FORT SCOTT COMMUNITY COLLEGE 2016-2017 Dependent Verification Form (V5-Aggregate)

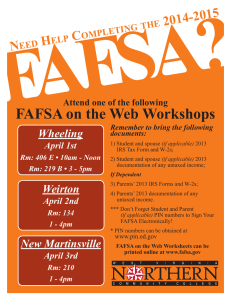

advertisement

FORT SCOTT COMMUNITY COLLEGE 2016-2017 Dependent Verification Form (V5-Aggregate) This form can only be hand-delivered or mailed to the Financial Aid Office. It cannot be faxed or e-mailed. Fort Scott Community College, Attn: Financial Aid Office, 2108 S. Horton, Fort Scott KS, 66701 Your 2016-2017 Free Application for Federal Student Aid (FAFSA) was selected for review in a process called verification. The law says that before awarding Federal Student Aid, we must ask you to confirm the information you reported on your FAFSA. To verify that you provided correct information, we will compare your FAFSA with the information on this institutional verification document and with any other required documents. If there are differences, your FAFSA information may need to be corrected. You and a parent whose information was reported on the FAFSA must complete and sign this institutional verification document, attach any required documents, and submit the form and other required documents to us. We may ask for additional information. If you have questions about verification, contact us as soon as possible so that your financial aid will not be delayed. _____________________________ Student’s Last Name _________________________ ____ Student’s First Name M.I. __________________ SSN or Student ID# _____________________________________________________________________________________________________________________________________________________________ ___________________________________________ Student’s Street Address Student’s DOB City State Zip Household Members and Number in College: List below the people in the parent(s)’ household. EVEN IF THEY ARE NOT ATTENDING COLLEGE. Include: The student The parent(s), including a stepparent, even if the student does not live with the parent(s). The parent(s)’ other children if the parent(s) will provide more than half of their support from July 1, 2016, through June 30, 2017, or if the other children would be required to provide parental information if they were completing a FAFSA for 2016-2017. Include children who meet either of these standards even if the children do not live with the parent(s). Other people if they now live with the parent(s) and the student’s parent(s) provide more than half of their support and will continue to provide more than half of their support through June 30, 2017. Full Name Age Relationship John Doe (example) 18 Brother Self College Attending (Or leave blank) FSCC Enrolled at Least Half Time (Y/N) Yes For any household member you listed above, also indicate who will be enrolled at least half-time at an eligible postsecondary educational institution any time between July 1, 2016 and June 30, 2017 _____________________________ Student’s Last Name _________________________ ____ Student’s First Name M.I. __________________ SSN or Student ID# Receipt of SNAP Benefits: Certify if a member of the parents’ household, (refer to page 1), received benefits from the Supplemental Nutrition Assistance Programs or SNAP (formerly known as the Food Stamp Program) sometime during 2014 or 2015. SNAP may be known by another name in some states. For assistance in determining the name used in a state, please call 1-800-433-3243. NOTE: If we have reason to believe that the information regarding the receipt of SNAP benefits is inaccurate, we may require documentation from the agency that issued the SNAP benefits in 2014 or 2015. In 2014 or 2015, did you or any member of your parents’ household receive SNAP benefits? Yes No Child Support Paid: It may have been indicated on the student’s FAFSA, that the student or one of the parents included in the household, paid child support in 2015. List below the names of the persons who paid the child support, the names of the persons to whom the child support was paid, the names of the children for whom the child support was paid, and the total annual amount of child support that was paid in 2015 for each child. If no child support was paid, please write N/A on the table below. Name of Person Who Paid Child Support Name of Person to Whom Child Support was Paid Name of Child for Whom Support was Paid Amount of Child Support Paid in 2015 NOTE: If we have reason to believe that the information regarding child support paid is not accurate, we may require additional documentation; such as: A copy of the separation agreement or divorce decree that shows the amount of child support to be provided A statement from the individual receiving the child support certifying the amount of child support received Copies of the child support payment checks or money order receipts _____________________________ Student’s Last Name _________________________ ____ Student’s First Name M.I. __________________ SSN or Student ID# Student’s Tax Information: Did the student file taxes for the 2015 year? Yes No If no, skip to the TAX NON-FILER section below. (Do not fill out the tax filer section). If yes, please continue to the TAX FILER section. (Do not fill out the tax non-filer section). TAX FILER: In order to verify the student’s tax information, one of the following steps must be completed: (Please refer to the detailed directions at the end of this form). The student has used or is going to use the IRS Data Retrieval Tool on their FAFSA. The student has submitted or is going to submit an IRS Tax Return Transcript to the Financial Aid Office. NOTE: For electronic filers, the IRS Data Retrieval Tool and the IRS Tax Return Transcript should be available 2-3 weeks after their 2015 IRS Income Tax Return has been accepted by the IRS. For paper filers, they are available after 8-11 weeks. TAX NON-FILER: The student was not employed and had no income earned from work in 2015. The student was employed and had income earned from work in 2015. NOTE: If the student was employed, list below the names of all the student’s employers, the amount earned from each employer in 2015, and attach copies of all 2015 W-2 forms issued by the employer(s). Employer Name John’s Auto Body Shop (example) 2015 Amount Earned $2,000 W-2 Form Attached (Y/N) Yes _____________________________ Student’s Last Name _________________________ ____ Student’s First