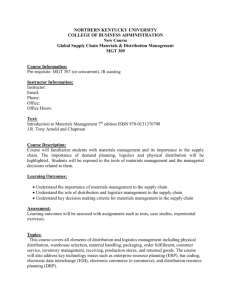

J A N U A R Y 2...

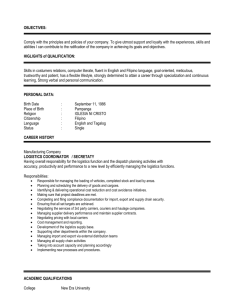

advertisement