2 Credit Information System (CIS) Overview Aggregated data covers 833 million credit operations (100%) Individualized data on 334 million operations (288 million to households, 46 million to enterprises) 37 million inquiries by financial institutions every month Individualized data covers (March 2013): 98.6% of financial system’s total outstanding credit 65.6 million borrowers (62.1 million individuals, 3.5 million enterprises) 5 Credit Information System (CIS) Banking supervision Available data allows for multi-dimensional assessments: of individual borrowers of individual financial institutions of each economic sector of the whole financial system 6 3 Credit Information System (CIS) Credit bureau Financial institutions have access to information on prospective borrowers, allowing them to assess clients’ credit history and total indebtedness; Availability of such information favors credit quality contributing for financial sustainability and the reduction of interest rates. 7 Credit Information System (CIS) Credit statistics Availability of individualized data on credit operations makes the CIS a very powerful database; This capability have been enhanced after the extension of CIS coverage after the reduction of the threshold for data on individualized operations from R$ 5,000 to R$ 1,000 (USD 2,500 to USD 500). 8 4 Credit Information System (CIS) Available information – borrowers identification; address; size / income class of enterprises / individuals; type of control (enterprises); annual turnover (enterprises); participation in conglomerates (enterprises); history of relationship with the financial institution; risk rating 9 Credit Information System (CIS) Available information – credit operations origin of funding nature of interest rate: prefixed, floating, inflation-indexed currency type of operation: auto loans, housing, credit card, overdrafts, working capital, etc. origin of operation – granted at the same institution or acquired loan loss provision days overdue interest rates risk rating (operation) instalments’ timetable 10 5 Credit Information System (CIS) Available information – credit operations (cont’d) original value of the operation and outstanding balance specific features: e.g. renegotiation additional info: credit assignment, write-offs guarantees: nature, original value, revised value 11 Credit Information System (CIS) Regional credit statistics based on postal code of borrowers compilation began in 2007 breakdowns for 5 geographical regions and 27 states balances, NPLs Regional credit - balances by region Regional credit - NPLs by region R$ billion % 1,4 7 1,2 6 1,0 5 0,8 4 0,6 3 0,4 2 0,2 1 0,0 0 mar/04 mar/05 mar/06 mar/07 mar/08 mar/09 mar/10 mar/11 mar/12 mar/13 North Northeast Center West Southeast South mar/04 mar/05 mar/06 mar/07 mar/08 mar/09 mar/10 mar/11 mar/12 mar/13 North Northeast Center West Southeast South 12 6 Credit Information System (CIS) Real estate collateral value index measures the long term trend of housing prices based on the appraisal values of residential units financed in 11 metropolitan regions published in March 2013 Real estate prices 12-month real growth (%) 25 20 15 10 5 0 jan/09 jul/09 jan/10 jul/10 IVG-R jan/11 jul/11 jan/12 jul/12 jan/13 FipeZap 13 Credit Information System (CIS) Credit quality data Individualized data on credit operations allows for the compilation of LTV (loan to value) and credit vintage statistics which are important for assessments of financial stability; In the end of 2010 high LTVs in auto loans were associated with an marked increase in NPLs, calling for the introduction of macroprudential measures which basically aimed at stimulating banks to lower LTVs; Credit vintages data provided valuable information on the evolution of NPLs before and after those measures 14 7 Credit Information System (CIS) Credit quality data Auto loans - NPLs by vintage % 10 8 6 4 2 0 fev/10 jun/10 out/10 4 months fev/11 jun/11 6 months out/11 9 months fev/12 jun/12 12 months 15 Credit Information System (CIS) Under construction Credit statistics (e.g. indebtedness) with breakdowns according to the size of enterprises or the income class of households; Sectoral data: CIS data can be matched with a statistical classification of economic activities to provided detailed information on sectoral destination of credit. 16 8 Credit Information System (CIS) A lot of work to be done The sheer size of the database magnifies the necessity of heavy IT support for statistical compilation using individualized operations data; Quality control is an issue ... ... But there is a wide range of possibilities for the compilation of credit statistics from CIS. 17 Thank you! Obrigado! 18 9