Writing About the Risk … Elements of an Effective Credit Analysis

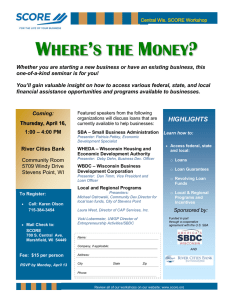

advertisement

The Wisconsin RMA Chapter presents a special workshop: Writing About the Risk … Elements of an Effective Credit Analysis Friday, MAY 20, 2016, 8:30 a.m. – Noon Kalahari Conference Center – Wisconsin Dells, WI Presented by the RMA Wisconsin Chapter This presentation builds on the Wisconsin RMA Chapter’s popular course “Essentials of Effective Loan Presentations.” AND…Expands the discussion of the purpose, content and structure of a written credit analysis Seminar Description The following may find this workshop beneficial: There are few formal training courses for teaching lenders and credit analysts about how to write an effective credit analysis. Often, the process of creating a credit analysis is learned via incomplete “on the job training.” The credit analysis narrative portion of a loan presentation should be a critical element in relating the credit risk in a credit request. Following are some of the topics that will be covered: Purpose of a written credit analysis Relating credit analysis to risk evaluation Understanding why “working capital” is not a loan purpose What to look for in financial statements and how to translate it to a written analysis How to use ratios as an element of a written credit analysis How the use of industry averages/comparisons is an often ignored tool Industry / competition comments Understanding the importance of trend analysis Written analysis of projections How a well done written credit analysis is a bridge to determining credit structure Using a simple cash flow worksheet to quickly identify sources and uses of cash Learn the rules of “trends, sudden changes and aberrations” Learn the rule of “never write a what without a why.” How all the tools can produce a critical summary of the borrower strengths and weaknesses Examples will be provided Senior lenders who would like to review or improve current written credit analysis. Credit analysts who would like more formal training on written credit analysis Lenders who want to improve the written analysis portion of their loan presentations and facilitate more efficient communications with credit analysts. Speaker - Gary D. Maples President, River Edge Consulting LLC, Sheboygan Falls, Wisconsin Gary currently provides consulting services (in the lending/credit administration areas) expert witness services and all types of credit training. Previously Gary was a District Bank President with thirty years experience in commercial lending, credit analysis, loan and credit administration, loan workouts and bank management. Other Teaching Experience includes: WI, IA, IL, KS, KT, MI, MN, NY, OH, and PA Bankers Assoc.; KS/NE Schools of Banking; Pacific Coast Banking School; Stonier Graduate School of Banking; Graduate School of Banking at the UW; Czech and Romanian Banking Institutes; ABA’s National Graduate Lending School. General Information 8:30 a.m.: Registration 9:00 a.m. - Noon: Seminar Fees: $155 per person Continuing Education: three CRCs are available for this program ------------------------------------------------------------------------------------------------------------------------------------------------------------------ REGISTRATION FORM: Writing About the Risk – May 20, 2016 Name:____________________________________ Title:_______________________ E-Mail:_________________________ Name:____________________________________ Title:_______________________ E-Mail:_________________________ Name:____________________________________ Title:_______________________ E-Mail:_________________________ Bank:_________________________________ Address:____________________________________________________ City:_________________________________ State:_________ Zip:____________ Phone:___________________________ Total: $_________________ (Based on fees listed above) To Register : fill out the form above and mail with payment to UWSP/Continuing Education, 2100 Main St. 032 Main, Stevens Point, Wisconsin 54481 or register online at www.uwsp.edu/conted/confwrkshp/pages/lenders.aspx