Enrollment of Dually Eligible Beneficiaries in Medicare Part D Plans:

advertisement

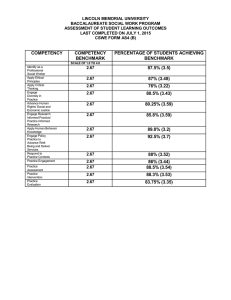

Enrollment of Dually Eligible Beneficiaries in Medicare Part D Plans: Autoassignment and Choice Christine Bishop, Ph.D.1 Cindy Parks Thomas, Ph.D. 1 Daniel Gilden, M.S.2 Joanna Kubisiak, M.S.2 AcademyHealth Annual Research Meeting June 29, 2009 1Schneider Institutes for Health Policy, Heller School for Social Policy and Management, Brandeis University 2JEN Associates Inc. Research Support Centers for Medicare & Medicaid Services Contract No. CMS 500-00-0031/T.O. #2 Project Officers: William Clark and Karyn Anderson 2 Background: Autoenrollment/Reassignment Initial matching to plans: October 2005 ♦ Dually-eligible beneficiaries were autoenrolled to benchmark (premium below average) Prescription Drug Plans (PDPs) ♦ Beneficiary had option to switch to PDP with formulary better meeting own needs ♦ No Lock In for Duals – can switch any month (unlike others) New dually-eligible beneficiaries autoenrolled monthly ♦ Newly qualified for both ♦ Previously Medicaid only ♦ Previously Medicare only Response to market evolution: 2006, 2007 ♦ Continuing beneficiaries are reassigned if own PDP premium falls above benchmark plus de minimis threshold ($2, $1) ♦ Some are moved to a below-benchmark plan offered by same sponsor (e.g. United Health, Humana) ♦ “Choosers” (past switchers) are not reassigned, but must pay premium difference if they stay in chosen plan -- of course may switch any month 3 2005->2006 2006->2007 2007->2008 No longer bench Stay/pay (no reassign) Or choose out Choose out Previous dual New dual Auto-assign Plan stays benchmark Plan stays benchmark Stay in No longer benchmark No longer benchmark If chooser: (reassign same or Stay/pay new sponsor) Or choose out (reassign same sponsor) No longer benchmark Plan stays benchmark (reassign new sponsor) No longer benchmark If chooser: (reassign same or Stay/pay new sponsor) Or choose out 4 Importance of Beneficiary Plan Choice Autoassignment: Assures that All Duals are Enrolled BUT Formulary restrictions of plans may differ ♦ Covered brands within a class may differ ♦ Prior authorization may be required for brand within protected class Beneficiaries should match to plan that covers needed drugs -- and Medicare supports choice But DO beneficiaries “choose away” from autoassigned plan? ♦ Some have no reason to choose away 5 Autoassigned plan meets needs Some have few drug needs Some may be less able to choose than others Impact on Health??? Current Analysis 6 Question 1: How much choice occurred at initial and key choice points? Question 2: What factors are associated with active choosing at these points in time? (Question 3: How much active choice AFTER these points for those who are autoassigned?) Study Populations Dually eligible for at least one month January 2006 through December 2007 ♦ for Medicare ♦ for full Medicaid (by state criteria) ♦ ~7.8 million Dually eligible at least one month during 2006 linked to Medicare 5% Sample: Medicare data for 2004-2006 ♦ ~275,000 7 Individual Monthly Enrollment Data for 24 Months CMS PDP Contract file ♦ Plan type (MA or stand-alone) contract number, plan number ♦ Sex, date of birth ♦ Enrollment type A = autoenrolled by CMS B = Beneficiary election C = Part D Facilitated enrollment by CMS D = System generated enrollment (rollover plan number change) Medicaid dual eligibility file ♦ State of eligibility ♦ Dual status (QMB,SLMB,QWDI,QI) ♦ FPL: below or 100%+ ♦ Institutional status (yes, no) 8 For 5%, Linked Medicare Data 2005 flags indicating presence of a chronic illness diagnosis Original and current reasons for eligibility ♦ Exclude ESRD 9 Race from Medicare enrollment data How Much Plan Change? Percent Dually Eligible Beneficiaries With Plan Change