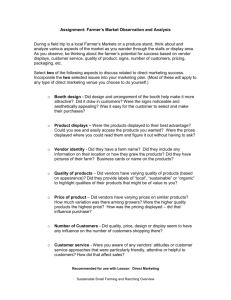

ASSESSING THE SUCCESS OF FARMERS’ SURVEY OF VENDORS, CUSTOMERS, AND MARKET MANAGERS

advertisement