Danier Leather Inc - Julia's E

advertisement

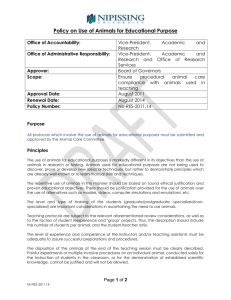

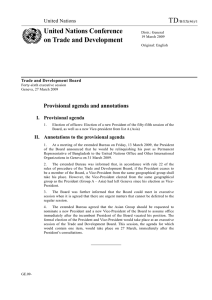

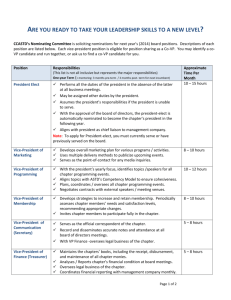

DANIER LEATHER INC. INVESTING By Julia Craig COMPANY OFFICERS Company Officers Jeffrey Wortsman President and CEO Olga E. Koel Executive Vice-President and Chief Merchandise Officer Bryan Tatoff, C.A. Senior Vice-President, CFO and Secretary Philip J. Cutter Vice-President, Information Technology and CIO Guia Lopez Vice-President and Chief Sourcing Officer Bruce Aitken Vice-President, Planning and Allocation Karen J. Marshall Vice-President, Logistics and Distribution Cris Ruivo Vice-President, Store Operations Cheryl Sproul Vice-President, Human Resources Jennifer Steckel Elliott Vice-President, Marketing OFFICES AND COMPANY RELATIONS Investor Relations Bryan Tatoff Senior Vice-President, CFO and Secretary Telephone: 416.762.8175 ext. 328 bryan@danier.com Bankers Canadian Imperial Bank of Commerce, Toronto HSBC Bank Canada, Toronto Head Office 2650 St. Clair Avenue West Toronto, Ontario M6N 1M2 Telephone: 416.762.8175 Fax: 416.762.4570 www.danier.com Auditors PricewaterhouseCoopers LLP, Toronto Legal Councel Davies Ward Phillips & Vineberg LLP, Toronto Registrar and Transfer Agent Computershare Investor Services Inc. COMPANY PRODUCTS AND SERVICES Values Always remembering the customers’ point of view; Having a passion for our customers, products and work; Finding ways to do things better; Finding solutions to problems; and Encouraging everyone to speak freely about ways to improve our business while also listening to other Apparel and Accessories business for 39 years. Offers high-quality, sophisticatedly crafted leather products at an astonishingly reasonable price. They have stores in 89 malls, strip plazas, street-front stores and more. REPORT OF THE INDEPENDENT AUDITORS PricewaterhouseCoopers LLP “In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of Danier Leather Inc. and its as of June 25, 2011 and June 26, 2010 and the results of their operations and their cash flows for the years then ended in accordance with Canadian generally accepted accounting principles.” LETTER TO THE SHAREHOLDERS Margin improvements – 180 basis point agreement Improvements attribute to performance of accessories Efforts focusing on brand and store itself Multiple labels to associate with different consumer demographics Added a Guest Designers collection Switching up sources for products from China alone and began manufacturing in Canada Thankful for customers continued loyalty FINANCIAL STATEMENTS Subordinate voting shares are the companies most important source of financing. Overall cash has increased over the past 2 years The company is not expanding through investing activites. (2011: 2,390 – 2010: 2,672 Balance sheet: Show that Assets = Liabilities + Owners’ Equity for the past year. $76 477 = $13 813 + $62 664 FCF – 2293 Net income 2011 - 7638 2010 - 7219 The Cash Flow is less than the net income for the past two years. The net income is increasing and seems to be continuing to do so. Net earnings 2011 - $1.63 2010 - $1.30 CONCLUSION Focusing on the margin improvement to maximize profit Shares are undervalued Significant yearly growth of 23% 10 year average equity return is only 5% The company would be a good investment if they continued to keep their earnings high but the history leaves reason to believe that is unlikely to happen There are 30% lower shares in 2011 than in 2007 I think that it isn’t an ideal investment but you would gain more than you would lose There is a strong that the value will rise rather than fall