Chapter 3 Operating a Lake Association

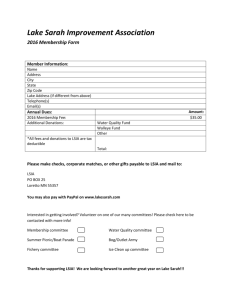

advertisement

Chapter 3 Operating a Lake Association Voluntary lake associations in Wisconsin have tremendous opportunities to address lake and watershed management issues. The Wisconsin Legislature has consistently recognized their potential by making qualified lake associations and nonprofit conservation organizations eligible for cost sharing funds and other state assistance. Federal tax-exempt status makes contributions to lake associations tax deductible and helps win support from businesses, individuals and foundations. When a voluntary association has a substantial agenda, it can organize in such a way as to qualify as tax-exempt and meet the qualifications of a nonprofit conservation organization. When an organization plans extensive political and lobbying activities, exempt status should not be sought. Chapter 1 gave you an idea of the types of lake associations that can be formed and the activities in which lake associations become involved. Unlike a lake district, once a voluntary lake association is formed there are few legal or formal requirements. If you have decided to incorporate under Chapter 181 of the Wisconsin Statutes or become a 501(c)(3) tax-exempt organization, there are certain requirements to keep those designations current. Other than those few requirements, how you decide to operate day-to-day is up to the members of your organization. Many organizations develop bylaws (see Appendix A for model bylaws) and many follow Roberts Rules of Order to run their meetings. (For more information on Roberts Rules of Order, see www.robertsrules.com). Beyond that, there are few requirements, but there are some helpful hints. So Where Do We Start? There may be some time that passes between deciding to form an association and the first formal meeting. If that is the case, think about selecting an initial steering committee to govern until an election can be held at an official first meeting. There are certain things you may want to accomplish at the first formal meeting or within the first year of existence. Developing a well thought-out, organized plan of action and a solid set of protocols and procedures under 23 Chapter 3: Operating a Lake Association which to operate should go a long way toward assuring you reach your lake organization goals. Make sure this is done with the input of any and all people interested in being involved. • Form a committee to start the process of developing bylaws so they can be approved by the membership at the first official meeting. Bylaws establish the formal structure and procedures of the association, and include: the stated purpose of the association; the date of the annual meeting; the numbers and appointments of officers and directors; the election procedures; and the formal committee structure, etc. (see Appendix A for model bylaws) Wis. Stat. § 181.0122 • Consider becoming a Qualified Lake Association (see Chapter 2) • Consider incorporating as a Wisconsin nonprofit, non-stock corporation under Chapter 181, Wisconsin Statutes. The process is relatively inexpensive and straightforward to do. A lawyer is not usually necessary. The articles of incorporation are filed with the Department of Financial Institutions (DFI). The form DFI/CORP102 is available online at www.wdfi.org/corporations/forms/corp181forms.htm (Form 102) and is to be filed with the fee with DFI, PO Box 7846, Madison, WI 53703-7846, 608-261-7577. The filing fee currently totals $35 (see Appendix B for a copy of the form) • Consider using Robert’s Rules of Order. For more information on Robert’s Rules of Order, see www.robertsrules.com. Most organizations operate using Robert’s Rules, which helps the organization be fair and complete in conducting its meetings. Officers and members of your group can easily obtain a copy. Behind Robert’s Rules are many years of experience with meetings, so the guidelines anticipate most questions that will arise • Nominate and elect officers • Form any other standing committees that you feel are important. Examples of the topics lake association committees typically address include: aquatic plant and aquatic invasive species management; education; water quality; volunteer lake monitoring; shoreland development; water recreation; public relations; government relations; and grants and fundraising Taxes By their very nature, lake organizations are involved with money. They often need to help pay for some lake management techniques and do it through fundraising events, dues, grants and other methods. If your association is involved with employees, grants, fundraising or collects more than $5,000 a year, it is a good idea to contact a professional accountant and make sure your organization is complying with federal and state tax laws. It is also a good idea to have someone check the various tax laws from time to time for changes and updates. 