Medicare Advantage Benchmark Payment Rates and Their Impacts

advertisement

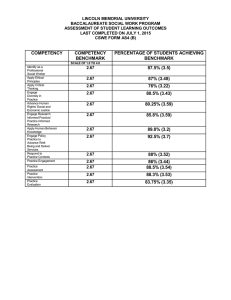

Medicare Advantage Benchmark Payment Rates and Their Impacts Deborah Healy, Ph.D. Greg Pope, M.S. Leslie Greenwald, Ph.D John Kautter, Ph.D Sarah Siegel, Ph.D RTI, International 1 Acknowledgments 2 Research funded by CMS. Any views expressed are the authors’ and not necessarily those of CMS. Purpose To explore how the MA county benchmark and the ratio of the benchmark to FFS cost impacts the availability of MA plans and premiums Focus on HMO and PFFS plans 3 83.2 percent of Enrollees Methods 4 Compared beneficiary access to MA plans and plan premiums across counties Counties stratified by their benchmark rate and ratio of the benchmark to the “FFS rate” County benchmark data are available from the CMS website. Premium data analyzed were available from the CMS Health Plan Management System (HPMS) Methods 5 MA plans considered HMO, HMO with POS, and PFFS Plans included Employer only plans excluded Part B only plans excluded Counties Alaskan counties aggregated to 4: Anchorage, Juno, Fairbanks, and Rest of State Puerto Rico, Guam, and other US territories excluded Methods 6 2008 Benchmark Rate 100% risk adjusted After budget neutrality adjustment Benchmark to FFS ratio county benchmark before budget neutrality/county FFS rate 2007 data FFS rate not recalculated in 2008 All counties received the minimum update Distribution of County Benchmarks County type 7 Less than $750 $750–800 Percentage of counties 53.4% 29.6% 6.7% 4.2% 6.2% 100.0% Large urban 0 67.1 13.3 7.3 12.3 100 Medium urban 0 88.0 3.7 2.5 5.9 100 Small urban 68.7 19.1 4.3 4.0 4.0 100 Rural 70.2 14.4 6.2 3.8 5.4 100 $800–850 $850–900 $900+ All benchmarks Distribution of County Benchmark to FFS Ratios County type Percent of counties Large urban Medium urban Small urban Rural 8 1 1 to 1.05 1.05 to 1.1 1.1 to 1.15 1.15 to 1.2 1.2 to 1.25 Greater than 1.25 All rate ratios 2.8% 19.0% 19.9% 20.5% 16.3% 9.8% 11.7% 100.0% 0.7 0.3 4.8 3.3 16.2 6.5 19.4 21.5 20.6 12.3 21.4 20.6 23.7 17.3 22.8 20.0 19.6 16.7 15.7 15.7 8.0 18.2 7.4 9.3 11.1 28.7 8.5 9.6 100 100 100 100 Plan Availability As the 2008 County benchmark increased, On average beneficiary access to HMO plans increased from less than 1 available plan to more than 11 plans in the highest benchmark counties Beneficiary access to PFFS plans was unaffected 2008 Plan Availability by 2008 MA county benchmark Plan type HMO PFFS Less than $750 0.9 $750–800 3.9 $800–850 5.3 $850–900 7.3 $900+ 11.2 7.0 8.8 5.9 6.5 7.2 Note: Weighted by Medicare eligibles 9 Plan Availability As the benchmark to FFS ratio increased, On average, beneficiary access to PFFS plans increased from less than 5 available plans to more than 10 Beneficiary access to HMO plans decreased from more than 6 available plans to fewer than 3 2008 Plan Availability by MA county Benchmark to FFS Ratio Plan type 1 1.05 to 1.1 1.1 to 1.15 1.15 to 1.2 1.2 to 1.25 HMO 12.6 6.7 4.4 4.1 3.1 2.8 2.8 PFFS 4.4 4.8 7.0 8.5 10.1 10.7 9.7 Note: Weighted by Medicare eligibles 10 1 to 1.05 Greater than 1.25 Plan Premiums As the 2008 county benchmark increased, Average HMO plan C+D premiums fell from more than $40 when the benchmark was less than $800 to under $8 for counties with benchmarks over $900. There was no correlation with PFFS plan premiums. 2008 Average C+D premiums, by MA county Benchmark Less than $750 $750–800 HMO (no SNP) 70.09 43.00 36.49 25.46 7.95 PFFS 23.32 29.62 86.38 61.64 38.81 Plan type Note: weighted by Plan enrollment 11 $800–850 $850–900 $900+ Plan Premiums As the county benchmark to FFS ratio increased, Average PFFS plan premiums fell from more than $50 to less than $11. There was no relationship with HMO plan premiums 2008 Average C+D premiums, by MA county Benchmark to FFS Ratio Plan type HMO (no SNP) PFFS 1 2.73 51.95 1 to 1.05 24.92 83.92 Note: Weighted by Plan enrollment 12 1.05 to 1.1 37.72 48.48 1.1 to 1.15 25.85 30.98 1.15 to 1.2 40.40 20.60 1.2 to 1.25 35.47 16.07 Greater than 1.25 58.48 10.47 Discussion and Conclusions 13 We found that the type of MA plan interacts with payment rates and costs in affecting plan availability and premiums. PFFS plans mimic traditional FFS – no provider network and often pay providers Medicare FFS rates. PFFS plan costs may be highly correlated with Medicare FFS costs such that the payment ratio is more important than the absolute payment rate HMO plans have a very different organizational structure than Medicare - operate networks and through provider bargaining and utilization review may control costs across areas, with greater cost saving potential in some high cost areas HMO plan costs may have limited correlation with Medicare FFS making the absolute payment the more relevant for plan profits Discussion and Conclusions 14 PFFS network requirements 2011, PFFS plans in counties with at least 2 local plans will need to provide a network May raise costs and could lead to a withdrawal of PFFS plans from areas with high provider costs PPACA and HCEARA - (Health Reform Act of 2010) No increase in MA benchmarks for 2011 Only one year, but could lead to a temporary increase in premiums, or reduction in “extra benefits” Gradual compression of bencharks Highest cost areas 95% of FFS Lowest cost quartile 115% of FFS What will be the impact on HMO plans? PFFS plans? Quality Bonuses New benchmarks can not be higher than benchmarks under the “old” MMA calculation