Product choice Research & Price

advertisement

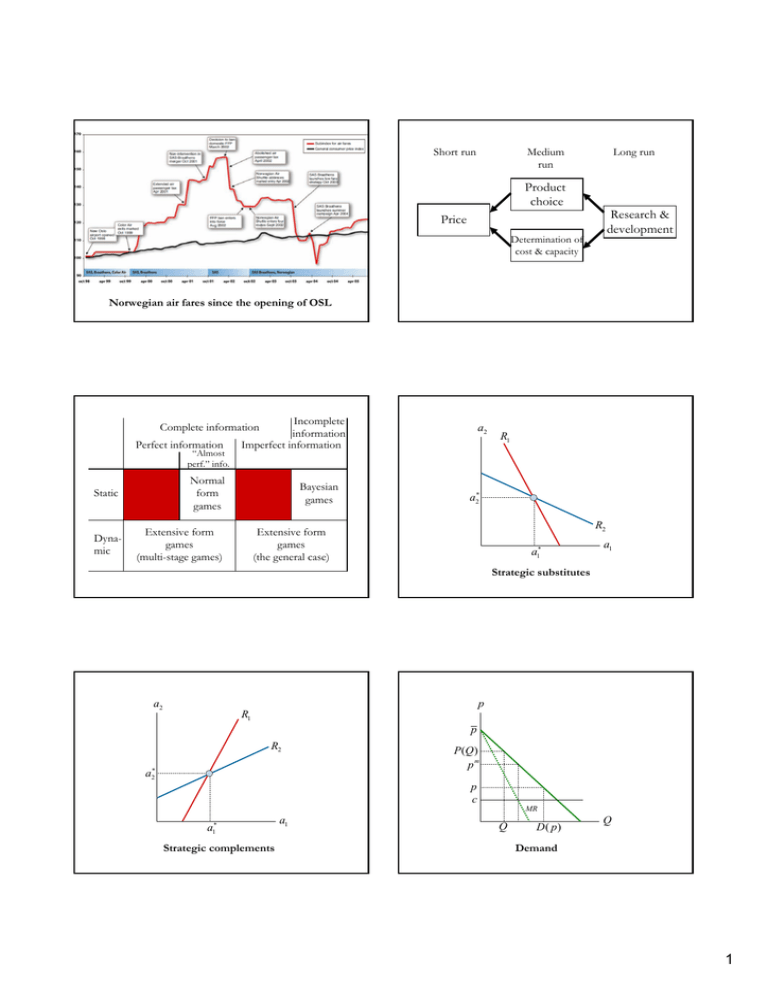

Short run Medium run Long run Product choice Research & development Price Determination of cost & capacity Norwegian air fares since the opening of OSL Incomplete information Imperfect information Complete information Perfect information “Almost perf.” info. Normal form games Static Dynamic Bayesian games a2 R1 a2 R2 Extensive form games (the general case) Extensive form games (multi-stage games) a1 a1 Strategic substitutes a2 p R1 p R2 a2 P (Q ) pm p c MR a1 Strategic complements a1 Q D( p) Q Demand 1 R1 p2 pm q2 R1 R2 q2 p2 c R2 p1 c pm p1 q1 q1 Price competition with homogeneous products Observations about Cournot competition Quantity competition with homogeneous products Characterization of Cournot competition marginal revenue • Best response curves have negative slope • Each firm has market power (P(Q) P(Q) P(Q) qi) • Cournot’s ”reaction story” is stabile. • Reduced c1 shifts 1’s curve outwards. • Outcome lies between monopoly and perfect comp. qq22 • Difference between price and marginal cost is reduced when the demand becomes more elastic. • Reduced c1 leads to increased q1 and reduced q2. qq11 • Reduced c1 leads to a direct and indirect advantage for 1 and an indirect disadvantage for 2. • Each firm’s difference between price and marginal cost is proportional to its market share. • A firm’s market share depends of its efficiency. • Even less efficient firms ”survive” with positive market share. q2 Intermediate capacity Large capacity Intermediate capacity Intermediate capacity p Efficient rationing R10 Intermediate capacity p2 R1 Small capacity p1 Q q1 q2 R2 Intermediate capacity R20 q1 Bertrand-Edgeworth model Capacity competition followed by price competion yields Cournot outcomes 2 p p Small capacity Intermediate capacity p1 P (q1 q2 ) p1 P (q1 q2 ) Q q1 q2 0 2 R (q1 ) Q q1 q2 R20 (q1 ) 3