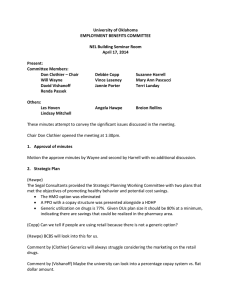

University of Oklahoma EMPLOYMENT BENEFITS COMMITTEE NEL 215 July 16, 2015

advertisement

University of Oklahoma EMPLOYMENT BENEFITS COMMITTEE NEL 215 July 16, 2015 Present: Committee Members: Don Clothier Vincent Leseney Tricia Rahal Karen Rupp-Serrano Gordon Shaw Debbie Copp Krista Petterson Renda Passek Will Wayne Suzanne Harrell Terri Lunday Joel Burcham Michael Kramer Breion Rollins Lindsay Mitchell Les Hoven Others: Angela Hawpe Jessica Cadotte Approval of Minutes (Leseney) Motion to approve minutes with correction. (Burcham) 2nd the motion Motion passed. Minutes approved. MetLife Rate Letter (Clothier) Some retirees received a letter from MetLife informing them of a rate increase. MetLife was offered in conjunction through TIAA-Cref many years ago. However, the University was never involved in this plan therefore we have no influence on rate changes. (Hawpe) A similar letter has come through several other sources. It is likely that OU employees and retirees will see letters from CNA next summer as well. 2016 Benefits (Hawpe) At the end of June the reserve accumulation was over $10 million which was approximately $2 million above our projections. Norman claims exceeded $3 million in May and April, the majority of claims were attributable to prescription drug claims. From 2014 to 2015 there has been a 19% increase per member per month. Utilization of generic drugs is increasing. Less than 0.5% of total claims account for more than 20 % of the total spend. Specialty drugs for diseases such as high cholesterol and Hepatitis C are driving the cost increase. We are considering strategy to extend partial fills for certain high cost drugs. The annual benefit plan renewal for the PPO and High Deductible plans is projected increase around 4.1%. The Medicare plan is projected to increase 22% and the HMO is projected to increase 13.9%. (Copp) Do these projections include claims experience from June? (Hawpe) Those increases represent claims experience from January through May and do not include June. May claims where around $3.3 million for Norman and $2.2 million for HSC in the PPO and High Deductible plans. The HMO will see a significant increase this year and is expected to have more migration out of the plan as a result. The Dental Plan is performing well and the rates will continue to hold for the 2016 renewal. There is no update for the renewals on the Vision, Life, AD&D and LTD plans as of yet. The Benefits Office is looking at possible options for changing the health plans. These options could include replacing the HMO with a copay based PPO and creating a hybrid plan design and converting the current High Deductible HRA plan to an HSA option. The HSA would allow employees to save money for medical coverage as it will roll over from year to year. The money would be fully portable and could also be used as a funding vehicle for employee retirement medical costs. There is also a tax benefit to the employee for utilizing the HSA plan option. (Passek) Is there interest that can be earned on an HSA? (Rollins) Interest could be earned if the plan was structured with an investment firm. (Hoven) As we continue to expect more migration out of the HMO plan, it is helpful to understand that there is also been a 10% decline in enrollment year over year within the HMO. One strategy that is being considered would be to freeze the plan in 2016 thus not allowing new enrollments. (Lunday) Is it better for the University to not have the HMO plan as an option? (Hawpe) The University medical contributions are based on the PPO plan participation. The Benefits Office must be thoughtful from every angle when considering plan changes. There will be a presentation of possible options during next month’s EBC meeting. Benefits is also considering possible options to narrow the networks with OU Physicians and the Norman Physician and Hospital Organization. Benefits would also like to revisit the recommendation to eliminate the subsidy waiver this year. (Clothier) Is there any anticipation that the University Dependent Tuition Waiver Program will have an effect on enrollment? (Hawpe) Yes. We suspect that the program with have an impact on enrollment for 2016. Benefits is also considering pursuing a claims audit to ensure that claims are being processed and paid at the correct level. This has potential to save on health care costs to the University. Another option for potential health cost savings to the University would be to carve out the pharmacy coverage from Blue Cross and issue an RFP for a separate pharmacy vendor. We don’t know what kind of impact this would have on our administrative fees with Blue Cross. However, going out for bid would give the University more transparency and control. Benefits would also like to revisit the recommendation to apply the $25 Tabaco Surcharge. (Rollins) Discouraging the use of Tabaco products is consistent with an “outcomes” based wellness program. (Hawpe) Benefits will begin a communications campaign to educate employees on their health plan options, how they work and the coordination of their benefits, giving them the tools they need to be aware of the value of their plans. Maintaining a data warehouse is also key to managing our self-funded plans and Benefits is investigating what options are available to the University. Utilizing data analytics will allow us to customize programs tailored to the OU population. Long Term Care (Hawpe) CNA gave notice in January that they will no longer accept new enrollments under Group Long Term Care (LTC) for 2016. As a result, premiums will not be deducted through payroll. Current employees may enter the plan during Open Enrollment and new employees may sign up until February 2016. It is anticipated that rates will increase in 2016, after the group contract expires. It is not cost effective to issue an RFP for LTC as part of the for OU employee benefits program’s. We will pursue opportunities to educate OU employees on LTC before and during open enrollment. Communicating the changes and educating employees will be a top priority. Retirement Update (Rollins) Data shows that more employees are staying longer with the University before they enter into retirement. Models are available for individuals to project their Social Security income as they get closer to retirement. The percent conversion is finished at the Health Sciences Center and we have seen an increase in employees raising their percentage contribution amounts. The conversion will begin for the Norman campus on the July check. The next RPMC meeting will be held in August. Wellness Update (Mitchell) Dental screenings will be added to the health screenings at no charge from Delta Dental. This will begin in August for both the Norman and HSC campuses. Tulsa’s Dental Screenings will begin in October. The Standing Desk Program communication will be sent out at the end of July. There are 100 desks available for both HSC and Norman and 30 desks for Tulsa. There is also a 10% discount if employees would like to purchase one on their own. The Fun Run is set for September and online registration begins August 1st. Update from Director (Hoven) The recent Supreme Court ruling on the ACA allows subsidies in states with a health care exchange set up by the federal government. In the coming weeks, we will be finalizing benefit plan changes and recommendations to be presented to the Board of Regents. New Business (Hawpe) Next meeting is scheduled for August 20th. We would like to have decisions and recommendations made by the September Regents meeting if possible. (Copp) Motion to hold the meeting with reservation to move on an as need basis. (Leseney) Motion seconded. (Clothier) Motion passed. The meeting adjourned at 3:00 pm.