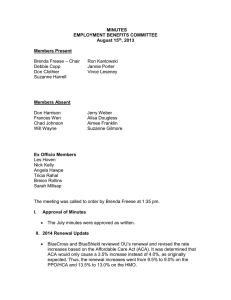

MINUTES EMPLOYMENT BENEFITS COMMITTEE October 21, 2010 Members Present

advertisement

MINUTES EMPLOYMENT BENEFITS COMMITTEE October 21, 2010 Members Present Don Clothier Debbie Copp Alisa Dougless Brenda Freese - Chair Don Harrison Members Absent Suzanne Gilmore Chad Johnson Frank Lawler Simone Pulat Sue-Anna Miller Scott Moses Jannie Porter Justin Wert Will Wayne Frances Wen Ex Officio Members Present Barbara Abercrombie Julius Hilburn Nick Kelly The meeting was called to order by Brenda Freese at 1:30 pm. I. Approval of Minutes The September minutes were approved pending one change to Scott’s comment about index funds. The comment should read: “Scott stated that there needs to be a larger number of index funds in tier 2 to cover asset classes that are not currently represented by the current set of 4 index funds. Examples of additional asset classes include real estate investment trusts and shortterm bonds.” II. Master Record-Keeper Update Human Resources has begun the information sharing process across all campuses. Presentations detailing the process and outlining the fund line up have been given to various groups. Town hall meetings are scheduled on all campuses to allow all employees an opportunity to hear the information first hand and ask questions. A website has been established to provide a forum for disseminating information and submitting questions. Employees will be able to access presentations from the website and review details of the enhanced plan. In addition, a Frequently Asked Questions page has been developed and will continue to evolve as the project moves forward. The RPMC will consider any significant issues that arise during the communication period. Their next scheduled meeting is November 15th. Julius shared the fund lineup which has been developed to consist of: Tier 1 -Target Date Retirement Funds Designed for employees using their planned retirement date to manage the degree of risk in their investments. Default option for employees who do not make investment elections. Tier 2 – Core Lineup A mixture of active and passive equity and fixed income funds– probably 12-15 funds The RPMC is evaluating the potential benefit of adding a real estate fund. Tier 3 Self-Directed Brokerage There will be over 3,000 options available New money added to certain transaction fee funds on regular intervals incurs a $5 transaction fee. Future transfers to those same funds incur a $75 fee. Participants with active TIAA-CREF accounts will not be required to move their money. TIAA-CREF funds will be available for continued use. However, negotiations are currently underway to determine if they will be in the brokerage window as non-transaction fee funds. There has been some interest in TIAA-CREF real estate funds. The current TIAA-CREF real estate fund is based on individual contracts and cannot be maintained through a record keeper. The Retirement Plans Management Committee (RPMC) has made the decision to include, in their recommendation to President Boren and the Board of Regents, a provision allowing loans and hardship withdraws. Anticipated timeline October/November 2010 Campus Communications November 2010 Final proposal to the President and Board of Regents December 2010 Employee education and communication to begin after regent’s approval Spring 2011 Employees to make investment choices Late Spring/Early Summer 2011 Implementation III. Ancillary Voluntary Benefits Nick indicated to the group that the benefits office has been receiving solicitations for potential ancillary services which could be offered to employees, such as, pre-paid legal and/or home and auto insurance. Adding any of the aforementioned benefits would require a competitive bid process. Bidding would be open to any vendor wishing to submit the required bid documents. Comment: Brenda stated she would have some concerns about changing because of the potential risks involved if and when the contract period expires. Comment: Debbie indicated she doesn’t think it would sell well given that many people are already tied to a particular company for the services discussed. Additional, she thinks there is too much going on which is urgent in nature, to worry about home and auto insurance or pre-paid legal services. IV. Enrollment Preview Benefits Fairs were held on all campuses the week of October 18th. Open enrollment will be available through employee self-service November 4-12. Dependents up to the age of 26 can re-enter the plan and stay on the plan until the end of the month in which they turn 26. OU will maintain “grandfathered” status under PPACA for the plan year 2011. Changes to the Flexible Spending Accounts: Over the counter drug purchases will not be eligible for FSA reimbursement after 12/31/2010, without a prescription. 2011 insurance rates are available on the Human Resources website. Goddard has held their first successful flu clinic of the season. Another clinic will take place in the coming weeks. BlueCross members only need their BlueCross and OU Employee ID to receive their flu shot at no cost. V. 2012 Benefits Outlook There is a strong likelihood that we will go to the market for our health, dental, vision, life, AD&D, and LTD for the 2012 plan year. There is a possibility that BlueCross BlueShield will provide a rate guarantee for 2012, but to date that has not happened. Some EBC members will be asked to serve on the evaluation committee(s) As we look ahead, we will look at various plan designs in effort to secure the highest level of benefits for the lowest possible cost. VI. Other Business Brenda provided a revised annual report which included changes (outlined below) from Scott Moses. Debbie made a motion to approve the report and it was seconded by Don Clothier. No one opposed. Change “Human Resources was asked to explore potential options for reducing benefits costs in 2010.” to “Human Resources was asked to explore potential options for budget reductions in 2010.” Likewise, for the first caveat, add “or benefits” Change from “These include: any reductions in compensation be used as a last resort” to “These include: any reductions in compensation or benefits be used as a last resort” The next EBC meeting will be Thursday, November 18, 2010. The meeting was adjourned at 2:40 p.m.