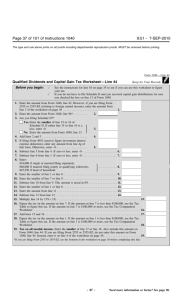

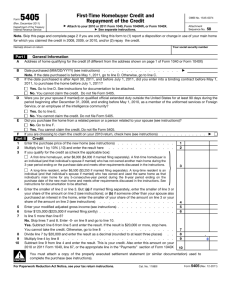

97 Publication 1407 Federal Tax Forms—Advance Proof Copies Department of the Treasury

advertisement