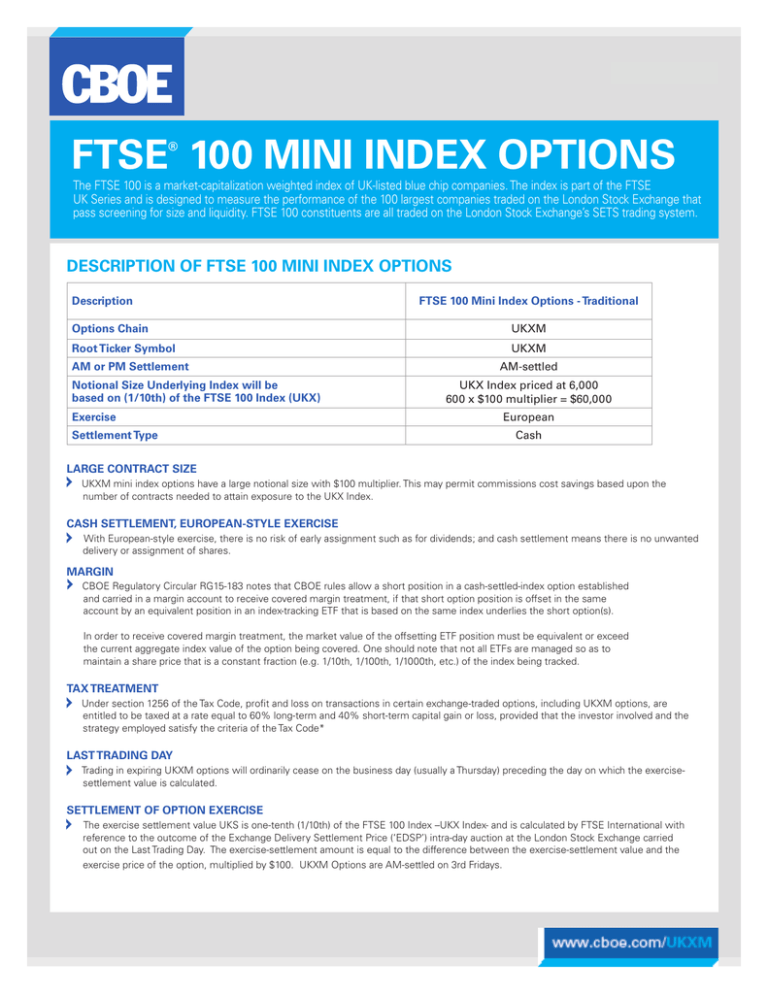

FTSE 100 MINI INDEX OPTIONS November 2015

advertisement

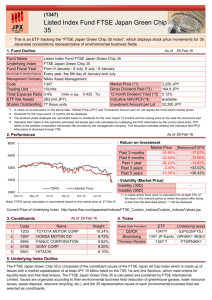

November 2015 FTSE 100 MINI INDEX OPTIONS ® The FTSE FTSE 100 100(ticker is a market-capitalization weighted index of UK-listed chip companies. The indexThe is part of the FTSE The UKX) is a market-capitalization weighted index ofblue UK-listed blue chip companies. index is part of the FTSE UK Series and is designed to measure the performance of the 100 largest companies traded on the London Stock Exchange UK Series and is designed to measure the performance of the 100 largest companies traded on the London Stock Exchange thatthat pass screening for size and liquidity. FTSE 100 constituents are all traded on the London Stock Exchange’s SETS trading system. pass screening for size and liquidity. FTSE 100 constituents are all traded on the London Stock Exchange’s SETS trading system. DESCRIPTION OF FTSE 100 MINI INDEX OPTIONS Description Options Chain Root Ticker Symbol AM or PM Settlement Notional Size Underlying Index will be based on (1/10th) of the FTSE 100 Index (UKX) Exercise Settlement Type FTSE 100 Mini Index Options - Traditional UKXM UKXM AM-settled UKX Index priced at 6,000 600 x $100 multiplier = $60,000 European Cash LARGE CONTRACT SIZE UKXM mini index options have a large notional size with $100 multiplier. This may permit commissions cost savings based upon the number of contracts needed to attain exposure to the UKX Index. CASH SETTLEMENT, EUROPEAN-STYLE EXERCISE With European-style exercise, there is no risk of early assignment such as for dividends; and cash settlement means there is no unwanted delivery or assignment of shares. MARGIN CBOE Regulatory Circular RG15-183 notes that CBOE rules allow a short position in a cash-settled-index option established and carried in a margin account to receive covered margin treatment, if that short option position is offset in the same account by an equivalent position in an index-tracking ETF that is based on the same index underlies the short option(s). In order to receive covered margin treatment, the market value of the offsetting ETF position must be equivalent or exceed the current aggregate index value of the option being covered. One should note that not all ETFs are managed so as to maintain a share price that is a constant fraction (e.g. 1/10th, 1/100th, 1/1000th, etc.) of the index being tracked. TAX TREATMENT Under section 1256 of the Tax Code, profit and loss on transactions in certain exchange-traded options, including UKXM options, are entitled to be taxed at a rate equal to 60% long-term and 40% short-term capital gain or loss, provided that the investor involved and the strategy employed satisfy the criteria of the Tax Code* LAST TRADING DAY Trading in expiring UKXM options will ordinarily cease on the business day (usually a Thursday) preceding the day on which the exercisesettlement value is calculated. SETTLEMENT OF OPTION EXERCISE The exercise settlement value UKS is one-tenth (1/10th) of the FTSE 100 Index –UKX Index- and is calculated by FTSE International with reference to the outcome of the Exchange Delivery Settlement Price (‘EDSP’) intra-day auction at the London