24 Chapter 3: Operating a Lake Association Typically, lake associations are considered exempt from paying federal and state income tax if they have annual gross receipts of less than $5,000. If your association receives monies exceeding $5,000 per year, or $15,000 over a three-year period, you may want to speak with an accountant (be sure they are familiar with nonprofit organizations). You may want to research the benefits of having the Internal Revenue Service (IRS) officially recognize your organization as having tax-exempt status. To establish exemption with the IRS, your organization should file for official recognition. More information can be found below. Federal Tax-Exempt Status Some associations may consider filing for federal tax-exempt status. Many people confuse nonprofit with tax-exempt organizations. Not all nonprofit groups are exempt from federal or state income tax. Typically, lake associations are considered exempt from having to file federal and state income tax returns if they have annual gross receipts of less than $5,000. If your association receives monies exceeding $5,000 per year, or $15,000 over a three-year period, contact an accountant familiar with nonprofit organizations. To establish official exemption with the IRS, your association should file for federal tax-exempt status. Governmental units, including lake districts, enjoy the advantages of being exempt from federal income tax automatically. Federal tax-exempt status provides several advantages: • The organization is not subject to federal or state income tax • A person that gives a gift to a qualifying tax-exempt organization is eligible to claim a tax deduction, which may encourage people to give money to the organization • Tax-exempt organizations can obtain bulk postal rate privileges • Because most foundations are also tax-exempt organizations, they often can only award grants to groups recognized as tax-exempt Although there are various types of tax-exempt organizations, a typical lake association would seek status as a “charitable, scientific or educational” organization under Section 501(c)(3) of the Internal Revenue Code. To qualify as an exempt organization under Section 501(c)(3), an organization must be structured and operated exclusively for “exempt purposes.” These may include scientific, educational and charitable activities. Water pollution prevention and control, land protection, and other activities of many lake associations are considered “charitable” under federal tax law. The IRS has specifically recognized that an organization formed to preserve a lake as a public recreational facility and to improve the condition of the water in the IRS Rev. Rule 70-186 25 Chapter 3: Operating a Lake Association lake is operated exclusively for charitable purposes. Federal tax-exempt organizations are also subject to important limitations on their activities under Section 501(c)(3). The IRS requires that these specific limitations on powers be included in the organization’s articles of incorporation or other charter. The most important of these are: 1. No part of the net income or earnings of the organization may be distributed to any director, member or other individual. (This does not prohibit compensation for services performed.) 2. Exempt organizations may not engage in political activity and are sharply limited in their authority to undertake lobbying activities. Not all Section 501(c)(3) organizations are created equally. Federal tax law makes a distinction between “private foundations” and “publicly supported charities.” Both are exempt from taxation, but public charities offer donors greater tax benefits. In general, an organization is considered to be publicly supported if it normally receives at least one-third of its total support from the combination of government or public contributions. The law on exempt organizations, including private foundation determination, is complex and may be difficult to understand. This section is not intended to go beyond a very general description of these provisions. In order to obtain tax-exempt status under Section 501(c)(3), an organization is required to file IRS Form 1023 and related schedules and exhibits, copies of the organization’s Articles of Incorporation, bylaws, and financial records including a two-year budget for new organizations and other materials. These documents are intended to explain the organization’s proposed activities in order to demonstrate that it meets the requirements for exemption. Wisconsin organizations file these papers with the IRS Exempt Organization Office in Chicago. For a brochure on applying for tax-exempt status, see www.irs.gov/pub/irs-pdf/p4220.pdf. For detailed information on public charities and forms, see www.irs.gov/charities/charitable. From the date of filing, it typically takes about six months to obtain a determination letter. The IRS review is quite detailed, and will usually return an incomplete or improperly prepared application, rather than request specific modifications. A nonrefundable determination user fee is payable at the time the application is filed. These user fees range from $150 to $500 depending on the expected annual receipts of the applicant organization. Some organizations recruit knowledgeable volunteers to develop the taxexempt status application, others obtain professional assistance from an experienced attorney or accountant. Attorneys’ fees may vary depending on the amount of work needed to prepare the application materials and obtain federal tax-exempt status. If you want to find out more about federal tax-exempt status, contact an accountant or the IRS Tax Exempt and Government Entities Division at 1-877-829-5500. 