Global Trends in Health Care Reform: The United States

advertisement

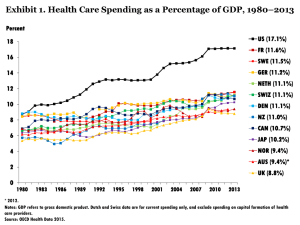

Global Trends in Health Care Reform: The United States Thomas Rice UCLA School S h l off Public P bli H Health lth AcademyHealth Annual Research Meeting June 28, 2010 1 Topics The need for reform: how the U U.S. S compares to other countries Main elements of the reform legislation Does the legislation make the U.S system look more like those of other countries? 2 The Need for Reform: How the U.S. Compares to Other Countries 3 SPENDING 4 International Comparison of Spending on Health, 1980 2005 1980–2005 Average spending on health per capita ($US PPP*) $7,000 Total expenditures on health as percent of GDP 16 United States Germany Canada France Australia United Kingdom $6,000 14 12 $5,000 10 $4,000 8 $3,000 6 United States Germany Canada France Australia United Kingdom $2,000 4 $1,000 2 $- * PPP=Purchasing Power Parity. Data: OECD Health Data 2007, Version 10/2007. Source: Commonwealth Fund National Scorecard on U.S. Health System Performance, 2008 04 20 02 20 00 20 98 19 96 94 19 19 92 19 90 19 88 19 86 19 84 19 82 19 80 19 04 02 20 20 00 20 98 19 96 19 94 92 19 90 19 88 19 86 19 19 84 19 82 19 19 80 0 5 5 6 ACCESS 7 Percentage of Population Uninsured, 2007 ((Source: OECD Health Data,, 2008)) 18% 16% 16% 14% Percent 12% 10% 8% 6% 4% 2% 2% 1% 0% 0% AUS CAN 0% 0% GER NETH UK US C Country t 8 Cost-Related Access Problems i P in Pastt Two T Years Y Base: Adults with any chronic condition Percent AUS CAN FR GER NETH NZ UK US Did not fill Rx or skipped doses 20 18 13 12 3 18 7 43 Did not visit a doctor when had a medical problem 21 9 11 15 3 22 4 36 Did not get recommended test, test treatment, or follow-up 25 11 13 13 3 18 6 38 Anyy of the above access problems because of cost 36 25 23 26 7 31 13 54 Data collection: Harris Interactive, Inc. Source: 2008 Commonwealth Fund International Health Policy Survey of Sicker Adults. 9 QUALITY 10 Infant Mortality Rate Infant deaths per 1,000 live births National Average and State Distribution U.S. average 12 Top 10% states 11.1 10 3 10.3 8 Bottom 10% states International Comparison, Comparison 2004 7.2 10.2 70 7.0 69 6.9 9.9 9.9 68 6.8 70 7.0 9.6 68 6.8 10.1 68 6.8 6.8 5.3 4 5.3 4.4 51 5.1 50 5.0 49 4.9 48 4.8 4.7 4.7 2003 2004 2.8 3.2 3.1 2.8 3.3 0 1998 1999 2000 2001 2002^ p Ja an Ic n el a d S d we en N w or ay l an F in d De a nm rk C a an da ^ Denotes baseline year. Data: National and state—National Vital Statistics System, Linked Birth and Infant Death Data (AHRQ 2003, 2004, 2005, 2006, 2007a); international comparison—OECD Health Data 2007, Version 10/2007. Source: Commonwealth Fund National Scorecard on U.S. Health System Performance, 2008 U. S. 11 Potential Years of Life Lost Due to Diabetes per 100,000 100 000 P Population, l ti 2006 100 99 80 65 56 60 39 40 37 36 35 29 25 24 UK* SWITZ* 20 0 US* NZ** CAN** NETH OECD SWED** GER FRA* Median *2005 **2004 Data: OECD Health Data 2008 (June 2008). 12 Medical, Medication, or Lab Test Errors i P in Pastt Two T Years Y Base: Adults with any chronic condition Percent AUS CAN FR GER NETH NZ UK US Wrong medication or dose d 13 10 8 7 6 13 9 14 Medical mistake in treatment 17 16 8 12 9 15 8 16 7 5 3 5 1 3 3 7 Delays in abnormal test results* 13 12 5 5 5 10 8 16 Any medical, medication, or lab errors 29 29 18 19 17 25 20 34 Incorrect diagnostic/lab test es results* esu s Data collection: Harris Interactive, Inc. Source: 2008 Commonwealth Fund International Health Policy Survey of Sicker Adults. 