Stock Exchange carried out on the Last Trading Day. The exercise-settlement amount is equal to the difference between the exercise-settlement value and the exercise price of the option, multiplied by $100. UKXM Options are AM-settled on 3rd Fridays. FTSE 100® MINI INDEX OPTIONS |2 Index Level SECTOR FTSE 100 monthly change (+/- 1% or greater) approximately 80% ofINDUSTRY the time over the WEIGHTINGS last 3 years. FTSE 100 INDEX (UKX) -7.18% Up = +6.13% During this time period the largest monthly moves: Down = 5 YR. MONTHLY CLOSING VALUES - JAN. 2010 - OCT. 2015 Oil & Gas 11.01% 6,900.00 Personal & Household Goods 10.81% 6,700.00 Banks10.29% FTSE 100 Index Industrial Goods & Services 8.77% 6,500.00 Monthly Change (%) Financial Services 6.59% 6,300.00 (2/2013 - 2/2016) Insurance6.11% 6,100.00 0.06 Telecommunications5.11% 5,900.00 0.04 Travel & Leisure 4.57% 5,700.00 0.02 Basic Resources 4.34% 5,500.00 Utilities3.80% 0 Real Estate 3.16% 5,300.00 -0.02 Technology1.63% 5,100.00 -0.04 Construction & Materials 1.02% 4,900.00 -0.06 Chemicals0.68% 4,700.00 -0.08 Automobiles & Parts 0.24% 1/1/2010 1/1/2011 1/1/2012 1/1/2013 1/1/2014 1/1/2015 Source: Bloomberg Source: FTSE Russell Source: Bloomberg FTSE 100® INDEX MONTHLY CHANGES (%)day IN GBP FTSE 100 average 30 Historical Vol = 18.00 The FTSE 100 Index Jan declined -9.78% and 30 day Historical Vol. rose +59.94% (8/17 - 9/29/2015). Feb Mar Apr May Jun Jul Aug Sep Oct 2.77% 0.34% -6.64% 2.69% 2015 2.79% 2.92% -2.50% 2014 -3.54% 4.60% -3.10% 2013 6.43% 1.34% 0.80% 0.29% 2012 1.96% 3.34% 7500 2.24% -1.76% -0.53% 2.75% 0.95%vs 30 -1.47% FTSE 100 Index Day Nov Dec -6.70% -2.98% 4.94% -0.21% Volatility 1.33% Historical -2.89% -1.15% 2.69% -2.33% -3.14% 0.77% 4.17% -1.20% 1.48% 1.35% 0.54% 2.38% -5.58% 6.53% Daily Price Movement (1/2/2015 - 3/11/2016) -7 .27% 4.70% 1.15% 0.71% 1.45% 0.53% 35 2011 -0.63% -1.42% 2.73% -1.32% -0.74% -2.20% -7.23% -4.93% 8.11% -0.70% 1.21% 30 2010 -4.14% 3.20% 6.07% -2.22% -6.57% -5.23% 6.94% -0.62% 6.19% 2.28% -2.59% 6.72% 7000 25 Source: Bloomberg 6500 20 15 6000 10 5 42006 42024 42040 42058 42074 42090 42110 42129 42145 42164 42180 42198 42214 42230 42249 42265 42283 42299 42317 42333 42349 42369 42388 42404 42422 42438 5500 Source: Bloomberg FTSE 100 30 Day Hist. Vol. *Investors should consult with their tax advisors to determine how the profit and loss on any particular option strategy will be taxed. Tax laws and regulations change from time to time and may be subject to varying interpretations. Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies are available from your broker, by calling 1-888-OPTIONS, or from The Options Clearing Corporation at www.theocc.com. The information in this document is provided solely for general education and information purposes. No statement within this document should be construed as a recommendation to buy or sell a security or to provide investment advice. CBOE® and Execute Success® are registered trademarks of Chicago Board Options Exchange, Incorporated (CBOE). FTSE® is a trademark and service mark of FTSE International Limited, used under license. Copyright © 2016 2015 CBOE. All rights reserved. CBOE | 400 South LaSalle Street | Chicago, IL 60605 April 2016 www.cboe.com