Document 11738425

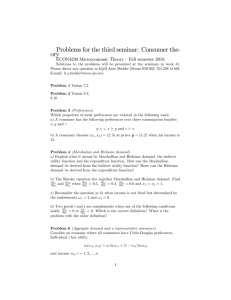

advertisement

er. if O#ad, on informzei availabie 23~the ion operator mnditional jht tith cm-refit consumption c,, to comb to compute utility at P, i.e., is specified as the CES form ?VhYWiX, (c, z) = [cp+ zyp, c,zlO, O#p<l, Oqkl. (4 us utility is defined recursively by Q= t2 o. [c/‘+ P(Etv+l)P’a]l’p, (3) a %is czi W = H st-+ ,t+B ” . s --k 9 9 W (a--- cave ce is 190 L 6. Epstein, Ri; k aversionand assetprices comparative risk aversion analysis change in prices is ambiguous if u cas. the issue of the circumstances u artingale property. It is well generally not a feature of states ‘that the presence of for current consumption is inconsistent odel, even with 8,‘s correlated see from (20) that only if a = p = 1 do we obtain the simple discounting formulae P(s,) = Bhh +PwL erfect intertemporal substitutability (a = ao) and risk neutrality ( a = 1) are necessary for these relations to be valid. f(0) > 0 ) f(co). Thus 3y* > 0, f( y*) = 0. hus y* is the unique zero of f. Step 2: Show that (22) possesses a unique solution. It suffices to prove existence and uniqueness of n_l solving fqKi)=O, j=l,..., ( &.l)p+ K*pqa-P)‘P 1 a soWion (Si+pi(s))](p-l)‘p, which is a form of ‘converse’ for (1 From (11) ,A(S)P/o-P)= for some constant derive l+ 3( Substitute the latter equation into ( 03) and (10) to 192 LG. Epstein, Risk aversionand assetprices intertemporal asset pricing model with stochastic consumption and f Financial Economics 7,265296. prices in a production economy, in: J.J. rtainty (University of Chicago Press, Chi stein, 1987, Non-expected utility preferences in a temporal framework n to consumptionGavings haviour, Working paper 8701 (University of intertemporal asset aaldson, J.B. and Mehra, 1984, Comparative dynamics of an equihb w of Economic Studies 51,491-508. .E. Zin, 1987a, Substitution, risk aversion and the temporal behaviour of asset returns I: A theorttical framework, Working paper 8715 (University of Toronto, Toronto). Epstein L.G. and S.E. Zin, 1987b, Substitution, risk aversion and the temporal behaviour of consumption and asset returns II: An empirical analysis, Working paper 8718 (University of Toronto, Toronto). Farmer, R.E.A., 1987, Closed-form sohuions to dynamic stochastic choice problems (University of Stochastic consumption, risk aversion, and the temporal of PoIitical Economy 91,249-265. 1972, Capital markets: Theory and evidence, Bell JoumaI of Economics and nt Science 3,357-398 Johnsen, T&I. and %.I%Donaldson, 1985, The structure of intertemporal preferences under uncertainty and time consistent plans, Econometrica 53,1451-1458. .J. lvfirman, 1974, Risk aversion with many commodities, Journal of Kihlstrom, R Economic oopmans, T aI utility and impatience, Econometrica 28,287-309. Kreps, D.M. and E.L. Porteus, 1978, Temporal resolution of uncertainty and dynamic choice Econometrica 46,185-200. E 1986, Comparative dynamics and risk premia in an overlapping generations model, evlew’bf Economic Studies 53,139-152. ale property of stock prices, International , , Journal an exchange economy, Econometrica 46,1429-1446. Optimal growth with many consumers, Journal of Economic : A puzzle, Journal of Monetary Economics onometrica 41,867-887. : The case of homogeneous aving under risk preference aeo. ( ard University,