26 Chapter 3: Operating a Lake Association If you plan on applying for federal tax-exempt status under Section 501(c)(3), you will need to obtain an Employer Identification Number (EIN), also known as a Federal Tax Identification Number. Most banks will require your organization to have an EIN in order to open a bank account. An EIN is a nine-digit number that the IRS uses to identify nonprofit organizations, government entities, trusts and estates, and other business entities. To obtain an EIN, an organization can apply to the IRS using Form SS-4, Application for Employer Identification Number. For more information see www.irs.gov/ Most banks will require your organization to have an EIN in order to open a bank account. businesses or call 1-800-TAX-FORM for a copy of the form. State Sales Tax-Exempt Status Rarely does a lake organization purchase enough items subject to state sales tax to make exempt status worthwhile. If yours does, you may want to look into applying for state sales and use tax-exempt status. To obtain state sales tax-exempt status, an organization may apply with the Wisconsin Department of Revenue for a Certificate of Exempt Status (CES) using Form S-103, Application for Wisconsin Sales and Use Tax Certificate of Exempt Status. Lake associations will need to be recognized by the IRS as having tax-exempt status and submit required documentation. If approved, the department will issue you a CES number to exempt you from sales tax when making purchases. Lake districts, since they are governmental units, will not need to demonstrate their qualifications as nonprofit organizations, but should use the form to receive a CES number. For more information and a copy of the form, contact the Wisconsin Department of Revenue or their website at www.dor.state.wi.us. Fundraising Sometimes lake organizations will have special fundraising campaigns in which they solicit donations from people on the lake as well as the general public. If you plan to raise significant funds, you may want to consider applying for status as a 501(c)(3) charitable organization. If donations to your organization (not including dues) exceed $5,000 in a year, you will need to register with the Wisconsin Department of Regulation and Licensing. This agency oversees the regulation of charitable organizations and licensing of business professions in Wisconsin. For more information, see http://drl.wi.gov/prof/char/cred. If you are going to be raising significant funds, contact an accountant, attorney, the Wisconsin Department of Regulation and Licensing or the Wisconsin Department of Revenue for assistance. 27 Chapter 3: Operating a Lake Association Financing Having the dollars to do the needed work and keeping good records is crucial to any lake organization. There may be numerous sources of dollars and partners to help in keeping your lake healthy. • Consider the organization’s general approach to business • Collect first dues/contributions • Create an initial budget; consider revenue and debt. The starting date of the fiscal year is up to the organization. Some select January 1, others select a date that corresponds with their annual meeting. See the sample lake association budget on the next page • Create a bank account, line of credit and any other fiscal business (any loans or lines of credit will need to be secured). Most banks will require an Employee Identification Number (EIN) in order to open a bank account. For information on obtaining an EIN, see the previous section on Taxes or go to www.irs.gov/businesses • Plan alternative sources of revenue. These sources may include fundraisers, grants, dividend income, gifts, retail sales and others • It may be a good idea to do an informal audit from time to time depending on the amount of money with which you are dealing • Agree on a general plan of action for the association, including any regular business and social meetings, fundraising events, etc. • Set a system in place to ensure accurate recordkeeping (grants, budgets, meeting minutes, resolutions). Arrange to keep the records in a secure place. Consider asking your public library to create a lake section to showcase meeting minutes, lake-related publications, and other materials relevant to your community • Consider applying to the IRS for tax-exempt status. See previous section on Federal Tax-Exempt Status 28 Chapter 3: Operating a Lake Association Sample Lake Association Budget Pretty Lake Association 20___ Budget Summary Revenues: Dues/Memberships Interest Income Fund-Raising