European Banking Union Key Issues and Challenges Presented at CIRSF Summer Conference 28

advertisement

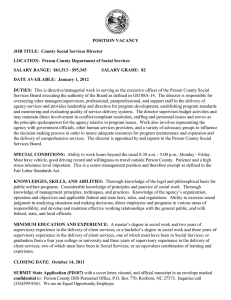

European Banking Union Key Issues and Challenges Presented at CIRSF Summer Conference 28th of June Pedro Duarte Neves Deputy-Governor Banco de Portugal TP0013 / Versão 1.0 Prudential Supervision Department Agenda • The Th need d for f a Banking B ki Union U i • The Single Supervisory Mechanism • Banking Supervision Security level: Public 1/15 The need for a Banking Union Security level: Public 2/15 The need for a Banking Union as a response to the shortcomings of governance model of the EMU Weak public finances in many countries Inconsistencies and vulnerabilities in the economic governance model of the EMU Accumulation of macroeconomic imbalances Perverse connection between sovereign g risk and banking risk (in both directions) Shortcomings of economic governance model of the EMU paved the way for the b k off financial break fi i l integration, i t ti inhibiting i hibiti the th effective ff ti transmission t i i off Monetary M t Policy, thus becoming a source of systemic risk in the euro area Security level: Public 3/15 How financial integration gave way to fragmentation in the wake of financial crisis Euro Area 10Y sovereign g bond yields y Commercial interest rates on new operations p Germany Spain France Greece Ireland Italy Portugal Euro area 8 7 6 5 % % 4 3 2 1 0 Jan‐03 Jan‐04 Jan‐05 Jan‐06 Jan‐07 Jan‐08 Jan‐09 Jan‐10 Jan‐11 Jan‐12 Source: Thomson Reuters and ECB and BdP Security level: Public 4/15 The financial trilemma and the impossibility of achieving three core objectives simultaneously Financial Stability Financial Integration National Financial Policies With increasing financial integration, pursuing national financial policies will generally not lead to financial stability, because national policies seek to benefit national ti l welfare, lf while hil nott taking t ki into i t accountt externalities t liti off their th i supervisory i practices on other countries Security level: Public 5/15 Banking Union 2nd Resolution 3rd Depositors Protection Fiinancial S Stability Supervision (SSM) Trusst 1st De-lin nk sovereign-ban nks Currently the implementation of a Banking Union is set to occur step by step Political Response (29th of June 2012): • Report: “Towards a genuine Economic and Monetary Union” • Euro Area Summit decisions: o o Security level: Public Mandate to the European Commission to present proposals for creating a Single Supervisory Mechanism (SSM), based on the Article 127 (6) of the Treaty and the EU Council “to consider these Proposals as a matter of urgency by the end of 2012” Commitment to: “When an effective single supervisory mechanism is established, involving the ECB, for banks in the euro area the ESM could, following a regular decision, have the possibility to recapitalize banks directly”. 6/15 The Single Supervisory Mechanism Security level: Public 7/15 The Single Supervisory Mechanism in the context of the Banking Union Single g Supervisory p y Mechanism (SSM) ( ) ECB Responsibility for the oversight of the SSM functioning and for ensuring supervisory consistency SSM Common Supervisory Framework Supervisory Decisions over All Banks: exclusive competence or use of specific powers Decision to Directly Exercise Supervision Direct Supervision of Significant Banks Security level: Public + National Competent Authorities (NCA) Euro Area Direct Supervision of Less Significant Banks Assistance to the ECB in the Supervision of Significant Banks + NCA other Member States (optional – close cooperation agreement) t) The supervisory p y framework will mirror the one applied within the Euro Area, but the ECB will exercise its tasks indirectly always through instructions to the NCA Exclusively Competent for Supervisory Tasks not conferred on the ECB 8/15 Single Supervisory Mechanism impacts for the Portuguese financial sector Allocation of supervisory tasks depends on the significance of the institution. Scope – Tasks Conferred on the ECB by the SSMR Microprudential Supervision Significant institutions Quantitative Criteria Macroprudential Supervision Less significant institutions • Assets in excess of 30 bn euros or in excess of 20% of GDP (except if assets are less than 5bn euros) • Other Institutions (falling within the SSM scope) Qualitative Criteria Security level: Public • Institutions considered by national authorities relevant in the national economy, with the consentt off the th ECB; ECB • The ECB, in its discretion, considers the institution relevant in the face of cross-border activity public funding g of the • Institutions with direct p EFSF or ESM 9/15 The Single Supervisory Mechanism Organization and Structure Supervisory Board President Experienced in Banking and Finance and not an ECB Governing Council member. Vi P Vice-President id t Must be and ECB Executive Board member. ECB R Representatives t ti Four ECB representatives nominated byy the Governing g Council. Security level: Public NCA R Representatives t ti One NCA representative p per Member State. 10/15 Roadmap for the Single Supervisory Mechanism implementation (I/II) July/September 2013 SSM Regulation enters into force 2014Q1-Q2 2014Q1 EBA Stress Tests ECB Framework Regulation + Balance-Sheet Balance Sheet Assessment Results (AQR) 2013 Q4 Public Consultation - Draft ECB Framework Regulation July 2013 (Expected) First (Internal) Draft of ECB Framework Regulation July/September 2014 ECB fully assumes its supervisory tasks (in principle, one year after the SSMR enters into force) From this date onwards the ECB will be able to: • Request to national supervision authorities information, including asset quality evaluations, in particular for those institution subject to ECB’s direct supervision; • Start supervising institutions on request of the European Stability Mechanism (ESM) (ESM), as a prerequisite for recapitalization processes Security level: Public 11/15 Roadmap for the Single Supervisory Mechanism implementation (II/II) December 2013 ESM backstop to SBRF Parliamentary Approvals 1 Jan 2014 CRD P Package k Before April 2014 EP – Council agreement on the SRM July/September y p 2014 SSM full implementation Security level: Public 2015-2017 SRM – Single Resolution Mechanism ESM – backstop to SBRF (Single Bank Resolution Fund) BRRD (Bank Recovery and Resolution Directive) Implementation on 1 January 2015 DGSD (Deposit Guarantee Schemes Directive) 12/15 Banking Supervision Security level: Public 13/15 What model for banking supervision? 1 Permanent on-site presence 2 Horizontal asset quality and RWA reviews through on-site inspections 3 Forward looking approach 4 Straight ties between micro and macroprudential supervision 5 Strengthen the role of internal and external auditors Security level: Public 14/15 European Banking Union Key Issues and Challenges Presented at CIRSF Summer Conference 28th of June Pedro Duarte Neves Deputy-Governor Banco de Portugal TP0013 / Versão 1.0 Prudential Supervision Department