Hospital Ownership & Medical Services: (co-author Austin Nichols, Urban Institute) June 2009

Hospital Ownership & Medical Services:

Market Mix, Spillover Effects and Nonprofit Objectives

Jill Horwitz, University of Michigan and NBER

(co-author Austin Nichols, Urban Institute)

June 2009

This work is made possible by a grant from the Robert Wood Johnson Foundation’s

Changes in Health Care Financing and Organization (HCFO) Initiative

Paper Goals

1. Fill a big gap in a huge literature -- identify the spillover effects of hospital ownership

2. Provide some facts for policy debate

3. Address the major econometric challenges

1. Market definition

2. Endogeneity

4. Theory

1. Evaluate theories of the non-profit firm

2. Identify empirical regularities to constrain future theories

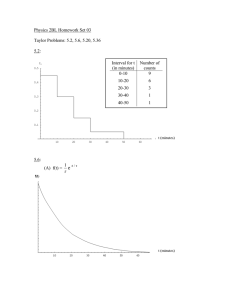

80

70

60

50

40

30

20

10

0

Hospital Ownership (1988-2005)

Urban Hospitals, Weighted by Admissions

Year

Gov

NFP

FP

Legal Context

Many Sources

– Federal and State Tax Exemptions (requirements for exemption, nondistribution constraint)

– State Corporations and Trust Law

– Common Law of Trusts --- strong fiduciary duties

Characteristics

– Enabling

– Little Formal Enforcement (informal matters)

Policy Context

– State community benefit rules, AG involvement

– Federal attention

Empirical Work –

NP v. FP Hospital Ownership

• Should there be a difference?

– Same training, docs, nurses etc.

– Same pay

– Same insurers, reimbursements

• Is there a difference?

– Mostly no when you look at financial measures

– Some outcomes

– Not on charity

– ***But lots when you compare service offerings

Empirical Framework

Sort Hospital Services by Type:

* High

Π

-making (Cardiac, MRI, NICU,

PICU)

* Low-profit/ high need (Psychiatric ER,

AIDS Testing/Treatment)

* Changing Profitability (Post Acute)

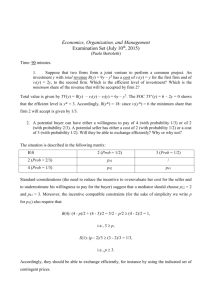

0.70

0.60

0.50

0.40

0.30

0.20

0.10

0.00

Home Health

Year

NP

GOV

FP

What about the market?

• Organizations don’t operate in isolation

– Unrealistic, therefore, maybe inaccurate

– Spillover effects may be > direct effects given distribution of ownership types

– Endogeneity concern (FPs choose markets)

• New Research: Do your neighbors matter?

– (Does your likelihood of offering medical services depend on the ownership of your “competitors”?)

Data Sources

• American Hospital Association, Annual Survey of

Hospitals 1988-2005 – What a Mess! (ownership, hospital type, lots of cleaning)

• 1990 and 2000 Census

• National Directory of HMOs (Baker)

• System databases constructed by 1) Madison 2) Dafny and Dranove

• Centers for Medicare and Medicaid Services’ Healthcare

Cost Report Information System

• Hospital Location – getting some precision

• CON database for CT scan

Spillover

E(ServiceProvided) it

= Φ [ β o

+ β

1

F it

+ β

2

Y it

+

β

3

Y it

*F it

+ β

4

FPMarket it

+ β5Fit*FPMarketit +

β

6

Y it

*F it

*FPMarket it

+ β

7

H it

+ β

8

D it

+

β

9

HMO it

+ β

10

HHI it +

β

11

Hosp# it

]

Control Variables: Extensive

• Hospital Characteristics

– Size by admission quintiles, teaching status, system membership

• Demographic Characteristics

– Population size, age (10 groups), race (5 groups), sex (2 groups), marital status by sex, hh income, income per capita, travel time to work (12 groups), employed people by industry (11 categories).

• Other Market Characteristics

– HMO Penetration (financial pressure)

– Herfindahl-Hirschman Index (market concentration)

– Number of hospitals in MSA (2,3,4,5) (evidence that entry of 2 or

3 hospital leads to convergence in competitive conduct)

• Sensitivity testing (state fe, CON)

Market Definitions: 3 Types

Each with i, without i

1. Basic – distance weighted (from hospital lat/lon, reciprocal of distance^2 adjusted so all the hospitals count, adjusted to reflect estimated patient draws from Gresenz)

2. MSA – proportion weig hted by admissions

3. Disk-Overlap – fixed radii with common distance (10 miles from hospital, weighted by the overlap of circles)

** sensitivity test with first year ownership

N F P H o s p ita ls

Relatively Profitable Services

O P E N - H E A R T S U R G E R Y

G O V H o s p ita ls F P H o s p it a ls

1 9 8 8 1 9 9 1 1 9 9 4

H ig h - F P M k t

1 9 9 7 2 0 0 0 2 0 0 3

L o w -F P M k t

1 9 8 8 1 9 9 1 1 9 9 4 1 9 9 7

H ig h - F P M k t

H ig h > 1 5 % a n d L o w < 1 0 % ( W t . v a r ie s in v . w /s q . d is t. - - n o t i- - e x c lu d e s o w n s ta tu s )