Total Revenue: Current Year Budgeted Current Year Actual Next Year Proposed $2,500 $ 0 $1,000 $3,500 $2,300 $ 50 $ 650 $3,000 $2,500 $ 50 $1,000 $3,550 $ 500 $ 450 $ 500 $ 300 $ 280 $ 300 $ 500 $ 380 $ 500 $ $ 0 $ 920 Expenses: Newsletter, Printing, Postage Clean Boats Clean Waters Boat Landing Watch Sensitive Area Buoy Markers Dissolved Oxygen Meter for Lake Monitoring Insurance Total Expenses: $ 500 $1,800 $ 490 $1,600 $ 530 $2,750 Cash Excess/Deficit: $1,700 $1,400 $ 800 Pretty Lake Association 20___ Statement of Cash Position Beginning Cash Balance Cash Excess/Deficit Ending Cash Balance 0 $1,000 $1,400 $2,400 Grants Some projects that you wish to undertake may require more capital than your organization is able to raise. If that is the case, you may consider applying for one or more lake grants. DNR lake coordinators will work with Qualified Lake Associations to award state funds to assist with meeting the costs of eligible projects. Qualified lake associations are eligible to receive state grant funds for certain projects under the Lake Management Planning Grant Program. They are 29 Chapter 3: Operating a Lake Association Wis. Stat. § 144.253 Wis. Stat. § 144.254 Wis. Stat. § 30.92 also eligible to receive state matching funds under the Lake Management Protection Grant Program and Aquatic Invasive Species grants. In addition, qualified lake associations are eligible for grants for certain recreational boating projects, including the purchase of capital equipment for aquatic plant harvesting, for public boat launch facilities and for navigational buoys. For detailed information on lake grants, see www.uwsp.edu/cnr/uwexlakes. Insurance The topic of insurance coverage can be a difficult one for lake organizations to address. The costs of insurance may vary greatly between lake organizations, depending on their size and activities. Should these smaller groups not buy insurance coverage? Are they at risk? Your lake association may face these questions as you examine your budget and strive to make the best use of the dollars available. For more information about insurance, see Chapter 7. Getting Connected Being aware of issues that face your lake compel you to be connected. Local issues may require you to have detailed knowledge of people and their viewpoints; regional or statewide issues may require you to have a broader understanding of the implications of different issues and how they affect others. It is important to stay connected, not only around your lake, but also in your county, your region, and across the state. To get connected: • Develop a way to communicate with your membership, other stakeholders, state government and other lake organizations such as the publication of a newsletter, email or development of a website • Use the Lake List Directory (see box on next page) to identify and include neighboring lake organizations • Consider developing a logo or stationery for the organization to help create a professional presence • Contact local government officials, the WDNR, UW-Extension Lakes Program and WAL and let them know you exist 30 Chapter 3: Operating a Lake Association The Lake List Directory Lake organizations do best when they stay in touch with their neighbor organizations and keep a finger on the pulse of town, county and state policies and issues that impact lakes. Who could be better than another lake organization to help answer your questions on how much insurance costs, who is a good contractor, or how neighboring lakes deal with aquatic invasives? The state keeps contact information and some other pertinent information on lake organizations, as well as businesses providing services to lakes, in a directory called the Lake List. The directory can be found at www.uwsp.edu/cnr/uwexlakes. Contact the UW-Extension Lakes Program at 715-346-2116 or uwexlakes@uwsp.edu when you form an association and to update contact information on an annual basis. The Lake List Directory is the most comprehensive directory of lake organizations in Wisconsin. Developing a Vision Lake organizations that have taken the time to articulate their vision have a better track record of accomplishing their goals. The clearer your vision of your lake’s future, the easier it will be to develop and follow a roadmap to your destination. • Start to formulate the purpose of the association. This may take the form of a mission statement. For assistance with development of a mission statement, contact your county UW-Extension Educator • Start thinking about how to prioritize any lake issues • Develop a plan to recruit new members • Start the process of arranging for a pre-planning, or “futuring,” meeting where all members and those interested in the lake can be heard. Such a process can help the organization to prioritize issues and help to craft a vision for the lake. (You may consider using a facilitator to assist you in developing an inclusive process that is respectful of the many points of view that frequently exist in lake communities; trained individuals can be engaged through your county