Graduate Curriculum Committee Minutes of 9/09/2009 Page 1

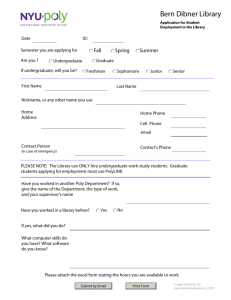

advertisement