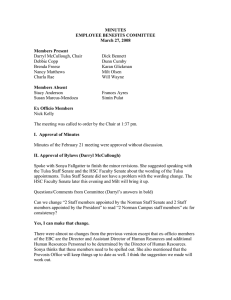

MINUTES EMPLOYMENT BENEFITS COMMITTEE August 27, 2009 Members Present

advertisement

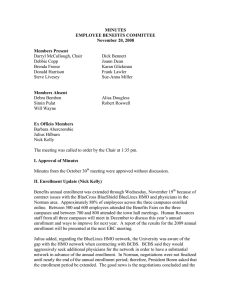

MINUTES EMPLOYMENT BENEFITS COMMITTEE August 27, 2009 Members Present Darryl McCullough, Chair Debra Bemben Debbie Copp Joann Dean Alisa Dougless Brenda Freese Suzanne Gilmore Betty Kupperschmidt Sue-Anna Miller Will Wayne Justin Wert Members Absent Don Clothier Don Harrison Chad Johnson Frank Lawler Simone Pulat Ex Officio Members Barbara Abercrombie Julius Hilburn Nick Kelly The meeting was called to order by the Chair at 1:30 pm. I. Officers As required in the Bylaws of the EBC the Chair of the committee is to state his/her willingness or unwillingness to continue as Chair of the committee for the coming year. Darryl McCullough announced his unwillingness to continue. Nominations for a new Chair will be turned in at the September meeting. Darryl asked that anyone interested in becoming the Chair e-mail him in the next week. If he does not receive any e-mails he will begin to solicit volunteers. If there is more than one candidate for Chair there will be a vote at the next meeting. Brenda Freese expressed her willingness to remain Vice Chair for another year. II. Introduction of New Members There were several new members appointed to the committee to replace those whose terms ended. New members are: Suzanne Gilmore, Retiree Chad Johnson, Human Relations - Tulsa Betty Kupperschmidt, College of Nursing – Tulsa Justin Wert, Political Science - Norman Prior to the introduction of new members the Chair informed the group of the passing of Mr. Dick Bennett, Retiree representative. Suzanne Gilmore was selected by the Retiree Association as his replacement. After introductions were made, the Chair gave a brief history of the EBC and explained that the charge of the EBC is to advise Human Resources and the President on changes to existing benefit programs and/or recommending new ones. III. Approval of Minutes Minutes from the April 16th and May 21st meetings were approved with no changes. IV. Annual Report Darryl requested comments on the draft of the Annual Report. The group indicated they had no changes. Brenda moved to approve the report in its current form. All committee members voted in favor of approving the report as written. There was a need expressed to put past EBC Annual Reports on the EBC website. V. Federal “Bicycle Benefits” Legislation Darryl stated that he received a message from an employee containing internet links with information on the Bicycle Commuter Act. Some highlights of the Act are: Employees may receive up to $20 per month from their employer to go toward the purchase or repair of a bicycle. This would be considered an additional fringe benefit and is optional for employers. Comment: Darryl expressed his desire to see this program at OU. He asked Nick if he was aware of the program. Nick indicated he is aware but needs to review the act in greater detail prior to making comments. Comment: Debbie Copp stated she does not think now is a good time to add an additional fringe benefit, since OU is currently evaluating reductions in many programs. Comment: Justin indicated that there is a distance requirement in order to qualify for the benefit. Comment: Darryl agrees that implementing a new fringe benefit at this time would likely receive some push back. Response: Julius Hilburn stated that he will ask Nick Kelly to research this issue and see what other peer institutions are doing. He indicated there may be some employer tax benefit, but there is also an issue of how much time it would take to administer the program. VI. Review of Benefits and Budget Challenges Julius began by providing an overview of benefits programs for new EBC members, as well as those who have not been on the EBC for a full cycle. He explained that Human Resources and the EBC work together to attempt to reach a mutually agreeable recommendation to be given to President Boren. However, at times the recommendations may vary as both Human Resources and the EBC are independent groups. Planning for benefit programs will be more difficult this year because of challenging budget circumstances at both the University and State level. Julius gave a presentation which reviewed the timetable for the 2010 health insurance recommendation, reviewed factors influencing health insurance recommendations, and looked at OU’s competitive position in regard to benefits. Health Insurance Highlights: Rates will be announced later in the year than normal in effort to accumulate more claims data. This is due to the fact that this is OU’s 1st year with BlueCross BlueShield. There is a 10% cap on the PPO, and 12% cap on the HMO renewal rate for health insurance which equates to a projected increase of approximately $6.5 million. Cost increases for the University could be a challenge if there are significant reductions in state appropriations. The state has fallen short of forecasted revenue in the first two months of FY2010. If state revenues continue to fall short of projections, it could have an effect on the budget and benefits. During the past 10 years insurance costs for employee only coverage paid by OU has increased by approximately $28 million. Question: Debbie Copp asked if there were any preliminary numbers available. Response: Julius indicated that current estimates indicate there will be a 10% increase. Benchmarks OU annual health