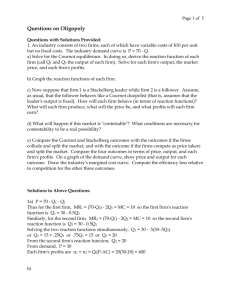

The Stackelberg model The Stackelberg model was developed by the German economist Heinrich von Stackelberg and is an extension of Cournot’s model. It is assumed, by von Stackelberg, that one duopolist is sufficiently sophisticated to recognise that his competitor acts on the Cournot assumption. This recognition allows the sophisticated duopolist to determine the reaction curve of his rival and incorporate it in his own profit function, which he then proceeds to maximise like a monopolist In this game, the leader has decided not to behave as in the Cournot’s model, however, we cannot ensure that the leader is going to produce more and make more profits than the follower. Total production will be greater and prices lower, but player one will be better off than player two, which serves to highlight two things: the importance of accurate market information when defining a strategy, and the interdependence of each player’s strategies, especially when there is a market leader (with the benefit of moving first) and a follower. Assume that the isoprofit curves and the reaction functions of the duopolists are those depicted in figure 9.20. If firm A is the sophisticated oligopolist, it will assume that its rival will act on the basis of its own reaction curve. This recognition will permit firm A to choose to set its own output at the level which maximizes its own profit. This is point a (in figure 9.20) which lies on the lowest possible isoprofit curve of A, denoting the maximum profit A can achieve given B’s reaction curve. Firm A, acting as a monopolist (by incorporating B’s reaction curve in his profit-maximizing computations) will produce XA, and firm B will react by producing XB according to its reaction curve. The sophisticated oligopolist becomes in effect the leader, while the naive rival who acts on the Cournot assumption becomes the follower. Cournot Model Cournot duopoly, also called Cournot competition, is a model of imperfect competition in which two firms with identical cost functions compete with homogeneous products in a static setting. It was developed by Antoine A. Counot “Researches Into the Mathematical principles of the Theory of Wealth”, 1838. Both companies are vying for maximum benefits. These benefits are derived from both maximum sales volume (a larger share of the market) and higher prices (higher profitability). The problem stems from the fact that increasing profitability through higher prices can damage revenue by losing market share. What Cournot’s approach does is maximise both market share and profitability by defining optimum prices. This price will be the same for both companies, as otherwise the one with the lower price will obtain full market share, which makes this a Nash equilibrium, also known for this model the Cournot-Nash equilibrium. Comparison with Stackelberg duopolies: -Cournot’s model is a simultaneous game, Stackelberg’s is a sequential game; -In Cournot duopolies quantity sold is the same for both firms, while in Stackelberg duopolies, the quantity sold by the leader is greater than the quantity sold by the follower; -When comparing each firm’s output and prices, we have: -With regard to total output and prices we have the following: