Measuring Success and the Way Forward Town Hall Meeting 28 November 2006

advertisement

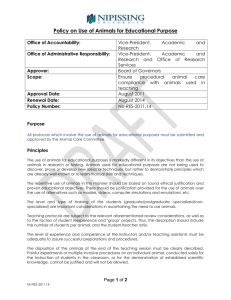

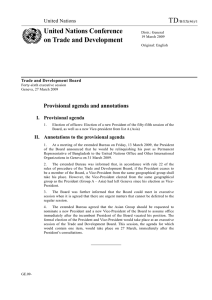

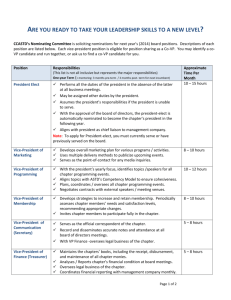

Measuring Success and the Way Forward Town Hall Meeting 28 November 2006 Steven E. Franklin, Ph.D. Vice-President Research Office of the Vice-President Research Overview • Introduction and Purpose of the Review • Research Environment/Research Culture • Current Strategic Programs and Initiatives • Context for the Second Planning Cycle • The Way Forward Office of the Vice-President Research Strategic Priorities Measures of Success Office of the Vice-President Research Strategic Priorities • Top 7 priorities – the green card • • • • • • • Research intensiveness/innovation Enhancing research culture Relationships/partnerships Creating effective research communications Developing successful research groups Foundational Documents and Strategic Directions Extending Horizons – specific indicators/ framework • Defining and using measures of success • Research communities and research culture Office of the Vice-President Research Photo courtesy Division of Media and Technology Extending Horizons • • • • • High-quality people Significance/relevance Ability to attract resources Significant collaborative activity Significant activity output • Qualitative, anecdotal evidence is important – highlights of research success in this paper and in each bi-annual report (2004, 2005, 2006) Photo courtesy Division of Media and Technology Office of the Vice-President Research The Research Environment Only possible to highlight a few aspects: • Total Research Funding and Associated Indicators • Research Revenue and Indirect Costs • International Research Photo courtesy Canadian Light Source Office of the Vice-President Research University of Saskatchewan Research Revenue (millions of dollars) CFI; 4,312; 4% Miscellaneous & Other; 16,169;15% Miscellaneous & Other; 12,126; 17% NSERC; 26,870; 26% CFI; 15,921; 22% Industry; 7,272; 10% NSERC; 10,763; 15% Provincial Depts. & Agencies; 16,225; 24% Industry; 13,531; 13% SSHRC; 2,767; 3% SSHRC; 771; 1% CIHR; 2,735; 4% CIHR; 10,639; 10% Provincial Depts. & Agencies; 23,210; 22% Federal Depts. & Agencies; 5,325; 7% 1999/2000 Total = $71,138 Federal Depts. & Agencies; 7,105; 7% 2004/2005 Total = $104,603 Data sourced from U of S Financial Statements 1999/2000 to present, courtesy U of S Institutional Analysis. “Miscellaneous and Other” includes Municipal Government, Foreign Government, Other Provinces, Donations, Income from Investments, etc. Office of the Vice-President Research Research Revenue Comparison by College (millions of dollars) CIHR; 0; 0.0% CFI; 98; 0.6% Miscellaneous & Other; 4,397; 25.0% NSERC; 2,427; 13.8% SSHRC; 265; 1.5% Federal Depts. & Agencies; 844; 4.8% Industry; 3,032; 17.2% Provincial Depts. & Agencies; 6,531; 37.1% College of Agriculture & Bioresources Research Revenue, 2004/2005 Total = $17,593 Miscellaneous & Other; 277; 4.0% CFI; 312; 4.5% Industry; 720; 10.3% Provincial Depts. & Agencies; 1,494; 21.4% Federal Depts. & Agencies; 498; 7.1% CIHR; 29; 0.4% NSERC; 3,657; 52.3% SSHRC; 0; 0.0% College of Engineering Research Revenue, 2004/2005 Total = $6,987 Data sourced from U of S Financial Statements 1999/2000 to present, courtesy U of S Institutional Analysis. “Miscellaneous and Other” includes Municipal Government, Foreign Government, Other Provinces, Donations, Income from Investments, etc. Office of the Vice-President Research Maximum CFI Contribution of Top 15 Universities Maximum CFI Contribution of Top 15 Universities* (000s of dollars) $250,000 $200,000 $150,000 $100,000 $50,000 Sherbrooke Dalhousie U of M Queen's U of C McMaster Ottawa Western U of S Laval U of A Montréal McGill U of T UBC $0 * Based on Maclean's ranking (November 2005) Are we the most successful CFI university in the country? Office of