insurance costs were compared to other institutions of higher education. OU employees pay 5% of the cost of their healthcare whereas employees at other institutions pay an average of 18%. OU is above the market in their contribution to employee only coverage. OU employees pay an average of 50% of the premium cost toward family coverage compared to 25% paid by employees of other institutions. OU is below market in their contributions toward family coverage. Competitive Position OU’s choice of plans and plan design are typical of others in the higher education market. OU is above market on dental. OU subsidizes 100% of employee only dental coverage whereas the average employer contribution is 70%. Providing credits for choosing a lower-cost health plan is an unusual feature, however, opt-out credits are common. OU is significantly above the market in retiree health and dental offerings. Currently, OU subsidizes 100% of the retirees medical premium, whereas, only about 50% of all higher education institutions give any contribution. Of those that do contribute to retiree health insurance a 50% contribution is common. OU retirees currently have the same dental plan as active employees. This benefit is above the market. Retirement Benefits All plans are in the top range for competitiveness. Employees hired prior to 1995, participating in OTRS receive salary minus $9,000 times 15% DCP for employees in OTRS hired after June 30, 1995 - salary minus $9,000 times 8% Hourly employee defined contribution plan – OU contribution of 9% of pay; no employee contribution required Optional Retirement Plan (ORP) for exempt employees hired since July 1, 2004 who do not elect to join OTRS – OU contribution of 9% of pay; no employee contribution required Question: Debra Bemben asked if there was any talk about changing the retirement plans. Response: Julius told the group that no specific proposals have been made, but retirement would be a potential place to look if severe budget cuts are required. Next Steps Human Resources will develop benefit options and alternatives for meeting cost targets Options and alternatives will be discussed with EBC at the September meeting The EBC will be asked in October to make a recommendation regarding rate increases and cost-sharing for 2010 Comment: Julius told the group that he believes President Boren does not want to implement changes which are going to negatively affect the OU community, but if budget cuts are required then it is likely he will choose to do those things which have the least possible impact. Question: Justin asked if BlueCross BlueShield would have to cut OU a better deal if the budget was cut, so that OU and employees do not absorb all of the impact. Response: Julius stated that a private organization would not subsidize a customer. VII. Updates Defined Contribution Plans Administrator Search An RFP was issued 7/1/2008 with a goal of finding a system which would be easier to administer than what is currently offered. At the time of the RFP there was $1 billion in assets, however, market fluctuations have complicated the search and negotiations. Negotiations have been ongoing with several companies. The committee is scheduled to meet on September 9th and it is anticipated that a proposal will be made. The new system will be able to offer better investment education. In addition users may be able to take out loans, hardship withdraws, and will have access to educational tools. Question: Debbie asked if Human Resources would administer the plans. Response: Julius said that a Third Party Administrator would be responsible for administration. An additional benefit to having one record keeper will an increased comfort level regarding OU’s compliance with specific IRS laws. Retiree Medical Final meeting of the Retirement Options Committee was August 26, 2009. The committee has tried to devise a plan that will have gradual changes which will be implemented over time. OU is trying to take an active role in preserving retiree benefits. Some public organizations have either discontinued benefits entirely or have been forced to make drastic changes. The final report should be submitted to President Boren around the 7th of September. It will be up to the President as to whether or not comment will be solicited from the OU community. Comment: Julius told the group that the project took longer than anticipated because the initial recommendations, agreed upon in June, were based on data that was approximately two years old. When the actuaries looked at the data again, based on the new demographics, they found that many employees had shifted groups because of the time lag. As a result, the committee chose to review the options again and make revised recommendations based on the new actuarial report. VIII. Other Business Debbie Copp presented a letter from the University Women’s Association and the Retiree Association requesting the University change their policy to require spousal consent when changes are made to an employee’s defined contribution plan, which would be consistent with the Employee Retirement Income Security Act (ERISA). The University’s Women’s Association has indicated they would like the support of EBC and Human Resources in this matter. Response: Julius stated the he has no position on this issue at this time. He will research the issue and report back at a later date. There being no other business, the meeting was adjourned at 3:15 p.m.