Name M.I. __________________ SSN or Student ID# Parent(s)’ Tax Information: Did the student’s parent(s) file taxes for the 2015 year? Yes No If no, skip to the TAX NON-FILER section below. (Do not fill out the tax filer section). If yes, please continue to the TAX FILER section. (Do not fill out the tax non-filer section). TAX FILER: In order to verify the parent(s)’ tax information, one of the following steps must be completed: (Please refer to the detailed directions at the end of this form). The student has used or is going to use the IRS Data Retrieval Tool on their FAFSA for their parent(s)’ tax information. The student has submitted or is going to submit their parent(s)’ IRS Tax Return Transcript(s) to the Financial Aid Office. NOTE: If the student’s parent(s) filed separately, they will need to obtain tax return transcripts for both individuals. For electronic filers, the IRS Data Retrieval Tool and the IRS Tax Return Transcript should be available 2-3 weeks after their 2015 IRS Income Tax Return has been accepted by the IRS. For paper filers, they are available after 8-11 weeks. TAX NON-FILER: The student’s parent(s) were not employed and had no income earned from work in 2015. The student’s parent(s) were employed and had income earned from work in 2015. NOTE: If the student’s parent(s) were employed, list below the names of all the parent(s)’ employers, the amount earned from each employer in 2015, and attach copies of all 2015 W-2 forms issued by the employer(s). Employer Name John’s Auto Body Shop (example) 2015 Amount Earned $2,000 W-2 Form Attached (Y/N) Yes _________________________ Student’s Last Name ______________________ Student’s First Name _____ M.I. ____________________ SSN or Student ID# High School Completion Status: Provide ONE of the following documents that indicate the student’s high school completion status when the student will begin college in 2016-2017. The student’s final official high school transcript that shows the date when the diploma was awarded. (This item may be faxed directly from the student’s high school to 620-768-2938). A copy of the student’s General Educational Development (GED) certificate or GED transcript. If State law requires a homeschooled student to obtain a secondary school completion credential for homeschool (other than a high school diploma or its recognized equivalent), a copy of that credential. If State law does not require homeschooled student to obtain a secondary school completion credential for homeschool (other than a high school diploma or its recognized equivalent), a transcript or the equivalent, signed by the student’s parent or guardian, that lists the secondary school courses the student completed and documents the successful completion of a secondary school education in a homeschool setting. If you have already submitted one of the above mentioned items, please check here: If you are going to submit one of the above mentioned items, please check here: If one of the above mentioned items is attached to this form, please check here: Identity and Statement of Educational Purpose (To be signed at the FSCC Financial Aid Office*): The student must appear in person at Fort Scott Community College to verify his or her identity by presenting an unexpired valid government-issued photo identification (ID), such as, but not limited to, a driver’s license, other state-issued ID, or passport. The institution will maintain a copy of the student’s photo ID that is annotated by the institution with the date it was received and reviewed and the name of the official at the institution authorized to collect the student’s ID. In addition, the student must sign, in the presence of the institutional official, the Statement of Educational Purpose provided below. Statement of Educational Purpose I certify that I _____________________________________ am the individual signing this Statement (Print Student’s Name) of Educational Purpose and that the Federal student financial assistance I may receive will only be used for educational purposes and to pay the cost of attending Fort Scott Community College for 2016-2017. ____________________________________________________ (Student’s Signature) ______________ (Date) _________________________________ (Student’s ID Number) FOR FINANCIAL AID OFFICE USE ONLY: WITNESS ___________________________________ DATE __________________ *If you are unable to appear in person at the FSCC Financial Aid Office, please see the following page. _________________________________________________________________________________________________________________________________________________________________________ _______________________________________________________________________________________________________________________________ ______________________________ ____________________________________________________________________________________________________________ Student’s Last Name Student’s First Name M.I. SSN or Student ID# Identity and Statement of Educational Purpose (To be signed in the Presence of a Notary): If the student is unable to appear in person at Fort Scott Community College to verify his or her identity, the student must provide to the institution: A. A copy of the unexpired valid government-issued photo identification (ID) that is acknowledged in the notary statement below or that is presented to a notary, such as, but not limited to, a driver’s license, other state-issued ID, or passport; and B. The original Statement of Education Purpose provided below, which must be notarized. If the notary statement appears on a separate page than the Statement of Educational Purpose, there must be a clear indication that the Statement of Educational Purpose was the document notarized. Statement of Educational Purpose I certify that I ____________________________________ am the individual signing this (Print Student’s Name) Statement of Educational Purpose and that the Federal student financial assistance I may receive will only be used for educational purposes and to pay the cost of attending Fort Scott Community College for 2016-2017. ________________________________________________ (Student’s Signature) ______________ (Date) ______________________________ (Student’s ID Number) Notary’s Certificate of Acknowledgement Notary’s