2 0 0 0 2 0 0 3

L o w -F P M k t

N F P H o s p ita ls

M R I F A C IL I T Y

G O V H o s p ita ls

1 9 8 8 1 9 9 1 1 9 9 4

H ig h - F P M k t

1 9 9 7 2 0 0 0 2 0 0 3

L o w -F P M k t

F P H o s p it a ls

1 9 8 8 1 9 9 1 1 9 9 4 1 9 9 7 2 0 0 0 2 0 0 3 1 9 8 8 1 9 9 1 1 9 9 4

H ig h - F P M k t L o w - F P M k t

H i g h > 1 5 % a n d L o w < 1 0 % ( W t . v a r i e s i n v . w /s q . d is t. - - n o t i - - e x c lu d e s o w n s ta tu s )

H ig h - F P M k t

1 9 9 7 2 0 0 0 2 0 0 3

L o w - F P M k t

1 9 8 8 1 9 9 1 1 9 9 4

H ig h - F P M k t

1 9 9 7 2 0 0 0 2 0 0 3

L o w - F P M k t

N F P H o s p ita ls

Relatively Unprofitable Services

H I V - A ID S S E R V IC E S

G O V H o s p ita ls F P H o s p it a ls

1 9 8 8 1 9 9 1 1 9 9 4

H ig h - F P M k t

1 9 9 7 2 0 0 0 2 0 0 3

L o w - F P M k t

1 9 8 8 1 9 9 1 1 9 9 4

H ig h - F P M k t

1 9 9 7 2 0 0 0 2 0 0 3

L o w - F P M k t

H ig h > 1 5 % a n d L o w < 1 0 % ( W t . v a r ie s in v . w /s q . d is t. - - n o t i- - e x c lu d e s o w n s ta tu s )

N F P H o s p ita ls

P S Y C H . E M E R G E N C Y S E R V IC E S

G O V H o s p ita ls

1 9 8 8 1 9 9 1 1 9 9 4

H ig h - F P M k t

1 9 9 7 2 0 0 0 2 0 0 3

L o w - F P M k t

F P H o s p it a ls

1 9 8 8 1 9 9 1 1 9 9 4

H ig h - F P M k t

1 9 9 7 2 0 0 0 2 0 0 3 1 9 8 8 1 9 9 1 1 9 9 4

H ig h - F P M k t

1 9 9 7

L o w - F P M k t

H i g h > 1 5 % a n d L o w < 1 0 % ( W t . v a r i e s i n v . w /s q . d is t. - - n o t i - - e x c lu d e s o w n s ta tu s )

2 0 0 0 2 0 0 3

L o w - F P M k t

1 9 8 8 1 9 9 1 1 9 9 4

H ig h - F P M k t

1 9 9 7 2 0 0 0 2 0 0 3

L o w - F P M k t

N F P H o s p ita ls

Profitability Changing

H O M E H E A L T H S E R V I C E S

G O V H o s p ita ls F P H o s p it a ls

1 9 8 8 1 9 9 1 1 9 9 4

H ig h - F P M k t

1 9 9 7 2 0 0 0 2 0 0 3 1 9 8 8 1 9 9 1 1 9 9 4

L o w - F P M k t

H i g h > 1 5 % a n d L o w < 1 0 % ( W t . v a r i e s i n v . w /s q . d is t. - - n o t i - - e x c lu d e s o w n s ta tu s )

H ig h - F P M k t

1 9 9 7 2 0 0 0 2 0 0 3

L o w - F P M k t

N F P H o s p ita ls

S K I L L E D N U R S I N G C A R E B E D S

G O V H o s p ita ls

1 9 8 8 1 9 9 1 1 9 9 4

H ig h - F P M k t

1 9 9 7 2 0 0 0 2 0 0 3

L o w - F P M k t

F P H o s p it a ls

1 9 8 8 1 9 9 1 1 9 9 4

H ig h - F P M k t

1 9 9 7 2 0 0 0 2 0 0 3

L o w - F P M k t

1 9 8 8 1 9 9 1 1 9 9 4

H ig h - F P M k t

1 9 9 7 2 0 0 0 2 0 0 3

L o w - F P M k t

H ig h > 1 5 % a n d L o w < 1 0 % ( W t . v a r ie s in v . w /s q . d is t. - - n o t i- - e x c lu d e s o w n s ta tu s )

1 9 8 8 1 9 9 1 1 9 9 4

H ig h - F P M k t

1 9 9 7 2 0 0 0 2 0 0 3

L o w - F P M k t

Other Services

• NP Hospitals

– More likely to offer many profitable services in Hi-FP markets

– **Less likely to offer unprofitable services in Hi-FP markets

– More likely to follow the money in offering post-acute in

Hi-FP markets

• Gov Hospitals

– Similar story, weaker results

• FP Hospitals

– Not much of a pattern

Conclusions

• Why do NPs respond? (margin results)

Financial pressure

• Interaction between a hospital’s own ownership and the ownership of its neighbors also matters

• Policymakers should consider effects of market mix in evaluating charities policy

(including tax exemption)

• Implications for theory