PRAIRIE VIEW A&M UNIVERSITY Administrative Procedures Manual

advertisement

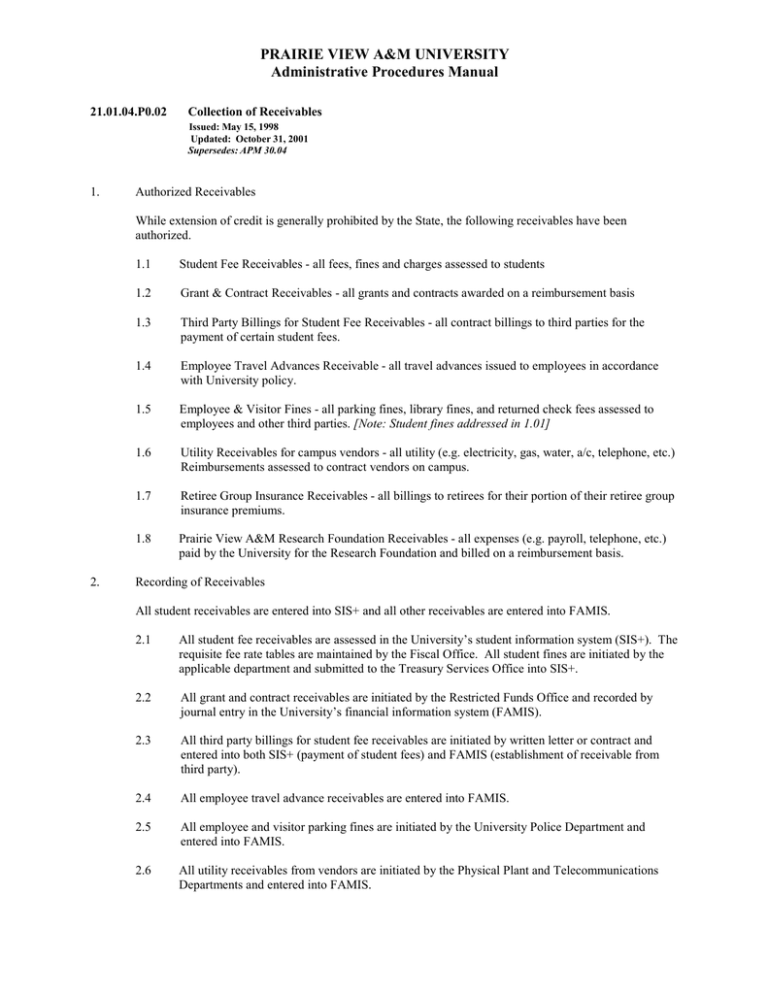

PRAIRIE VIEW A&M UNIVERSITY Administrative Procedures Manual 21.01.04.P0.02 Collection of Receivables Issued: May 15, 1998 Updated: October 31, 2001 Supersedes: APM 30.04 1. Authorized Receivables While extension of credit is generally prohibited by the State, the following receivables have been authorized. 2. 1.1 Student Fee Receivables - all fees, fines and charges assessed to students 1.2 Grant & Contract Receivables - all grants and contracts awarded on a reimbursement basis 1.3 Third Party Billings for Student Fee Receivables - all contract billings to third parties for the payment of certain student fees. 1.4 Employee Travel Advances Receivable - all travel advances issued to employees in accordance with University policy. 1.5 Employee & Visitor Fines - all parking fines, library fines, and returned check fees assessed to employees and other third parties. [Note: Student fines addressed in 1.01] 1.6 Utility Receivables for campus vendors - all utility (e.g. electricity, gas, water, a/c, telephone, etc.) Reimbursements assessed to contract vendors on campus. 1.7 Retiree Group Insurance Receivables - all billings to retirees for their portion of their retiree group insurance premiums. 1.8 Prairie View A&M Research Foundation Receivables - all expenses (e.g. payroll, telephone, etc.) paid by the University for the Research Foundation and billed on a reimbursement basis. Recording of Receivables All student receivables are entered into SIS+ and all other receivables are entered into FAMIS. 2.1 All student fee receivables are assessed in the University’s student information system (SIS+). The requisite fee rate tables are maintained by the Fiscal Office. All student fines are initiated by the applicable department and submitted to the Treasury Services Office into SIS+. 2.2 All grant and contract receivables are initiated by the Restricted Funds Office and recorded by journal entry in the University’s financial information system (FAMIS). 2.3 All third party billings for student fee receivables are initiated by written letter or contract and entered into both SIS+ (payment of student fees) and FAMIS (establishment of receivable from third party). 2.4 All employee travel advance receivables are entered into FAMIS. 2.5 All employee and visitor parking fines are initiated by the University Police Department and entered into FAMIS. 2.6 All utility receivables from vendors are initiated by the Physical Plant and Telecommunications Departments and entered into FAMIS. PRAIRIE VIEW A&M UNIVERSITY Administrative Procedures Manual 3. 4. 5. 2.7 All billings for the retiree’s portion of their group insurance premiums are entered into FAMIS by way of automated feed from the B/P/P system. 2.8 All authorized payments for the Prairie View A&M Research Foundation are initiated by entry into FAMIS. Billing of Receivables 3.1 All student fee billings are issued at registration to the student. Reminder notices are issued prior to the second and third installment due dates. Additional billings are issued monthly. 3.2 Most federal grants and contracts provide for electronic drawdowns of reimbursements and thus, no billing is required. Certain State grants provide General Revenue appropriation transfers which the University may expend against and thus, no billings are required. Reimbursement billings for all other grants and contracts are issued in letter form to the granting agency generally on a monthly basis. 