certification may vary by State State of ___________________________________________________________________________________ City/County of _____________________________________________________________________________ On _________________, before me, ____________________________________________________________ (Date) (Notary’s name) personally appeared, _________________________________________________, and proved to me on basis (Printed name of signer) of satisfactory evidence of identification __________________________________________ to be the above(Type of government-issued photo ID provided) named person who signed the foregoing instrument. WITNESS my hand and official seal (seal) __________________________________________ (Notary Signature) My commission expires on ___________________. (Date) Certification and Signatures: Each person signing below certifies that all of the Information reported is complete and correct. ________________________________________ Student’s Signature ______________ Date ________________________________________ Parent’s Signature ______________ Date WARNING: If you purposely give false or misleading information, you may be fined, be sentenced to jail, or both. Certification READ, SIGN, AND DATE If you are the student, by signing this application you certify that you (1) will use federal and/or state student financial aid only to pay the cost of attending an institution of higher education, (2) are not in default on a federal student loan or have made satisfactory arrangements to repay it, (3) do not owe money back on a federal student grant or have made satisfactory arrangements to repay it, (4) will notify your college if you default on a federal student loan, and (5) will not receive a Federal Pell Grant from more than one college for the same period of time. If you are the parent or the student, by signing this application you agree, if asked, to provide information that will verify the accuracy of your completed form. This information may include U.S. or state income tax forms that you filed or required to file. Also, you certify that you understand that the Secretary of Education has the authority to verify information reported on this application with the Internal Revenue Service and other federal agencies. If you sign any document related to the federal student aid programs electronically using a Personal Identification Number (PIN), you certify that you are the person identified by the PIN and have not disclosed that PIN to anyone else. If you purposely give false or misleading information, you may be fined $20,000, sent to prison, or both. Everyone whose information is given on this form should sign below. The student (and at least one parent, if parent information is given) MUST sign below. Student________________________________________________ Date: ____________ Parent_________________________________________________Date:_____________ Student’s FSCC ID# or SSN _________________________________ This form must be submitted to the Financial Aid Office by the following dates: Fall 2016 – November 18th, 2016 Spring 2017 – April 21st, 2017 th Summer 2017 – June 5 , 2017 (4 week session) and July 3rd, 2017 (8 week session) Failure to meet these deadlines may result in no aid awarded for that semester HOW TO USE THE DATA RETRIEVAL TOOL ON YOUR FAFSA 1. Log into your FAFSA at www.fafsa.ed.gov. 2. When you come to the tab for Financial Information, select Already Completed your IRS Income Tax Return. 3. On the next question, select the appropriate tax filing status. Ex: Single, Married-Filed Jointly. 4. You may be able to use the Data Retrieval Tool if you answer No to all the questions asked – Did you file an amended tax return? Did you file a foreign tax return? Did you file in the last three weeks? 5. If you answered no to the above questions, click on Link to IRS. 6. Select OK when it asks if you want to leave FAFSA on the Web. 7. On the IRS site, you will have to provide your filing status, name and address exactly as it was listed on your tax return. (If you are having trouble matching your address, go to www.usps.com, use the 8. Look Up a Zip Code option, type your street address, city, state and zip and hit FIND. Use the “standard” address that is displayed). Click on Submit and it will show you the information that will be transferred. (If it did not work than the address you provided is probably incorrect according to the IRS’ records. You may try again but you will be locked out after three failed attempts). 9. Check the Transfer my Tax Information into the FAFSA box and then click the Transfer Now button. 10. Once the information has been transferred, do not make any changes! 11. Enter the information for your wages and click Next. 12. Again, any information transferred by the IRS should not be changed. If selected for verification, this will delay your financial aid being processed. 13. Finish filling out your FAFSA, sign with your PIN, and submit. You may not be eligible to use the IRS Data Retrieval if: You filed your tax return within the past two weeks You filed an amended tax return Your filing status is “Married Filing Separately” You filing status is “Head of Household” and you actually are married (but not separated or divorced). If you are unable to transfer your tax information using the Data Retrieval Tool, you will need to use copies of your tax returns to fill out the FAFSA. If you need the Data Retrieval Tool completed for verification purposes, you will need to request a tax return transcript. If you are still having trouble with using the Data Retrieval, call the FAFSA hotline at 1-800-433-3243. REQUEST TAX RETURN TRANSCRIPT TO BE MAILED 1. Go to www.irs.gov. 2. Under Tools, click on Get a Tax Transcript. 3. Click on Get Transcript by Mail, and then Ok. 4. Type in the required information and then click on Continue. (You must enter the information listed under the primary taxpayer). 5. Under Type of Transcript, select Return Transcript. 6. Under Tax Year, select the correct tax year. If you are using this transcript for your 2016-2017 FAFSA, you will need to select the 2015 tax year. 7. Click on Continue. 8. A Tax Return Transcript will be mailed to the address you provided in approximately 5-10 days. Submit to the Financial Aid Office as soon as possible.