UW-Extension Educator) • Have a plan. A sound written plan that all interested parties have contributed to can benefit your lake community and the lake in many ways. It will be the short and long-term “road map” that will determine where your efforts and funding will go. A lake management plan can present a coordinated strategy and assure that everyone knows what is planned for your lake. It can enhance communication, build consensus, assure that you will be cost effective with your projects and make sure you comply with state and federal laws and local considerations. A written plan can communicate your vision for the lake to new members of the community, and provide the basis for checking progress toward your lake protection goals 31 Chapter 3: Operating a Lake Association The Seven Step Plan What are the steps in creating a plan? No matter what type of plan you are developing for your lake organization, the basic steps in planning remain the same. While the specifics and details vary depending on lake size and management issues, the process of planning (and a plan) typically includes the following general steps: 1. Goal setting – Organize the effort, identify issues to be addressed, and agree on the goals 2. Inventory – Collect base information to define past and existing conditions 3. Analysis – Synthesize the information, quantify and compare current conditions to desired conditions, research opportunities and constraints, and set directions to achieving goals 4. Alternatives – List all the possible management alternatives and evaluate their strengths, weaknesses and general feasibility 5. Recommendations – Prioritize and select preferred management options, set objectives based on priorities and assets, then draft the plan 6. Implementation – Formally adopt the plan, line up funding, and schedule activities for taking action to achieve the goals 7. Monitor & Modify – Develop a mechanism for tracking activities and adjust the plan as it evolves While each step is necessary, the level of effort and detail for each step will vary depending upon the project’s goals, size of the lake, and number of stakeholders. For many Wisconsin lakes, there may be a number of plans that fold into a whole lake management plan. Lake organizations can develop plans to deal with water recreation or aquatic plant management, which should fit easily into a whole lake plan. You should carefully assess your lake’s needs and then consider the detail required for each step in the process. A rule of thumb may be that the more complex the issue, and the larger the lake and population, the more comprehensive the plan will need to be. (For more details on planning, contact your county UW-Extension Educator.) 32 Chapter 3: Operating a Lake Association Learning About Your Lake Wisconsin is fortunate to have over 15,000 lakes and a great network of people to help you get the answers you need. There is probably someone out there who has dealt with the same issue, can help with funding or has developed educational materials on the subject. Take the time to learn about the assets that the Wisconsin Lakes Partnership can bring you: • Attend the annual Wisconsin Lakes Convention in the spring, and/or attend one of the numerous regional Wisconsin lake education events sponsored by area lake organizations. Agenda items and displays usually include a lot of “how-to-do-its” and “how-they-did-its” on various lake issues. Most importantly, you get to meet and talk with others who share common lake interests. Information on upcoming events is posted on the web at www.uwsp.edu/cnr/uwexlakes • Make use of the resource organizations described at the beginning of this guide, including UW-Extension Lakes, your county UW-Extension Educator, WAL and your DNR Lakes Coordinator. • Get on the mailing list of Lake Tides, the free quarterly newsletter published by UW-Extension. • Consider joining the Wisconsin Association of Lakes (WAL), and subscribe to their newsletter, The Lake Connection. Find more information at www.wisconsinlakes.org • Subscribe to the bimonthly DNR magazine, Wisconsin Natural Resources, at PO Box 7191, Madison, WI 53707, 800-678-9472. Finding a Rhythm There you have it! It can be a lot of work but something that most people feel is well worth the effort. As the years pass, your organization will probably find a rhythm. Local folks, members, local businesses and government people who know the lake will develop a certain level of trust for your mission and work. Some may become active partners in implementing your program. Revisit your plan to see how closely you have been able to follow it. Identify those priorities that may have changed; a plan should evolve and change as the lake and needs of the community evolve and change. Make sure people stay engaged in this process, and that they are able to understand how their actions play a role in the health of the lake and the lake community. It is important that everyone understands, and relates to, the issues and priorities of the lake and its surrounding community. 33