Statistics on foreign financial claims of Portuguese Immediate risk, ultimate risk

advertisement

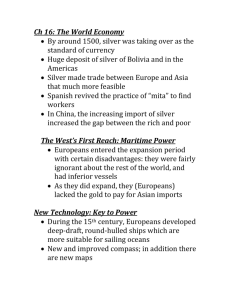

No 13 • November 2015 Statistics on foreign financial claims of Portuguese banks on a consolidated basis Banco de Portugal will publish statistical information in the Statistical Bulletin (Tables C.5.1 to C.5.3) as of today on foreign financial claims of Portuguese banks on a consolidated basis and the respective time series and multidimensional components in the BPstat | Statistics online. This information focuses on the exposure to risks of banks having their head office in Portugal, particularly to country-risk associated with financial claims (except financial derivatives) held by them in the context of their international activity, including foreign claims of branches and subsidiaries abroad. These statistics are compiled according to the methodological guidelines established by the Bank for International Settlements (BIS) in the field of international banking statistics, which in addition to statistics on a consolidated basis, comprise locational banking statistics. The latter focus on financial claims and liabilities in the unconsolidated balance sheet of resident banks in Portugal, and are currently published by Banco de Portugal as part of the balance sheet of other monetary financial institutions under monetary and financial statistics. International banking statistics, on a locational and consolidated basis, are reported by Banco de Portugal to BIS, which releases the information collected from 31 countries on a consolidated basis and 44 countries on a locational basis at: http://stats.bis.org/bis-statstool/org.bis.stats.ui.StatsApplication/StatsApplication. html Immediate risk, ultimate risk and risk transfers One of the most relevant aspects of these statistics is the provision of information on risk transfers, derived on two different bases: Immediate risk basis (Table C.5.1 of the Statistical Bulletin) - Corresponds to foreign financial claims against the counterpart which signed the agreement with the bank, and which is primarily responsible for its compliance, even when guaranteed by a third party. Ultimate risk basis (Table C.5.2 of the Statistical Bulletin) - Corresponds to foreign financial claims against the counterpart that is ultimately responsible for the compliance with the agreement, i.e. when there is a third party that guarantees compliance with the agreement, it takes the place of the immediate counterparty. 2 STATISTICAL PRESS RELEASE • November 2015 Table 1 sums up the categories of foreign financial claims included in both bases. Table 1 Classification of foreign claims of Portuguese banks that aggregate stemming from net risk transfers. These are associated with situations where the geographical aggregate of the ultimate risk counterpart of foreign claims is different from that of the immediate risk counterpart. Currency of the claim Holder of the claim Head office in Portugal Subsidiary or Branch in another country within the Monetary Union Subsidiary or Branch in another country outside the Monetary Union (1) (2) Counterparty country Portugal Another country Portugal Host country of the Subsidiary or Branch Another country Portugal Host country of the Subsidiary or Branch Another country Local (1) External (2) N.A. External claim N.A. Local claim Local claim in in local foreign currency currency External claim N.A. Local claim Local claim in in local foreign currency currency Foreign claim Includes the euro, in the case of countries within the Monetary Union. Includes the euro, in the case of countries outside the Monetary Union. Table C.5.1 of the Statistical Bulletin also includes net risk transfers to other