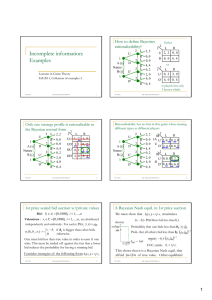

Incomplete information: Examples How to define Bayesian rationalizability?

advertisement

How to define Bayesian

rationalizability?

Incomplete information:

Examples

U

1

A ( 12 )

N t

Nature

B ( 12 )

Lectures in Game Theory

Spring 2011, Collection of examples 3

11.01.2011

G.B. Asheim, ECON4240-ex3

1

A ( 12 )

N t

Nature

B ( 12 )

D

U

1

D

11.01.2011

2 L

2, 2

R

2 L

R

2 L

0, 0

0, 0

4,, 4

0, 2

2, 0

4, 0

R

0, 4

R

2 L

R

0, 4

R

L

U 2, 2 0, 0

D 0, 0 4, 4

2

or

R

L

1

U 0, 2 2, 0

D 4, 0 0, 4

is played, but only

1 knows which.

2

G.B. Asheim, ECON4240-ex3

1

A ( 12 )

N t

Nature

B ( 12 )

UD 3, 1 0, 2

DU 0,

0 1 3,

3 2

DD 2, 0 2, 4

2, 2

R

2 L

D

R

2 L

U

D

3

2

R

L

1B

0, 0 1A U 2, 0, 2 0, 2, 0

0, 0 U

D 2, 4, 1 0, 0, 2

4,, 4

2

0, 2

R

L

1B

2, 0

U 0, 0, 1 4, 2, 2

4, 0 D

D 0, 4, 0 4, 0, 4

0, 4

2 L

1

Bid : bi Ai [0, 1000], i 1,, n

11.01.2011

R

2 L

R

4

G.B. Asheim, ECON4240-ex3

A Bayesian Nash equil. in 1st price auction

We must show that bi ( vi ) nn1 vi maximizes

Valuations : vi Ti [0, 1000], i 1, , n, are distribute d

x

independen tly and uniformly : For each i, Pr(v j x) 1000

.

v b if bi is bigger than other bids.

ui (bi , bi ; vi ) i i

otherwise.

th i

0

One must bid less than true value in order to earn if one

wins. This must be traded off against the fact that a lower

bid reduces the probability for having a winning bid.

Consider strategies of the following form: bi ( vi ) nn1 vi

G.B. Asheim, ECON4240-ex3

R

2 L

0, 0

0, 0

4,, 4

0, 2

2, 0

4, 0

11.01.2011

U

1st price sealed bid auction w/private values

11.01.2011

R

2 L

1

Rationalizability has no bite in this game when treating

different types as different players

2

R

L

1

UU 1, 2 1, 0

G.B. Asheim, ECON4240-ex3

U

D

1

2, 2

R

2 L

1

Only one strategy profile is rationalizable in

the Bayesian normal form

U

D

2 L

Either

2

5

(vi bi ) Pr (Others bid less than bi )

density

n

( n 1)1000

1

1000

Probability that one bids less than bi:

n bi

n 1 1000

Prob.

ob. that all o

others

e s bid

b d less

ess than bi:

n 1

n bi

n 1 1000

bid

b

max (vi bi ) nn1 1000

i

( n 1)1000 1000

n

n 1

bi

FOC yields: bi nn1 vi

This shows that it is a Bayesian Nash equil. that

all bid (n-1)/n of true value. Other equilibria?

11.01.2011

G.B. Asheim, ECON4240-ex3

6

1

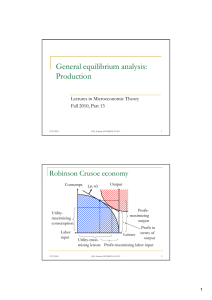

Cournot

comp. w/

incompl.

info.

price

Bayesian Nash equilibrium

Firm 1' s unit cost : c

Firm 2' s unit costs : cH or cL

2 (q1 , q2 ; cHL )) PP((Q

Q)) ccLHqq22

a ( q1 q2 ) cLH qq22

Invers

demand fn.:

P (Q ) a Q

Firm 2 knows

its own cost.

