Document 11950767

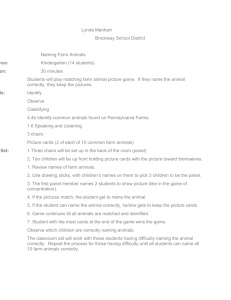

advertisement