Dear Montana University System Employee,

advertisement

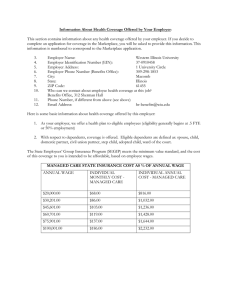

July 2014 Dear Montana University System Employee, The Patient Protection and Affordable Care Act (PPACA) and its amendment by the Health Care and Education Reconciliation Act of 2010 (“Affordable Care Act of ACA”) requires employers to provide certain notification to employees regarding the Health Insurance Marketplace (“Marketplace”), previously known as the Exchange. You are receiving this letter containing information about the Marketplace and how it relates to existing benefit coverage offered by the Montana University System Employee Benefit Plan. There are two important things for employees to note: You are receiving this notice because you have an employment relationship, or are a retiree, with a unit of the Montana University System (MUS). This is irrespective of your eligibility to receive benefits under the MUS Employee Benefit Plan. The individual mandate for health insurance began on January 1, 2014. In 2014, all Americans qualified for an exemption which allowed them to enroll in a medical plan that began providing coverage no later than May 1, 2014. Specific information regarding the MUS Employee Benefit Plan Coverage: * If you are eligible to receive coverage as an active employee under the MUS Employee Benefit Plan, you receive a contribution from the employer toward the cost of coverage for yourself and any eligible dependents. Currently state law sets this amount at $887 per month. Retirees do not receive an employer contribution. The employer contribution for some affiliated entities eligible for the MUS Employee Benefit Plan may be different. * The MUS Employee Benefit Plan meets the federal requirements for "minimum essential coverage" and "affordability" under the Employer Shared Responsibility provisions of the ACA. * Since the MUS Employee Benefit Plan meets these requirements, employees who choose to waive the employer coverage will not be able to receive the monthly employer contribution nor be eligible to receive subsidized coverage from the Marketplace. Employees considering waiving benefits and accessing Marketplace coverage may wish to consider the fiscal impacts carefully. Specific information regarding the Marketplace: If you are not eligible to receive coverage under the MUS Employee Benefit Plan or through another group employer plan that meets the “minimum essential coverage” and “affordability” standards, depending on your individual circumstances, you may be eligible for premium subsidies through government assistance to assist in purchasing coverage on the Marketplace. There is a specific Marketplace notice prepared by the federal government. This notice contains two parts. Part A - "General Information" is enclosed with this letter. Part B - "Information About Health Coverage Offered by Your Employer" is utilized when an individual chooses to apply for coverage on the Marketplace. Upon request MUS will provide a completed copy of Part B to employees. The Part B documentation must be submitted along with an application for Marketplace coverage. We understand that employees may have a number of ongoing questions regarding health care coverage, the ACA impact on the individual, and the MUS Employee Benefit Plan coverage. In some cases we are still awaiting guidance and information from the federal government. Please contact the UM HRS office with questions and we will work to provide answers. If you need more information about MUS Employee Benefit Plan coverage you can review the Summary Plan Description or the Choices Enrollment Workbook. (They are available online at www.choices.mus.edu/). You may also contact your campus HRS office or call the MUS Employee Benefits office directly at 1(877) 501-1722. Sincerely, Terri H. Phillips Associate Vice President University of Montana terri.phillips@umontana.edu New Health Insurance Marketplace Coverage Options and Your Health Coverage Form Approved OMB No. PART A: General Information When key parts of the health care law take effect in 2014, there will be a new way to buy health insurance: the Health Insurance Marketplace. To assist you as you evaluate options for you and your family, this notice provides some basic information about the new Marketplace and employment­based health coverage offered by your employer. What is the Health Insurance Marketplace? The Marketplace is designed to help you find health insurance that meets your needs and fits your budget. The Marketplace offers "one-stop shopping" to find and compare private health insurance options. You may also be eligible for a new kind of tax credit that lowers your monthly premium right away. Open enrollment for health insurance coverage through the Marketplace begins in October 2013 for coverage starting as early as January 1, 2014. Can I Save Money on my Health Insurance Premiums in the Marketplace? You may qualify to save money and lower your monthly premium, but only if your employer does not offer coverage, or offers coverage that doesn't meet certain standards. The savings on your premium that you're eligible for depends on your household income. Does Employer Health Coverage Affect Eligibility for Premium Savings through the Marketplace? Yes. If you have an offer of health coverage from your employer that meets certain standards, you will not be eligible for a tax credit through the Marketplace and may wish to enroll in your employer's health plan. However, you may be eligible for a tax credit that lowers your monthly premium, or a reduction in certain cost-sharing if your employer does not offer coverage to you at all or does not offer coverage that meets certain standards. If the cost of a plan from your employer that would cover you (and not any other members of your family) is more than 9.5% of your household income for the year, or if the coverage your employer provides does not meet the "minimum value" standard set by the Affordable Care Act, you may be eligible for a tax credit.1 Note: If you purchase a health plan through the Marketplace instead of accepting health coverage offered by your employer, then you may lose the employer contribution (if any) to the employer-offered coverage. Also, this employer contribution -as well as your employee contribution to employer-offered coverage- is often excluded from income for Federal and State income tax purposes. Your payments for coverage through the Marketplace are made on an aftertax basis. How Can I Get More Information? For more information about your coverage offered by your employer, please check your summary plan description or contact MUS Employee Benefits at 1-877-501-1722. . The Marketplace can help you evaluate your coverage options, including your eligibility for coverage through the Marketplace and its cost. Please visit HealthCare.gov for more information, including an online application for health insurance coverage and contact information for a Health Insurance Marketplace in your area. 1 An employer-sponsored health plan meets the "minimum value standard" if the plan's share of the total allowed benefit costs covered by the plan is no less than 60 percent of such costs. AFFORDABLE CARE ACT INFORMATION I acknowledge that I have received the Affordable Care Act (ACA) notification letter and Part A information. NAME (Please Print) _____________________________________ 790# UM Identification Signature Date