Firm 1: 2 high

cost w/prob .

cH

cL

q1

11.01.2011

quantity

Q

q2

Firm 2 if high cost : q2 (cH ) max a ( q1 q2 ) cH q2

FOC : q2 (cH ) 12 a q1 cH

Firm 2 if low cost : q2 (cL ) max a ( q1 q2 ) cL q2

FOC : q2 (cL ) 12 a q1 cL

Firm 1 : q1 max a (q1 q2 (cH )) c q1

(1 )a ( q1 q2 (cL )) c q1

FOC : q 12 a q2 (cH ) c (1 )a q2 (cL ) c

1

7

G.B. Asheim, ECON4240-ex3

Bayesian

Nash equil.:

q2 (cH ) 13 a 2cH c 16 cH cL

Comparison w/compl. info.

q2

Are there quantitites for firm 1, firm 2 if high cost and

firm 2 if low cost so that no firm would regret its own

choice if it were informed of the choices of the others?

11.01.2011

The model of Cournot comp. with

incomplete information includes

q2 (cL ) 13 a 2cL c 6 cH cL

1’s best resp fn

1

3

2’s best resp fn

if low cost

q2 (cL )

Fi 2 w/high

Firm

/hi h cost

produces more than

under compl info.

2’s best resp fn

if high cost

q2 (cH )

Firm 2 w/low cost

produces less than

under compl info.

q1

q1

11.01.2011

Action sets : A1 [0, ) and A2 [0, )

q a 2c cH (1 )cL

1

9

G.B. Asheim, ECON4240-ex3

Type sets : T1 {c} and T2 {cH , cL }

Nature' s choice : p (cH ) and p (cL ) 1

1 (q1 , q2 ; c ) a (q1 q2 ) c q1

Profit functions :

(Payoff functions) 2 ( q1 , q2 ; cH ) a ( q1 q2 ) cH q2

2 (q1 , q2 ; cL ) a (q1 q2 ) cL q2

11.01.2011

Beer – Quiche game

Player 1 has four

pure strategies.

Player 1 has four

pure strategies.

3, 2 U 2 L 1

R 2 U 1, 0

(r )

(q ) D 0, 1

PBE w/(LL)? YES 2, 0 D

A ( 12 )

PBE w/(RR)? NO

Nature

B ( 12 )

1 0 U (1 r )

1,

21

(1 q ) U 2,

R

L

1

D 0, 0

1, 1 D

PBE w/(LR)? YES

[(LR ), (UU), q 0, r 1]

PBE w/(RL)? NO

11.01.2011

Choosing R is dominated for 1A.

[(LL), (DU), q , r 1 / 2] is an unreasonable equilibrium, because

it requires 2 to have q 1 / 2.

G.B. Asheim, ECON4240-ex3

11

10

G.B. Asheim, ECON4240-ex3

Are all perfect Bayesian equilibria reasonable?

[(LL), (DU), q , r 1 / 2]

where q 1 / 2.

8

G.B. Asheim, ECON4240-ex3

2, 0 U 2 Q 1

PBE w/(QQ)? YES 0, - 1 D

[(QQ), (DU), q , r 9 / 10 ]

where q 1 / 2.

(r )

B 2 U 3, 0

(q ) D 1, - 1

S ( 109 )

Nature

W ( 101 )

3 0 U (1 r )

3,

2 0

(1 q ) U 2,

PBE w/(BB)? YES

Q

B

1

D 0, 1

[(BB), (UD), q 9 / 10, r ] 1, 1 D

where r 1 / 2.

PBE w/(BQ)? NO

PBE w/(QB)? NO

11.01.2011

Is [(QQ), (DU), q , r 9 / 10 ] a

reasonable equilibrium?

Only 1S has possibly something to

gain by choosing B. But q 1 / 2.

G.B. Asheim, ECON4240-ex3

12

2