countries by Portugal, which reflect the difference between the ultimate risk basis and the immediate risk basis. Highlights According to available data (Table C.5.1 of the Statistical Bulletin), the value of the consolidated foreign claim outstanding amount of Portuguese banks on an immediate risk basis nearly doubled during the 2004-2010 period, from €67 billion to €121 billion. It subsequently decreased by approximately one-third, up to the second quarter of 2015 (€87 billion). These developments were mostly due to the ‘external claims and local claims of subsidiaries and branches denominated in foreign currency’ component, which also accounts for the largest share (Chart 1). Chart 1 Foreign financial claims on an immediate risk basis (end-of-period outstanding amounts) 140,000 Table C.5.2 of the Statistical Bulletin also breaks down other potential exposures to risks (memo itens), which despite not corresponding to foreign claims, when effectively used, may account for an increase in risks associated with foreign claims of Portuguese banks. This includes financial derivatives (with a positive market value), guarantees and credit commitments. Table C.5.3 of the Statistical Bulletin includes foreign claims of Portuguese banks broken down into both risk basis and by geographical aggregate of the counterparty. For each geographical aggregate, the difference between the figures under both risk basis reflects the increase or decrease in Portuguese banks’ exposure to 120,000 EUR millions When the ultimate risk of a foreign claim held by a Portuguese bank is addressed by a resident entity in Portugal, the associated risk transfer is recorded with a negative sign. When the ultimate risk of a domestic asset held by a Portuguese bank is addressed by a nonresident entity, the risk transfer is recorded with a positive sign. 100,000 80,000 60,000 40,000 20,000 0 Local claims in local currency External claims and local claims in foreign currency Total On a consolidated basis, the share of local claims in total foreign claims of Portuguese banks has increased. According to the assessment by immediate risk basis (Table C.5.2 of the Statistical Bulletin), where this increase was most notable, local claims are, as of the third quarter of 2012, the component with the largest share in the total (from 27% in 2004 to 52% in the second quarter of 2015) (Chart 2). 3 STATISTICAL PRESS RELEASE • November 2015 Chart 2 Foreign financial claims on an ultimate risk basis by type of asset Chart 4 Foreign financial claims on an ultimate risk basis by counterparty sector (end-of-period outstanding amounts) (end-of-period positions) 60 120,000 60,000 50 100,000 40 40,000 30 30,000 % EUR millions 50,000 20 20,000 EUR millions 70,000 80,000 60,000 40,000 10 10,000 0 20,000 0 0 External claims Local claims Share local claims/total (r-h scale) This reflects the higher relative importance of subsidiaries and branches of Portuguese banks in their host countries, most notably in the African (Angola and Mozambique) and European markets (particularly Poland and Spain) (Chart 3; Table C.5.3 of the Statistical Bulletin). Chart 3 Local claims on an ultimate risk basis - main geographical aggregates (end-of-period outstanding amounts) Non-resident public sector Other non-resident monetary financial institutions Non-resident non-monetary private sector The analysis of net risk transfers indicates that over the past 10 years there have been three different stages of exposure to international risk of financial claims held by Portuguese banking groups (Chart 5). Chart 5 Foreign financial claims of Portuguese banks – risk bases and risk transfers (end-of-period outstanding amounts) 140,000 4,000 40,000 120,000 2,000 100,000 0 EUR millions 