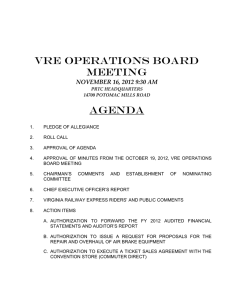

AGENDA ITEM 8-F ACTION ITEM TO:

advertisement

AGENDA ITEM 8-F ACTION ITEM TO: CHAIRMAN ZIMMERMAN AND THE VRE OPERATIONS BOARD FROM: DALE ZEHNER DATE: APRIL 17, 2009 RE: AUTHORIZATION TO INVESTIGATE REFUND OF SERIES 1998 COMMUTER RAIL REVENUE BONDS RECOMMENDATION: The VRE Operations Board is being asked to authorize an investigation of refunding the Series 1998 Commuter Rail Revenue Bonds. BACKGROUND: In February of 1990, NVTC issued $79,350,000 of tax exempt Commuter Rail Revenue Bonds to fund the establishment of VRE. In July 1993 and in March 1998, NVTC refunded a portion of the original debt in order to achieve a lower interest rate and lower annual payments. The ability to gain an advantage from the refunding of tax-exempt debt depends on the provisions of the bond agreement and prevailing market interest rates. Public Financial Management, VRE’s financial advisor for bond financing, has calculated the net savings of again refunding the $25 million remaining balance of the Series 1998 bonds. At current prevailing rates, the net present value savings are estimated at $1.3 million, spread over the next six years. (Under federal tax law, the term of the refunding bonds cannot exceed the term of the original bonds, which were issued for 25 years in 1990). VRE is currently pursuing several options for how to best achieve the refunding, including the following: • • • Issuance of a refunding bond issue through the sale of tax-exempt bonds. Our financial advisor recommends that this be a “negotiated” sale in which one or more underwriters are chosen through a competitive process and the terms of the bond sale is negotiated with the chosen underwriters. Participation in a pooled financing through the Virginia Resources Authority (VRA). VRA issues debt twice a year on behalf of jurisdictions and other public entities throughout the state and the costs are shared by all participants. Issuance of a refunding bond issued through a private placement with a competitively selected bank or other financial institution. The objective is to maximize the net savings to VRE through achieving the lowest possible interest rate and minimizing the costs of the transaction. The transaction costs are significant and could be as high as $680,000 for the first option outlined above. VRE’s intention is to pursue the refunding so long as net savings are in excess of $1,000,000 and represent at least 4% of the value of the new debt. This approach is consistent with the parameters used by several of the jurisdictions and with a prior state law. Professional staff at Fairfax County, Prince William County, and the Virginia Resources Authority have been consulted about this refunding opportunity. These conversations will continue as the options outlined above are reviewed. Staff in all member jurisdictions and the Commissions will be involved in discussions regarding refinancing options. A proposal will be brought back to the Operations Board and Commissions later this spring. Each of the member jurisdictions would then need to approve the issuance of refunding debt. FISCAL IMPACT: There is no fiscal impact associated with this investigative work. 2 TO: FROM: DATE: RE: CHAIRMAN ZIMMERMAN AND THE VRE OPERATIONS BOARD DALE ZEHNER APRIL 17, 2009 AUTHORIZATION TO INVESTIGATE REFUND OF SERIES 1998 COMMUTER RAIL REVENUE BONDS RESOLUTION 8F-04-2009 OF THE VIRGINIA RAILWAY EXPRESS OPERATIONS BOARD WHEREAS, in February of 1990, NVTC issued $79,350,000 of tax exempt Commuter Rail Revenue Bonds to fund the establishment of VRE; and, WHEREAS, in July 1993 and in March 1998, NVTC refunded a portion of the original debt in order to achieve a lower interest rate and lower annual payments; and, WHEREAS, VRE’s financial advisor for bond financing has calculated that the net present value savings of again refunding the $25 million remaining balance of the Series 1998 bonds would be approximately $1.3 million at prevailing interest rates. NOW, THEREFORE, BE IT RESOLVED THAT, the VRE Operations Board authorizes an investigation of refunding the Series 1998 Commuter Rail Revenue Bonds. 3