13 Exhibit ES-1. Overall Ranking Countryy Rankings g 1.00–2.33 2.34–4.66 4 67–7 4.67 7.00 00 AUS CAN GER NETH NZ UK US OVERALL RANKING (2010) 3 6 4 1 5 2 7 Quality Care 4 7 5 2 1 3 6 Effective Care 2 7 6 3 5 1 4 Safe Care 6 5 3 1 4 2 7 Coordinated Care 4 5 7 2 1 3 6 Patient-Centered Care 2 5 3 6 1 7 4 6.5 5 3 1 4 2 6.5 Cost-Related Problem 6 3.5 3.5 2 5 1 7 Timeliness of Care 6 7 2 1 3 4 5 Efficiency 2 6 5 3 4 1 7 Equity 4 5 3 1 6 2 7 Long, Healthy, Productive Lives 1 2 3 4 5 6 7 $3,357 $3,895 $3,588 $3,837* $2,454 $2,992 $7,290 Access Health Expenditures/Capita, 2007 Note: * Estimate. Expenditures p shown in $ $US PPP (p (purchasing gp power p parity). y) Source: Calculated by The Commonwealth Fund based on 2007 International Health Policy Survey; 2008 International Health Policy Survey of Sicker Adults; 2009 International Health Policy Survey of Primary Care Physicians; Commonwealth Fund Commission on a High Performance Health System National Scorecard; and Organization for Economic Cooperation and Development, OECD Health Data, 2009 (Paris: OECD, Nov. 2009). Main Elements of the R f Reform Legislation L i l ti 15 Insurance Coverage From 48 million to 21 million uninsured: – – – – Income Income--based subsidies to uninsured Employer mandate Individual mandate Medicaid (low (low--income coverage) expansion Mechanisms: – Private: Each state create insurance exchange for individuals w/o coverage and small employers – Public: the Medicaid expansion 16 Coverage (continued) Subsidies: sliding S b idi lidi scale l up tto 400% poverty t level Medicaid: everyone covered whose income is less than 133% of poverty level Individual mandate: Everyone must buy coverage or pay a penalty ($700/individual, $2100/family), unless this exceeds 8% of income income. Employer mandate: Employers with more than 50 employees must provide coverage or pay penalty of $2000/employee. 17 Health Insurers Insurers… Cannot turn applicants down who have history of illness Cannot terminate coverage Must renew coverage Cannot charge more to those who history of illness (older people can be charged maximum of 3 times that of younger person) Return at least 80% of premiums in the form of health service benefits 18 Quality Enhancement Establish E t bli h office ffi tto supportt “comparative “ ti effectiveness research” Pilot program to develop “bundled payment” p y systems y for hospital, p ,p physician, y , and post post--acute services to “accountable organizations” care organizations Pay hospitals based on performance on quality measures measures, with nursing homes and home health care to follow 19 Financing Increase Medicare Partt A payrollll ttax ffrom 1.45 I M di P 1 45 tto 2.35%, and 3.8% extra tax on investment income, for those with incomes over $200 $200,000 000 individual or $250,000 family “Cadillac Cadillac tax” tax on employer health plans with values above $10,000 individual/$27,500 families, beginning 2018. Tax = 40% of amount above th h ld thresholds Reduce payments to Medicare managed care plans Eff Effect other h reductions d i iin M Medicare di spending; di establish Board to submit proposals to contain costs if Medicare spending rises too quickly 10% tax on indoor tanning services 20 Does the legislation g make the U.S system look more like those off other countries? ? 21 How Close is U U.S. S Moving? Q lit Quality: – Some small but significant steps towards using comparative--effectiveness research to determine comparative coverage of technologies/drugs – Pilot studies/grants g to encourage g moving g away y from fee--for fee for--service, through bundled payments to new new-fangled provider groups (accountable care organizations) – More tangible steps to link (first) hospital payment (and eventually) physician and outpatient care, to use of effective processes and success in achieving desired outcomes 22 S Moving? (cont How Close is U U.S. (cont.)) Access: Access: – Number uninsured to be reduced by about 60% – All poor and d nearnear-poor will ill h have M Medicaid, di id b butt sometimes this is viewed as second tier coverage Costs: – Very little (but that was politically necessary) for-profit insurance – Greater (!) reliance on private private, forthan before – No movement towards monopsonistic p p purchasing g power with rejection of public option – Almost no “supply“supply-side” cost containment 23