The limits to stabilization policy. IAM Ch 22. Ragnar Nymoen

advertisement

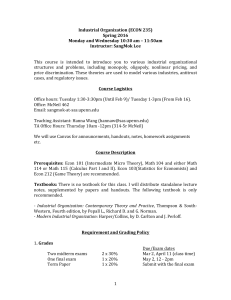

The limits to stabilization policy. IAM Ch 22. Ragnar Nymoen Department of Economics, UiO 5 October 2009 ECON 3410/4410: Lecture 7 Limits to stabilization policy Fine tuning the economy to avoid large and persistent deviation from full employment is a di¢ cult task, also in the case where full employment is the only steady-state of the economy (as the PCM implies). Ch 22 in IAM identi…es three types of assumptions that have been implicit so far: 1 No information lags. The policy maker knows the state of the economy (the initial situation). There are no serious measurement problems. 2 There are no adjustments lags in policy decisions— and policy instruments can be adjusted “both up and down”. 3 The announced policy is credible. IAM Ch 22 contains in-depth discussions of all three. Here we concentrate on 3. ECON 3410/4410: Lecture 7 Rule based equilibrium We simplify the AD-AS model by assuming vt = st = 0, gt = g , = 0 and = 1: And we assume rational expectations, RE. From Ch 21, the RE equilibrium under a Taylor-rule with = 0, as in rt = r + h t + b(yt y ); and with the above simpli…cations, is yt = y ; t =0 e tjt 1 = 0. ECON 3410/4410: Lecture 7 (1) (2) (3) Central bank objective function (social loss function) Assume that the central bank minimizes the loss-function SL = (yt y )2 + 2 t (4) where y = y + !, ! > 0: ! is a parameter that re‡ects labour and product market distortions/ine¢ ciencies. y is the e¢ cient level of output that is attainable, given the degree of permanent distortions represented by !. Formally, (4) is like a ordinary (dis)utility function. The marginal rate of substitution, between the two “goods” is MRS = which (for non-negative t) d t y = dyt yt t has its sign determined by yt . ECON 3410/4410: Lecture 7 (5) The value of social loss under the Taylor-rule Insertion of the RE solution (1) and (2) gives SLR = (yt y )2 + 0 = ! 2 > 0 for the value of the social loss function under the rule based policy. Is this the minimum social loss? ECON 3410/4410: Lecture 7 The “cheating” equilibrium I Express the SL function as SL = f(yt Since y ) + (y y )g2 + 2 t = 1, we have the PCM t e tjt 1 = yt y and therefore the SL can be written as n o2 e SL = ( t ) + (y y ) + tjt 1 (6) 2 t (7) Assume that the central bank has led the public to believe that it will ensure price stability, so etjt 1 = 0 as in the rule based RE solution. What is the optimal its rule? t if the central bank can deviate from ECON 3410/4410: Lecture 7 The “cheating” equilibrium II The “cheating” in‡ation rate is de…ned by c t = minf( t = minf( t The closed form expression for c t Insertion of e tjt 1 !+ y ))2 + + (y !)2 + 2 tg 2 tg c t is obtained from the 1oc: c t =0 c t = ! 1+ >0 = 0 into the Phillips curve (6) gives ytc = y + ! : 1+ ECON 3410/4410: Lecture 7 The “cheating” equilibrium III These “cheating values” of the rate of in‡ation and output give zero SLC < SLR , The e¤ect from distortions ! on output are reduced. An alternative mathematical derivation: Consider …nding the minimum of (4): SL = fyt y g2 + 2 t given the Phillips curve (6) with etjt 1 = 0 imposed, i.e. conditional on expectations being …xed at zero in‡ation. ECON 3410/4410: Lecture 7 The “cheating” equilibrium IV First, form the Lagrangian function: L = fyt y g2 + 2 t ( t yt y) and obtain the two …rst order conditions @L = 0 () y yt = @yt @L = 0 () t = @ t These two conditions entails MRS = 1: The derivation using the Lagrangian function therefore brings out that the cheating equilibrium is where the slope of the Phillips curve with etjt 1 = 0 is a tangent to one of the indi¤erence curves of the social loss function. This is useful for the graphical illustration of the solution. ECON 3410/4410: Lecture 7 Graphical solution π LRAS SRAS ( SRAS ( ω /κ E π e = 0) E R ER is the Taylor rule equilibrium EC is the cheating equilibrium. D ω /(1 + κ ) E π e = ω /κ ) C E * y * ' y ECON 3410/4410: Lecture 7 ED is the time-consistent equilibrium. Time-consistent equilibrium I The “cheating policy” is however self-defeating, since agents, after having being cheated once, will take account of the cheating behaviour. This is called the time-inconsistency problem after Kydland Precott (1977). Speci…cally rational in‡ation expectations will be formed from ( t e tjt 1 !) + t =0 (8) which is the 1oc for minimization of the cheating loss function (7). Alternatively: obtain it from the 1ocs for the Lagrangian function. Taking expectations on both sides of (8) gives ( e tjt 1 e tjt 1 !) + !+ e tjt 1 e tjt 1 = 0 = 0 ECON 3410/4410: Lecture 7 Time-consistent equilibrium II So the in‡ation expectations that take account of the central bank’s cheating becomes: e tjt 1 = ! = t (9) The last “=” sign in (9) re‡ects that there is no uncertainty in the model, ie. after the simpli…cations we did initially. Insertion of (9) in the Phillips curve (6) gives yt = y (10) (9) and (10) de…ne the time-consistent RE equilibrium. In‡ation is higher than in the Taylor-rule equilibrium. Therefore loss of credibility in monetary policy can be said to lead to an in‡ation bias. ECON 3410/4410: Lecture 7 In‡ation bias and credibility loss That loss of credibility in monetary policy can lead to an in‡ation bias is a result which has been very in‡uential in practice. For example: One of the main rationale for credibility building, which often involves delegation of monetary policy and central bank independence. Compare Sweden’s Riksbank. On 15 January 1993, the Riksbank announced that monetary policy would be conducted with a view to achieving price stability. But because of high in‡ation expectations, it was also stated that the target for monetary policy would not begin to apply until 1995. One interesting point made in IAM, is that the case for central bank independence with a strict mandate for in‡ation stabilization is strongest when demand shocks dominate. With dominating supply shocks, the results may be excess variability in output. Compare Ch 21. ECON 3410/4410: Lecture 7