50,000 30,000 20,000 -2,000 80,000 -4,000 60,000 -6,000 10,000 40,000 -8,000 0 20,000 -10,000 0 -12,000 Portuguese-speaking African countries European Union Total The analysis by counterparty sector of foreign claims held by Portuguese banks, on a consolidated basis, points to a reduction in the share of other monetary financial institutions and an increase in other sectors, most notably the non-monetary private sector, which includes non-financial corporations, non-monetary financial institutions and households (Chart 4). Risk transfers (r-h scale) Immediate risk EUR millions EUR millions 60,000 Ultimate risk Between 2004 and 2008, risk transfers were systematically positive, reflecting a period where foreign financial claims of Portuguese banking groups were more exposed to other countries in terms of ultimate risk than in terms of immediate risk. Between 2008 and 2011, there was a reversal of net risk transfers and exposure to ultimate risk fell below that on an immediate risk basis. This shows that part of international immediate risk was ultimately borne by residents in Portugal. This stemmed from Portuguese banks’ acquisition of securities issued by non-resident credit securitisation companies, namely from Ireland, 4 STATISTICAL PRESS RELEASE • November 2015 whose underlying assets were credits held by those banks (Chart 6). Chart 6 Net risk transfers by counterparty country (differences between end-of-period outstanding amounts) 4,000 EUR millions 2,000 0 -2,000 -4,000 -6,000 -8,000 -10,000 -12,000 -14,000 Germany Luxembourg Cayman Islands Spain United Kingdom Malta France Ireland Netherlands As of 2012, the size of net risk transfers has decreased markedly. This suggests that the value of foreign claims on an immediate risk basis is very similar to that of claims on an ultimate risk basis. C. ESTATÍSTICAS DA BALANÇA DE PAGAMENTOS E DA POSIÇÃO DE INVESTIMENTO INTERNACIONAL Balance of payments and International investment position statistics C.0 Estatísticas da balança de pagamentos | Balance of payments statistics C.1 Balanças corrente e de capital | Current and capital accounts C.2 Balança financeira | Financial account C.3 Posição de investimento internacional | International investment position C.4 Dívida externa | External debt C.5 Estatísticas bancárias internacionais em base consolidada | International consolidated banking statistics Novembro 2015 C.5.1 Ativos internacionais dos bancos portugueses Em base consolidada - Ótica do risco imediato Foreign claims of portuguese banks Consolidated activity - Immediate risk basis Posições em fim de período End-of-period outstanding amounts 106 euros Fonte / Source: Banco de Portugal Total Ativos externos e ativos locais das sucursais e filiais em moeda estrangeira Total Maturidade residual Até 1 ano Total Residual maturity Setor público(1) 12 13 14 15 Mar Jun Set Dez Mar Jun Set Dez Mar Jun Set Dez Mar Jun Set Dez Mar Jun Transferências de risco líquidas(2) Setor privado não monetário Institutional sector of the non resident counterparty of which: Up to and including 1 year Por memória: dos quais: Outras instituições financeiras monetárias External claims and local claims of foreign affiliates and branches in non-local currencies Total Ativos locais das sucursais e filiais em moeda local Setor institucional da contraparte não residente dos quais: 11 191 Local claims of foreign affiliates and branches in local currency Memo items: of which: Other monetary financial institutions Official sector(1) Net risk transfers(2) Non-monetary private sector 1=2+7 2 3 4 5 6 7 8 112 919 108 087 104 245 105 957 107 573 104 017 101 319 96 937 93 897 85 137 82 683 84 644 87 107 90 235 89 470 87 172 88 089 86 844 76 007 71 554 68 572 69 824 70 528 