3.3 All employee and other third party receivables are billed monthly. Reporting of Receivables 4.1 A detail listing (IBMR052) of employee and third party receivables is provided to the Manager of Treasury Services, Controller, Asst. Vice President for Fiscal and Administrative Services, Vice President for Finance and Administration, and Chief of Staff on a monthly basis for review. 4.2 A detail listing (IBMR050) of departmental (i.e. telecommunications, utilities, university police, etc.) receivables are provided to each respective billing department for their information, review and assistance in collection. 4.3 An aged listing of student fee receivables is reviewed at the end of each fiscal year in connection with adjusting the allowance for uncollectable and preparation of the annual financial report. Other Collection Efforts 5.1 Students are not allowed to register for a semester until they have paid their prior balance (including balances written off) in full. Exceptions must be approved by Controller. 5.2 Students are dropped from enrollment if they do not meet the minimum required installment payment by the census date. 5.3 The Vice President for Finance and Administration writes letters to employees and third parties to assist in clearing delinquent accounts. 5.4 All student receivables that are one year old are turned over to a letter writing service. All student receivables that are two years old are turned over to collection agencies. 5.5 Employee’s travel reimbursements are held until all outstanding debts to the University are paid. 5.6 Individuals leaving the employment of the University are required to process their Employee Clearance Form through Treasury Services, where they are reminded of their outstanding debt to the University. 5.7 Requests for refunds from TRS or ORP are not processed until all outstanding debts are cleared. 5.8 Except for certain utilities, services may be discontinued when an account becomes 180 days delinquent. Action will be taken by the applicable department, subject to their vice president’s approval. PRAIRIE VIEW A&M UNIVERSITY Administrative Procedures Manual 6. Write Off of Receivables 6.1 The University uses the allowance method for accounting for uncollectible student fee receivables. At the end of each fiscal year, the University determines its allowance for uncollectible student receivables as follows: Age 0 - 1 year old 1 - 2 year old Estimated Uncollectible 80% 100% 6.2 After the estimated uncollectible is determined, the allowance for uncollectible is adjusted so that it equals the estimate. The offset to this adjustment is bad debt expense which is allocated to the various student fee accounts on a pro-rata basis. 6.3 All student receivables that are over 2 years old are written off the books by reducing the receivable and the allowance for uncollectible. [Note: All write-offs are still tracked until paid.] 6.4 When a written off receivable is subsequently collected, the receivable and allowance are reinstated and the payment is posted. 6.5 The University does not write off receivables from employees or other third parties. Contact: Manager of Treasury Services