by Month 25.0% 20.0% 707,417 Beneficiaries Autoassigned: 13.2% 15.0% 10.0% 408,804 Beneficiaries Changed Plan: 7.6% 5.0% 10 Dec-07 Nov-07 Oct-07 Sep-07 Aug-07 Jul-07 Jun-07 May-07 Apr-07 Mar-07 Feb-07 Jan-07 Dec-06 Nov-06 Oct-06 Sep-06 Aug-06 Jul-06 Jun-06 May-06 Apr-06 Mar-06 Feb-06 0.0% Question 1: How much Choice at three Plan Choice Points? January 2006 ♦ Beneficiaries autoassigned in October 2005 had 3 prior months to choose away from autoassigned plan New beneficiaries coming onto Medicaid ♦ February 2006 – December 2007 Enrollees in plans that lose below benchmark status (January 2007) ♦ Previous chooser: pay premium difference or switch ♦ Informed beneficiary: choose new plan before 1/07 ♦ Do nothing: Autoassigned to a different benchmark plan 11 First Enrollment: 5 Million Duals Autoassigned October 2005 1.1 Million (21%) Chose Different Plan by January 2006 Unknown, 170,000 , 3% Autoassigned, 3,780,000 , 76% 12 New duals as of 1/06 are included Chose: Stand Alone Plan, 620,000 , 12% Chose: MA Plan, 450,000 , 9% 13 10,000 1,085,542 - Dec-07 Nov-07 Oct-07 Sep-07 38,000 43,000 45,000 43,000 45,000 Aug-07 44,000 Jun-07 46,000 45,000 May-07 Jul-07 46,000 48,000 41,000 47,000 38,000 44,000 Apr-07 Mar-07 Feb-07 Jan-07 Dec-06 Nov-06 49,000 20,000 Oct-06 30,000 49,000 40,000 Sep-06 47,000 49,000 47,000 60,000 70,000 Aug-06 Jul-06 Jun-06 May-06 45,000 50,000 Apr-06 60,000 52,000 74,000 80,000 Mar-06 Feb-06 1.1 million beneficiaries became newly dually eligible for Medicaid and Medicare from February 2006 through December 2007 After May 2006, about half of new dual beneficiaries were choosing a plan (stand-alone or MA) by first Medicaid month 100% 8%11% 11% 13% 19% 20% 15% 16% 14% 17% 17% 18% 13% 90% 19% 80% 70% 27% 12% 12% 11% 35% 34% 33% 60% 50% 12% 13% 13% 14% 14% 14% 14% 14% 34% 29% 31% 36% 37% 35% 34% 33% 34% 34% 40% 65% 54% 44% 52% 40% 40% 20% 36% 34% 31% 35% 34% 33% 33% 32% 10% 30% 14 Dec-07 Oct-07 Aug-07 Jun-07 Apr-07 Feb-07 Dec-06 Oct-06 Aug-06 Jun-06 Apr-06 Feb-06 0% Unknown Facilitated Chose MA Chose Stand-Alone Autoassigned Some dual beneficiaries’ plans went Above Benchmark in January 2007 22% of duals in stand-alone plans in December 2006 had their plans move above benchmark in January 2007 – 1.02 million beneficiaries ♦ 23% (235,000) of duals in plans going above benchmark chose a different plan by January 2007 ♦ 62% (630,000) were autoassigned in January 2007 Includes specific facilitated shifts within sponsor ♦ 15% (160,000) remained in same plan ♦ A very small handful (5,000) moved to MA plans 15 Sum up re: Question 1 For dual beneficiaries new to Part D or new to dual eligibility - 16 21% (1.1 million out of 5 million) chose a different plan as Part D began 30-40% (total of 500,000 of the 1.1 new duals Feb 06-Dec 07) chose a different plan as they became newly eligible as duals 23% (235,000 out of 1.02 million) chose a different plan, rather than accepting an autoassigned benchmark plan, when they learned their PDP was going above benchmark Question 2: Who was more likely to choose at the choice points? Choosing perhaps more likely if ♦ Better information – outreach from state ♦ Past diagnoses associated with chronic utilization of certain brand drugs ♦ Greater drug needs ♦ Better cognitive function ♦ Support from setting of care (e.g. nursing home, other institution) ♦ Time: 17 As all become familiar with Part D As more are previously enrolled in Part D 5% Medicare sample 18 Sex Age categories (same as Aged vs. Disabled) Institutionalized Income 100% FPL + State Medicare reported race Diagnosis indicators for certain chronic conditions (FFS in 2005) 1.88 1.8 1.6 1.4 1.23 1.2 0.98 1.07 0.96 1 0.98 0.98 0.97 0.80 0.71 0.8 0.6 0.4 0.2 Accounting for state and Dx indicator effects 19 Hispanic Black Institutional Resident Income>FPL Age 90+ Age 