65 806 62 270 58 512 55 189 51 700 48 556 49 812 51 865 54 296 54 411 49 838 52 242 51 512 20 318 20 198 18 575 21 203 22 967 24 723 22 600 18 294 16 481 14 586 11 837 12 401 13 696 16 560 18 174 13 411 14 534 14 085 14 810 13 008 12 466 12 638 13 191 13 408 13 919 11 163 9 598 7 521 6 591 6 943 8 530 8 497 11 713 8 449 10 370 9 521 5 780 5 391 5 341 5 163 5 246 5 399 5 866 6 615 8 098 7 977 7 860 7 932 8 705 10 315 9 603 10 004 9 084 9 771 55 188 52 927 50 536 51 779 51 804 46 712 42 237 40 484 36 927 35 635 33 746 34 698 34 390 35 246 33 084 31 301 32 696 32 137 36 912 36 533 35 673 36 133 37 045 38 211 39 048 38 425 38 708 33 437 34 127 34 833 35 243 35 938 35 059 37 334 35 846 35 332 -9 254 -9 567 -7 932 -7 494 -7 952 -1 376 -396 760 -637 -969 -981 -1 432 -158 111 774 180 627 181 (1) Os Bancos Centrais e as Organizações Internacionais estão incluídos no setor público. / Central Banks and International Organizations are included in the official sector. (2) As transferências de risco líquidas correspondem à diferença entre a ótica do risco de última instância e a ótica do risco imediato. O sinal positivo (negativo) reflete uma maior (menor) exposição ao risco de Portugal face ao exterior na ótica de última instância. / Net risk transfers represent the difference between ultimate risk basis and immediate risk basis. A positive (negative) sign reflects a higher (lower) risk exposure of Portugal vis-à-vis foreign countries at the ultimate risk basis. C.5.2 Ativos internacionais dos bancos portugueses Em base consolidada - Ótica do risco de última instância Foreign claims of portuguese banks Consolidated activity - Ultimate risk basis Posições em fim de período End-of-period outstanding amounts 106 euros Fonte / Source: Banco de Portugal Total Setor institucional da contraparte não residente dos quais: Outras instituições financeiras monetárias Total Setor público(1) 1=5+6 12 13 14 15 103 665 98 521 96 313 98 463 99 621 102 640 100 923 97 697 93 259 84 168 81 702 83 213 86 950 90 346 90 244 87 352 88 716 87 026 2 17 978 15 820 14 982 15 295 15 793 16 413 17 006 14 533 12 839 10 647 9 986 10 716 12 033 12 184 15 194 11 101 13 393 12 634 Official sector(1) 3 11 860 11 677 11 388 11 908 12 264 12 622 13 431 13 969 14 972 15 395 14 946 15 760 16 677 18 399 17 454 20 989 18 774 18 665 Ativos locais External claims 4 Outras exposições potenciais ao risco(2) 5 Compromissos de crédito Memo items: Local claims Other potencial risk exposures(2) Financial derivatives 55 901 51 450 49 833 50 695 51 451 52 778 50 142 48 604 44 424 41 350 38 244 38 954 41 962 44 639 46 123 40 668 42 236 41 754 Garantias Type of claims Non-monetary private sector 73 556 70 759 69 476 70 808 71 078 73 124 70 045 68 751 64 686 57 521 56 482 56 479 57 977 59 497 57 570 55 164 56 441 55 633 Por memória: Derivados financeiros Institutional sector of the non resident counterparty Other monetary financial institutions Mar Jun Set Dez Mar Jun Set Dez Mar Jun Set Dez Mar Jun Set Dez Mar Jun Ativos externos Setor privado não monetário of which: 11 Tipo de ativos 6 47 764 47 071 46 480 47 768 48 171 49 862 50 781 49 093 48 835 42 817 43 458 44 258 44 987 45 707 44 121 46 684 46 480 45 272 (1) Os Bancos Centrais e as Organizações Internacionais estão incluídos no setor público. / Central Banks and International Organizations are included in the official sector. (2) As outras exposições potenciais ao risco não estão incluídas no total de ativos. / Other potencial risk transfers are not included in total claims. 