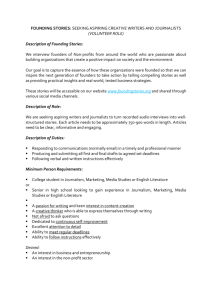

Cutting your teeth: the beginning of the learning curve Please share

advertisement