85-89 Age 80-84 Age 75-79 Age 65-69 0 Male Odds of Having Chosen Plan (Not MA) January 2006 2 Logistic Regression—Aged: Odds of Choosing StandAlone Plan vs. Autoassignment by January 2006 0 Accounting for state and demographic characteristics hypertension macular degeneration Alzheimers 1.04 skin ulcer 1.03 1.05 osteoporosis urinary incontinence 1.10 1.02 cellulitis arthritis 1.05 UTI 1.10 1.06 teritis/colitis/diverticulitis chronic renal failure 1.03 peptic ulcer 0.92 1.03 asthma COPD 1.02 0.97 bronchitis/emphysema pneumonia 1.08 1.04 CHF CVA, stroke 1.04 1.10 atrial fibrilation 0.92 1.14 1.02 1.06 0.2 depression 0.4 1.06 0.6 lipid disorder 0.8 1.03 1 ischemic heart disease 20 1.08 1.2 diabetes cancer Odds of Having Chosen Plan (Not MA) January 2006 Logistic Regression: Odds of Choosing Stand-Alone Plan vs. Autoassignment by January 2006 0.60 0.71 0.71 0.72 1 MA CT RI CA WI WA SC NC NY FL AL TN MO AZ KY UT MS LA SD OK OH KS PA NH IA CO TX NE MN ID GA AR OR ME ND Odds of Having Chosen Plan (Not MA) January 2006 2.5 2 1.5 1.21 1.23 1.26 1.27 1.31 1.61 1.63 1.63 1.64 1.77 1.79 1.79 1.83 1.83 1.87 1.88 1.92 2.03 2.13 2.14 3.5 3 2.57 2.65 2.69 2.81 2.85 2.95 2.98 3.04 3.29 3.31 Choice more likely in some states 5 4.5 4 0.5 0 21 Odds of Chosen Plan (Not MA) Mo 1 New Duals 2.5 Odds of New Duals Choosing Stand-Alone Plan vs. Autoassignment, First Eligible Month (Full Enrollment Study Group) 2 1.5 1.22 1.04 1.12 1.31 1.27 0.83 0.55 0.63 0.59 Age 55-64 0.81 Age 45-54 1 1.07 1.22 0.5 Institutional Resident Age 90+ Age 85-89 Age 80-84 Income>FPL 22 Age 75-79 All coefficients significant at p<.05 Age 65-69 Age 21-44 Age 0-21 Male 0 Odds of Dual Eligible with Plan Moving Above Benchmark Choosing StandAlone Plan or No Change vs. Autoassignment (Full Enrollment Study Group) 2.50 2.11 1.93 2.00 1.50 1.15 1.12 Age 90+ 0.98 1.23 1.17 1.08 Age 85-89 0.98 0.89 1.09 1.02 Age 80-84 1.00 1.021.02 Age 75-79 1.10 1.16 1.13 Choose Stand-Alone Pla 1.08 0.89 0.80 0.50 Income>FPL Age 65-69 Age 55-64 Institutional Resident 23 Age <55 Male 0.00 No Change Question 3: Pattern of Choosing After Autoassigned at Choice Point “Survival” curves show proportion who remain autoenrolled after t months ♦ January 2006 ♦ Autoassigned after plan goes above benchmark, January 2007 24 Duals Autoassigned in January 2006 Tended to Remain in Autoassigned Plan Still Over 80% by Month 24 1 0.9 Proportion Still Autoenrolled 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 0 25 5 10 15 Months 20 Dual beneficiaries autoassigned after old plan Above Benchmark (Dec 06) tended to stay in new autoassigned plan 1 0.95 Proportion Still Autoenrolled 0.9 0.85 0.8 0.75 0.7 0.65 0.6 0.55 0.5 26 1 3 5 7 9 11 PRELIMINARY Implications SOME dual beneficiaries DO choose away from autoassigned plans First enrollment (January 2006) (65+): more likely to choose if ♦ Institution resident ♦ Income 100%FPL+ First enrollment LESS likely to choose if ♦ Black ♦ Hispanic 27 Residents of certain states have higher probability of choosing PRELIMINARY Implications (2) New duals: more likely to choose if ♦ Income 100% FPL+ ♦ Age patterns: sequencing of eligibility? Plan goes above benchmark: more likely to choose if ♦ Institution resident ♦ Income 100%FPL+ Dually eligible beneficiaries tend to remain passively enrolled in autoassigned plans – original or after benchmark change ♦ Low need for Rx drugs? ♦ Satisfied with initial plan? 28 Next steps Impact of cognitive impairment on choice Subgroup analysis: duals using selected Rxs in 2005 ♦ Autoassigned or chose plans including those brands? ♦ Impacts on health outcomes? Effects of market change on beneficiary outcomes ♦ Note: more beneficiaries affected by plans moving above benchmark in January 2008 and January 2009 ♦ How many dual beneficiaries are paying premiums? ♦Health Outcomes 29