7 5 824 5 407 6 276 6 041 6 176 6 411 4 752 4 490 5 009 3 836 3 852 3 840 3 384 3 641 3 820 3 901 3 705 3 106 Guarantees 8 7 305 6 541 6 007 6 162 5 902 6 205 6 456 6 193 5 708 6 539 6 094 5 845 5 709 5 814 6 009 5 230 5 002 5 077 Credit commitments 9 5 596 5 702 5 364 5 136 5 082 4 926 4 767 4 572 3 964 4 093 4 428 4 559 4 183 4 260 4 413 4 161 4 033 3 640 192 C.5.3 BANCO DE PORTUGAL • Boletim Estatístico Ativos internacionais dos bancos portugueses Em base consolidada - Por agregado geográfico da contraparte não residente Foreign claims of portuguese banks Consolidated activity - By geographical aggregate of the non resident counterparty Posições em fim de período End-of-period outstanding amounts 106 euros Fonte / Source: Banco de Portugal Ótica do risco imediato(1) Ótica do risco de última instância(1) União Europeia(2) Ótica do risco imediato(1) Immediate risk basis(1) 1 12 13 14 15 Mar Jun Set Dez Mar Jun Set Dez Mar Jun Set Dez Mar Jun Set Dez Mar Jun 112 919 108 087 104 245 105 957 107 573 104 017 101 319 96 937 93 897 85 137 82 683 84 644 87 107 90 235 89 470 87 172 88 089 86 844 dos quais: Área do Euro Ótica do risco imediato(1) Ultimate risk basis(1) 2 103 665 98 521 96 313 98 463 99 621 102 640 100 923 97 697 93 259 84 168 81 702 83 213 86 950 90 346 90 244 87 352 88 716 87 026 3 79 547 76 777 73 699 71 269 73 107 67 609 66 664 65 134 65 598 58 621 56 402 56 474 56 926 59 415 58 817 56 027 56 876 57 100 Total of which: Ultimate risk basis(1) Euro Area 4 68 950 66 010 64 603 62 241 64 395 65 170 65 648 64 768 64 560 57 170 54 399 54 669 55 707 58 084 57 976 54 778 56 288 56 269 Immediate risk basis(1) 5 63 286 60 079 57 531 55 090 56 271 50 738 49 468 47 725 48 516 42 611 39 818 40 019 40 132 41 951 41 044 39 566 39 094 38 717 Ótica do risco imediato(1) Ótica do risco de última instância(1) European Union(2) Immediate risk basis(1) 11 Total Ótica do risco de última instância(1) Países Africanos de Língua Oficial Portuguesa(2) Ótica do risco de última instância(1) BRICS(2) Ótica do risco imediato(1) Portuguese Speaking African Countries(2) Immediate risk basis(1) Ultimate risk basis(1) Ótica do risco de última instância(1) BRICS(2) Immediate risk basis(1) Ultimate risk basis(1) Centros Financeiros Off-shore(2) Ótica do risco imediato(1) Ótica do risco de última instância(1) Off-shore Financial Centers(2) Immediate risk basis(1) Ultimate risk basis(1) Ultimate risk basis(1) 6 52 721 49 331 48 607 46 211 47 717 48 371 48 503 47 444 47 528 41 245 37 784 38 343 38 550 40 250 39 803 37 966 38 143 37 535 7 10 478 11 218 11 536 11 803 12 115 13 159 12 807 13 216 12 243 12 325 12 668 13 417 14 572 14 773 16 835 16 961 17 221 16 408 8 10 461 11 149 11 492 11 765 12 000 13 158 12 816 13 372 12 430 12 542 12 889 13 261 14 727 14 949 17 057 17 163 17 490 16 483 9 6 842 5 577 5 345 5 325 5 132 5 405 5 234 5 362 4 549 4 126 3 991 3 907 4 454 4 733 4 479 3 899 4 199 3 920 10 7 831 6 353 5 911 5 913 5 770 6 119 5 742 6 159 4 811 4 350 4 532 4 242 4 886 5 362 5 111 4 347 4 595 4 308 11 6 122 5 411 4 358 8 297 8 086 8 483 7 659 5 372 5 001 4 711 4 591 5 262 5 234 5 578 4 706 4 466 4 376 4 987 12 6 392 5 729 4 509 8 776 8 171 8 775 7 761 5 501 4 959 4 756 4 710 5 372 5 349 5 656 4 786 4 552 4 322 4 953 (1) Para cada agregado geográfico, a diferença entre a ótica do risco de última instância e a ótica do risco imediato corresponde às transferências de risco líquidas, onde um sinal positivo (negativo) reflete uma maior (menor) exposição ao risco de Portugal face a esse agregado geográfico. / For each geographical aggregate, the difference between the ultimate risk basis and the immediate risk basis corresponds to net risk transfers, where a positive (negative) sign reflects a higher (lower) risk exposure of Portugal vis-à-vis that geographical aggregate. (2) Ver composição dos agregados geográficos no BPstat | Estatísticas online. / The composition of geographical aggregates can be found in BPstat | Statistics online.