the Vice-President Research Office of the Vice-President Research Useful Associated Indicators • Matching/RAP Awards >$1-M leveraged >$30-M • Increase to 34 Canada Research Chairs (~10%) • More than 200 patents licensed to date, up to 80 invention disclosures annually • Number of grants and amount of funding increased >100% in six years – all communities • Indirect costs program – are we the most successful university in the country (up 25% compared to program increase of 15% in 2006 in a zero sum program)? Office of the Vice-President Research Indirect Costs Funding of Selected Institutions Institution % Change – 2003/2004 to 2004/2005 % Change – 2004/2005 to 2005/2006 % Change – 2005/2006 to 2006/2007 McGill University 10.34% 7.22% -2.68% McMaster University 9.23% 5.34% -2.77% Simon Fraser University 7.53% -1.87% -0.09% University of Alberta 6.16% 3.55% -3.04% University of Calgary 12.31% 8.51% -1.77% University of Guelph 5.94% -1.10% 0.55% University of Manitoba 8.85% 3.55% 0.38% University of Saskatchewan 8.08% 4.52% 10.75% University of Waterloo 3.81% 1.81% -1.06% University of Western Ontario 8.60% 6.39% -3.19% Office of the Vice-President Research Indirect Costs • College/centre priority – 22% • Research management/admin – 22% • Resources – 20% • Facilities – 17% • IP Management – 10% • Regulatory/accreditation – 9% Photo courtesy Division of Media and Technology Office of the Vice-President Research International Research: Global Connections Legend: Current project Completed project < $99-K $100-K to $499-K > $500-K International projects operated independently from the International Research Office are not fully reflected here. Office of the Vice-President Research These are actual quotes! • “I want to take this opportunity to thank you and all of the other administrators at the U of S that have made the development of this world class program possible.” • “The RAP program opened many other doors for us – it was invaluable. Money well spent.” • “Thanks for all you and everyone at the U of S have done to help me get the NSERC proposal in. First rate support.” Photo courtesy Division of Media and Technology Office of the Vice-President Research Current Strategic Programs and Initiatives • Extending Horizons: University of Saskatchewan Research, Scholarly and Artistic Landscape • Team Approach of Co-ordinators/ Facilitators/Research Officers • Task Force on the Management of Centres • Industry Liaison – new package of services and programs for researchers/entrepreneurs • Effective/Strategic Research Communications – huge increase in potential audience reach • University of Saskatchewan Chairs Program Photo courtesy Division of Media and Technology Office of the Vice-President Research Context for the Second Planning Cycle • Research-Intensive, Engaged Institution through commitment to knowledge translation and exchange (KTE) • Focus on students – research experiences, benefits of research intensiveness, KTE • Review of existing OVPR structure and function – VP Executive, VP Advisory, units/groups Photo courtesy Division of Media and Technology Office of the Vice-President Research The Way Forward Office of the Vice-President Research The Way Forward • Priority Action Items for the OVPR Second Integrated Plan: • Leadership Development • Project Management • Research Group Development • Measures of Success Implementation • Internal/External Partnership Development Photo courtesy Division of Media and Technology Office of the Vice-President Research The Way Forward • International Research • Balanced Tri-Council and Non-Tri-Council Funding Strategy • Blended Model for Research Facilitation • Infrastructure/Equipment • Student Experience in Research • A University of Discovery and Creation Photo courtesy Division of Media and Technology Office of the Vice-President Research http://www.usask.ca/vpresearch/strategic_plans.shtml Office of the Vice-President Research